- United States

- /

- Diversified Financial

- /

- NYSE:WEX

Assessing WEX (WEX) Valuation After Recent Share Price Decline

Reviewed by Simply Wall St

See our latest analysis for WEX.

While WEX's share price has slipped 8.4% over the past month, this follows a broader downtrend that has gathered pace throughout the year. The year-to-date share price return stands at -16.8%. Over the longer term, the total shareholder return remains in negative territory, signaling that recent momentum has faded as the market reassesses growth potential versus risk.

If you’re rethinking your options in light of WEX’s shifting momentum, now’s a great time to broaden your search and discover fast growing stocks with high insider ownership

Given WEX’s sizeable drop, improved earnings, and a notable discount to analyst price targets, investors must now ask themselves if the recent weakness is setting up a value entry or if the market is already accounting for what lies ahead.

Most Popular Narrative: 18.2% Undervalued

Compared to its last close of $145.68, the most popular narrative places WEX’s fair value much higher. This amplifies the debate about whether the market is underestimating its future potential and sets the stage for a deeper look at the underlying assumptions driving such optimism.

Expanding investments in product innovation (AI-powered claims processing, enhanced payment platforms, and API integrations) and significant sales force increases, especially in Corporate Payments and Mobility, indicate a forward pipeline of new customer wins and greater share of digital payment transactions. This positions WEX to benefit from higher transaction volume, improved margins through operating leverage, and increased cross-sell of value-added services.

Curious what forecasts justify such a high valuation? The numbers behind this narrative hinge on bold profit expansion and a declining future earnings multiple. Want to see what big assumptions power this target price? Find out which projections really move the needle in the full narrative.

Result: Fair Value of $178 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, heightened competition from payment disruptors and risks tied to the global shift toward electric vehicles could challenge WEX’s path to sustained growth.

Find out about the key risks to this WEX narrative.

Another View: What Do Market Ratios Say?

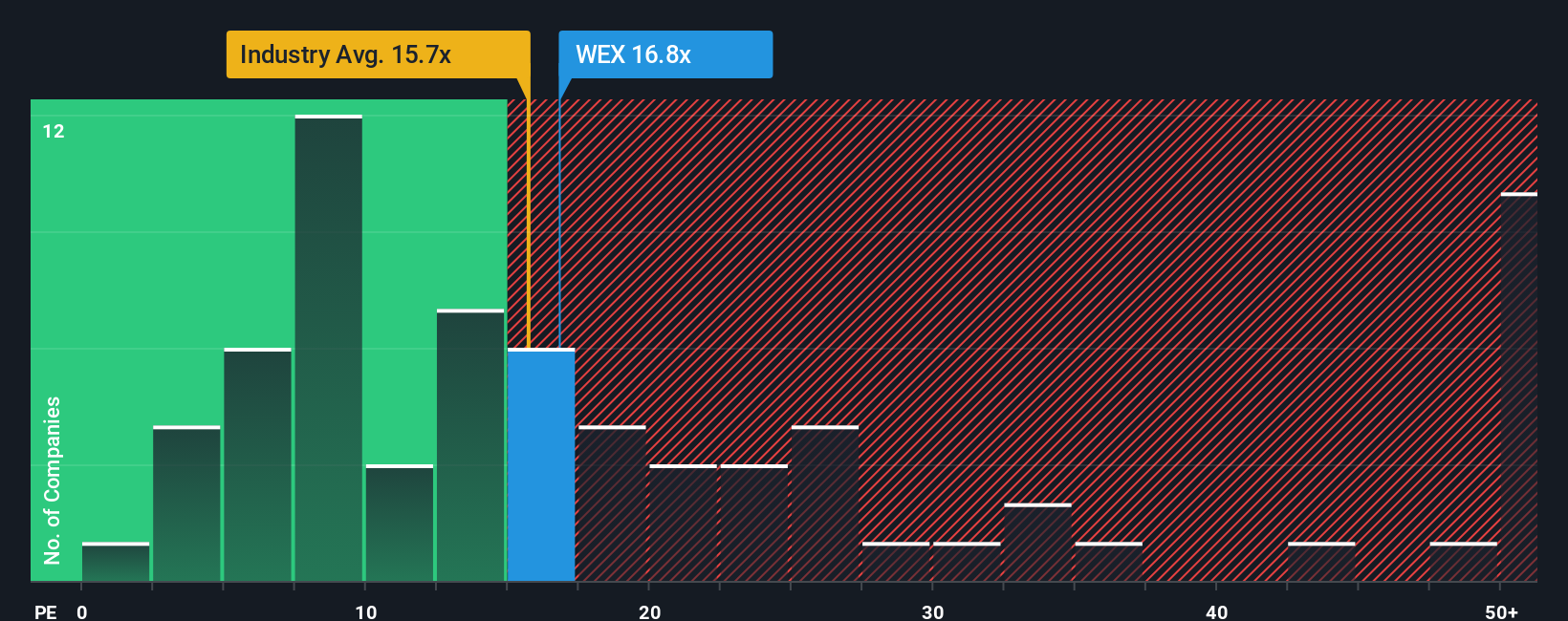

While the analyst target implies WEX is undervalued, looking at price-to-earnings tells another story. WEX trades at 17.6x earnings, which is higher than the industry average of 14.2x, its peer average of 17.1x, and even the fair ratio of 17.3x. This suggests investors are currently paying a premium, not a discount. Could this mean the market is pricing in unique strengths, or does it raise the risk if growth fails to materialize?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own WEX Narrative

If you want to dig deeper or form a different perspective, you can quickly create your own narrative with the latest numbers and insights. Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding WEX.

Looking for more investment ideas?

Avoid missing your next big opportunity by opening the door to fresh stock picks with the Simply Wall Street Screener's powerful filters and strategies.

- Uncover compelling value with these 870 undervalued stocks based on cash flows and find opportunities trading below their estimated cash flow worth.

- Boost your passive income by evaluating these 16 dividend stocks with yields > 3%, featuring reliable stocks boasting yields above 3%.

- Capitalize on breakthroughs in healthcare innovation by reviewing these 32 healthcare AI stocks, a resource showcasing companies revolutionizing treatment with artificial intelligence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if WEX might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WEX

WEX

Operates a commerce platform in the United States and internationally.

Reasonable growth potential and fair value.

Similar Companies

Market Insights

Community Narratives