Visa (V): Evaluating Valuation as Regulatory Scrutiny and Lawmaker Pushback Shake Up Investor Confidence

Reviewed by Simply Wall St

Visa (V) is back in the spotlight as new political and regulatory challenges emerge. U.S. lawmakers are pushing back on its recent settlement with Mastercard over credit card interchange fees, and this push for industry reform is adding to investor uncertainty.

See our latest analysis for Visa.

While Visa’s recent headlines have added near-term volatility, the bigger picture reveals a nuanced story. Over the past year, the share price has steadily climbed, reflecting a 6.2% total shareholder return. However, shares slipped roughly 5% over the last month as regulatory risks have come into focus. Despite market jitters, Visa’s long-term momentum remains strong, with three- and five-year total shareholder returns of 57% and 59% respectively.

If shifts in the payments landscape have you thinking bigger, now’s the perfect time to broaden your search and discover fast growing stocks with high insider ownership

With regulatory heat intensifying and shares pulling back from their highs, investors now face a classic valuation puzzle. Is the recent dip a window to buy Visa before its next growth phase, or is the market already pricing in everything ahead?

Most Popular Narrative: 17% Undervalued

Visa's fair value, according to the consensus narrative, stands well above the last close. This suggests significant long-term opportunity in today's market conditions.

Rapidly accelerating adoption of value-added services (VAS), with VAS revenue up 26% year-over-year and expanding into areas such as AI, risk solutions, and open banking, is increasing Visa's mix of higher-margin business lines. This should lift net margins and improve overall earnings quality.

What’s behind this surging growth estimate? The narrative points to blockbuster expansion in key business lines and assumes Visa will keep improving its profit engine. Want a glimpse at what ambitious forecasts drive the fair value and which numbers could shock the skeptics? Discover why this narrative defies the current market pullback and projects a bright upside.

Result: Fair Value of $391.46 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, the rise of real-time payment systems and ongoing regulatory scrutiny could challenge Visa’s traditional fee model and may put pressure on future revenue growth.

Find out about the key risks to this Visa narrative.

Another View: Digging Into Market Comparisons

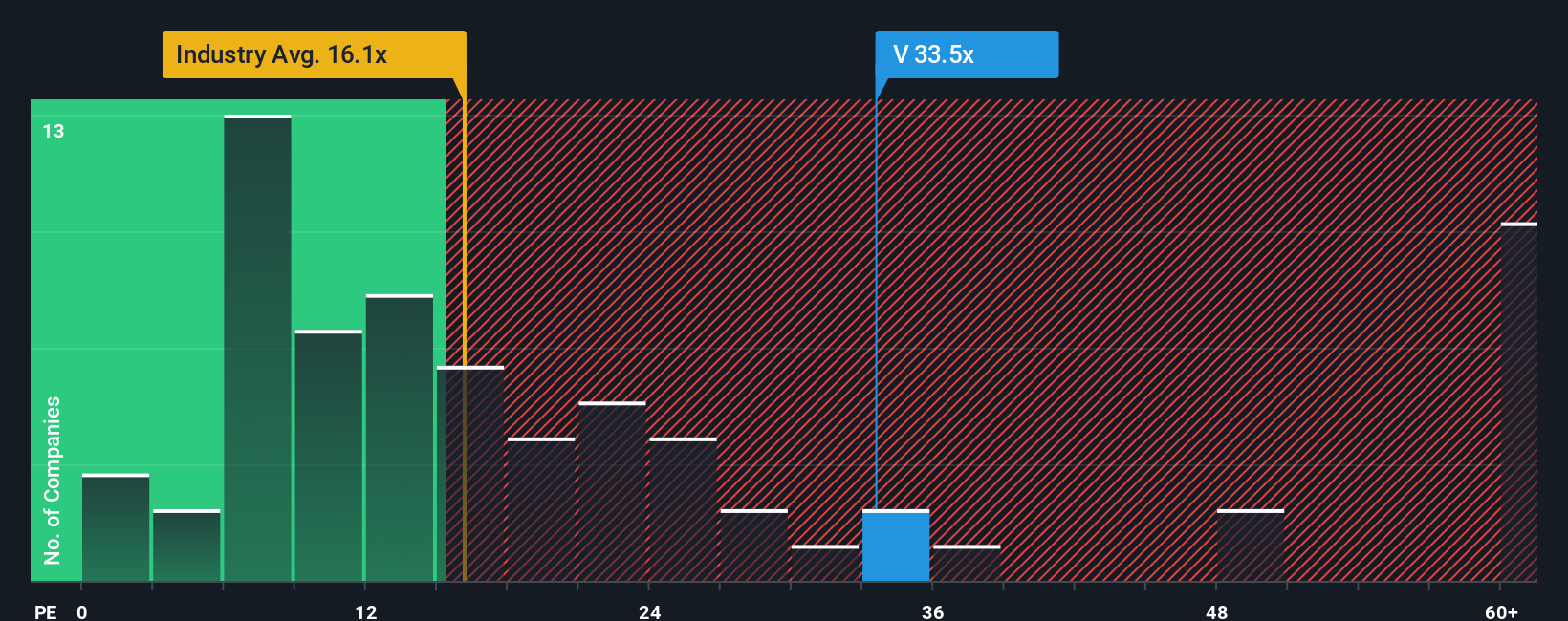

Looking at Visa's valuation through earnings, the stock trades at a 31.2x ratio, which is much higher than the US industry average of just 13.1x and the peer group at 16.5x. The fair ratio sits at 20.8x, suggesting today's pricing carries extra risk if expectations shift. Does this premium signal true strength, or is it a warning to take a closer look?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Visa Narrative

If you have your own take on Visa or want a deeper dive into the numbers, you can easily craft your own narrative in just a few minutes, Do it your way

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Visa.

Ready for More Investment Ideas?

Don’t limit your strategy to just one stock. Uncover fresh opportunities that are driving market excitement and find hidden winners by using these targeted lists:

- Snag potential high-yield returns by reviewing these 15 dividend stocks with yields > 3%, a list of companies offering yields above 3% and solid fundamentals.

- Take a front row seat to the AI revolution by checking out these 27 AI penny stocks, where innovation and rapid growth are reshaping industries.

- Capitalize on tomorrow’s breakthroughs by browsing these 26 quantum computing stocks, featuring firms leading advancements in quantum computing and technology.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:V

Visa

Operates as a payment technology company in the United States and internationally.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives