A Closer Look at Visa’s (V) Valuation Following Strong Earnings and Digital Payments Expansion

Reviewed by Simply Wall St

Visa announced earnings that surpassed Wall Street’s forecasts, highlighting steady revenue growth and upbeat guidance for fiscal 2026. The company is also demonstrating major progress in digital payments and international stablecoin initiatives.

See our latest analysis for Visa.

Visa’s share price has drifted lower lately, dipping 3.7% over the past month, despite robust quarterly results, a record $30 billion buyback plan, and fresh partnerships like its new deal with Edenred. Still, the stock’s total shareholder return of 16.3% over the past year and 72% over three years signals that long-term momentum is very much intact. This suggests investors remain confident that Visa’s expansion in digital payments and ongoing innovation will keep powering growth.

If Visa’s global reach sparked your curiosity, now is a smart time to broaden your investing lens and discover fast growing stocks with high insider ownership

With strong earnings and expansion into digital payments, is Visa currently undervalued with room to run? Or has the market already priced in its growth story, leaving limited opportunity for new investors?

Most Popular Narrative: 13.9% Undervalued

Visa’s narrative fair value estimate stands at $391.46, about 13.9% above its last close. The market seems split on how much future growth gets priced in; however, bullish catalysts are front and center.

Rapidly accelerating adoption of value-added services (VAS), with VAS revenue up 26% year-over-year and expanding into areas such as AI, risk solutions, and open banking, is increasing Visa's mix of higher-margin business lines, which should lift net margins and improve overall earnings quality.

Want to know what is powering this narrative? The roadmap hinges on a shift in business mix and ambitious earnings growth projections. Craving the specific upgrades and bold profit assumptions? Explore the full rationale behind this fair value. Some of the narrative’s numbers might surprise you.

Result: Fair Value of $391.46 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, the rapid growth of real-time payment networks and tougher global regulations could pressure Visa’s traditional fees, which may challenge its long-term revenue trajectory.

Find out about the key risks to this Visa narrative.

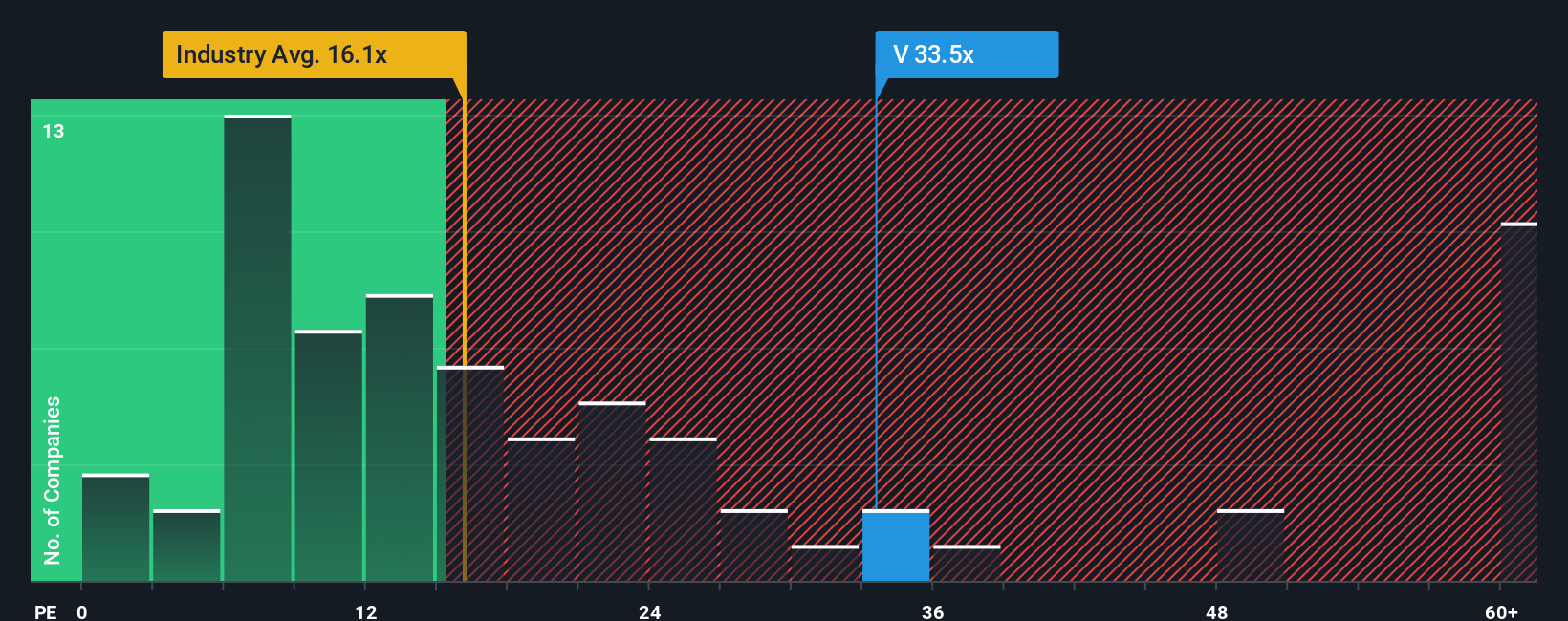

Another View: What Do Valuation Ratios Suggest?

Looking beyond fair value estimates, Visa’s price-to-earnings ratio sits at 32.2x. This is noticeably higher than the US Diversified Financial industry average of 14.8x, the peer average of 18.1x, and even the fair ratio of 20.9x that our model suggests could serve as a market anchor. This premium signals investors are willing to pay more, but it also raises questions about future upside potential compared to risk. Could these elevated ratios signal an opportunity, or are they indicating caution for buyers at these levels?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Visa Narrative

If you see things differently or want to dive into the numbers yourself, you can build your own view in just a few minutes by using Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Visa.

Looking for More Smart Investment Moves?

You owe it to yourself to check out investment opportunities that could reshape your portfolio. Don’t let these market trends pass you by. Get ahead now with unique recommendations curated by Simply Wall Street.

- Maximize your income potential by tapping into these 18 dividend stocks with yields > 3% with reliable yields greater than 3%.

- Ride the momentum of artificial intelligence by seizing opportunities among these 27 AI penny stocks making an impact in tomorrow’s world.

- Uncover hidden value by targeting these 841 undervalued stocks based on cash flows that stand out based on strong cash flow fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:V

Visa

Operates as a payment technology company in the United States and internationally.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives