- United States

- /

- Diversified Financial

- /

- NYSE:VOYA

Voya Financial (VOYA) Margin Decline Reinforces Investor Focus on Discounted Valuation and Dividend

Reviewed by Simply Wall St

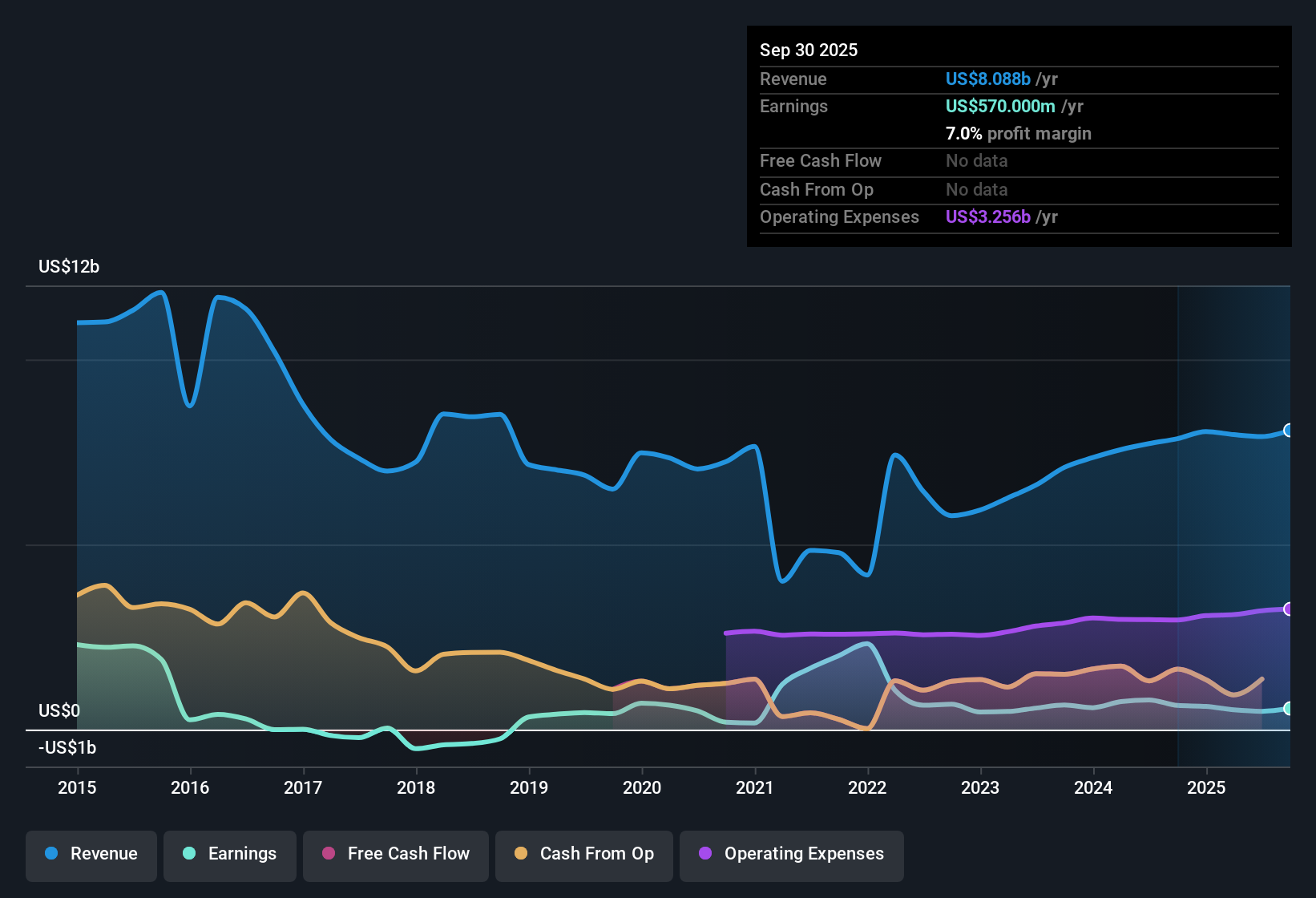

Voya Financial (VOYA) reported revenue growth projections of 4.4% per year and expects annual EPS to rise 13.5%, both lagging behind the broader US market’s respective averages of 10.5% and 16%. Current net profit margin is 6.2%, down from 10.4% a year ago, and earnings have declined on average by 14.9% annually over the past five years. With these margin and growth headwinds, investor focus is likely to remain fixed on Voya’s discounted valuation, robust earnings quality, and attractive dividend as the key potential rewards from this earnings release.

See our full analysis for Voya Financial.The next section takes Voya’s latest numbers and puts them head-to-head with the big market narratives, highlighting where expectations line up and where surprises may emerge.

See what the community is saying about Voya Financial

Margins Set to Recover, Doubling by 2028

- Analysts expect Voya’s net profit margin will rise from 6.2% today to 12.1% over the next three years, signaling a rare turnaround after several years of double-digit annual earnings declines.

- According to the analysts' consensus view,

- The company’s digital transformation and integration of OneAmerica are cited as drivers of these improved margins. New technology is lowering costs, and expanded partnerships are creating operational leverage,

- even as risks like fee compression and volatile medical costs still threaten to reverse these gains if not managed carefully.

- For a deeper dive into how analysts are weighing the upbeat margin outlook against industry risks, read the full consensus narrative.

📊 Read the full Voya Financial Consensus Narrative.

DCF Fair Value Points to Upside

- Voya’s current share price of $71.13 is trading at a deep discount to both the DCF fair value of $119.11 and the official analyst target of $85.90. The stock also has a Price-to-Earnings ratio of 13.7x compared to the peer average of 17.7x.

- Consensus narrative highlights,

- that Voya screens as undervalued based on standard valuation metrics and sector comparisons, suggesting room for re-rating if forecasted growth materializes,

- yet divergence in analyst price targets (ranging $64.00 to $90.00) underscores how much depends on the delivery of anticipated profit gains and improvements in financial position.

Revenue Growth Lags, But Assets Surge Past $1 Trillion

- While company-wide revenue is projected to rise just 4.4% per year, which is less than half the US market growth rate, Voya has surpassed $1 trillion in assets and nearly 10 million participant accounts in its retirement business, driven by strong organic net flows and new client wins.

- Analysts' consensus view notes,

- that despite the slow headline revenue trend, Voya’s focus on holistic financial wellness, digital automation, and alternative investment solutions is strengthening its diversification and asset base,

- but ongoing pressures from fee compression, regulatory uncertainty, and disruptive digital competitors could still threaten top-line growth and margins if not navigated well.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Voya Financial on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a fresh take on these figures? Share your perspective and shape your narrative in just a few minutes: Do it your way.

A great starting point for your Voya Financial research is our analysis highlighting 5 key rewards and 2 important warning signs that could impact your investment decision.

See What Else Is Out There

Voya’s sluggish revenue growth, past earnings declines, and margin headwinds suggest it currently lacks the steadiness and expansion seen in top performers.

If consistent results matter to you, use our stable growth stocks screener (2074 results) to zero in on companies that reliably deliver steady growth year after year.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:VOYA

Voya Financial

Provides workplace benefits, and savings solutions and technologies in the United States and internationally.

Very undervalued established dividend payer.

Similar Companies

Market Insights

Community Narratives