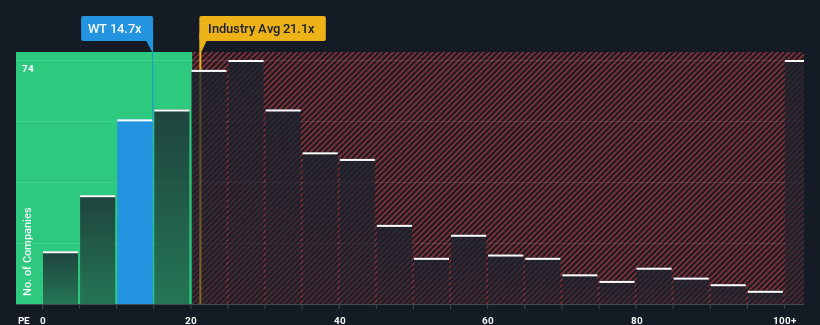

When close to half the companies in the United States have price-to-earnings ratios (or "P/E's") above 18x, you may consider WisdomTree, Inc. (NYSE:WT) as an attractive investment with its 14.7x P/E ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/E.

Recent times have been pleasing for WisdomTree as its earnings have risen in spite of the market's earnings going into reverse. One possibility is that the P/E is low because investors think the company's earnings are going to fall away like everyone else's soon. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

Check out our latest analysis for WisdomTree

How Is WisdomTree's Growth Trending?

There's an inherent assumption that a company should underperform the market for P/E ratios like WisdomTree's to be considered reasonable.

Taking a look back first, we see that the company grew earnings per share by an impressive 109% last year. However, the latest three year period hasn't been as great in aggregate as it didn't manage to provide any growth at all. So it appears to us that the company has had a mixed result in terms of growing earnings over that time.

Looking ahead now, EPS is anticipated to slump, contracting by 24% during the coming year according to the eight analysts following the company. With the market predicted to deliver 11% growth , that's a disappointing outcome.

In light of this, it's understandable that WisdomTree's P/E would sit below the majority of other companies. Nonetheless, there's no guarantee the P/E has reached a floor yet with earnings going in reverse. There's potential for the P/E to fall to even lower levels if the company doesn't improve its profitability.

The Final Word

Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

As we suspected, our examination of WisdomTree's analyst forecasts revealed that its outlook for shrinking earnings is contributing to its low P/E. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. It's hard to see the share price rising strongly in the near future under these circumstances.

The company's balance sheet is another key area for risk analysis. Take a look at our free balance sheet analysis for WisdomTree with six simple checks on some of these key factors.

You might be able to find a better investment than WisdomTree. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if WisdomTree might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:WT

WisdomTree

Through its subsidiaries, operates as an exchange-traded funds (ETFs) sponsor and asset manager.

High growth potential with solid track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

The AI Infrastructure Giant Grows Into Its Valuation

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success