- United States

- /

- Diversified Financial

- /

- NYSE:UWMC

Why Did UWM Holdings (UWMC) Affirm Its Dividend Despite a Quarterly Loss and Insider Sale?

Reviewed by Sasha Jovanovic

- UWM Holdings Corporation recently reported its third quarter 2025 results, revealing a net loss of US$1.26 million, an improvement over the same period last year, while revenues surpassed consensus and the company affirmed its dividend for the twentieth straight quarter.

- A significant insider share sale from a major shareholder, occurring just days before the results announcement, added an intriguing element to market reactions as the company issued cautious guidance for the upcoming quarter.

- We'll examine how UWM's reaffirmed dividend amidst a quarterly loss may influence its investment narrative and expectations going forward.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

UWM Holdings Investment Narrative Recap

To be a shareholder in UWM Holdings, you need to believe that its investment in technology and emphasis on broker-driven wholesale mortgage origination will deliver consistent growth and margin improvement. The recent quarterly results, showing a narrowed loss and reaffirmed dividend, do not materially shift the biggest near-term catalyst, which is volume growth from origination, or the main risk: margin compression if loan volumes lag behind rising fixed costs.

Among recent announcements, the company's cautious production guidance of US$43 billion to US$50 billion for the fourth quarter stands out, especially alongside ongoing competitive pressures in the wholesale mortgage channel. Clear visibility on whether higher production can offset margin risks remains crucial for those tracking the most sensitive catalysts for UWM’s future performance.

Yet, in contrast, investors should be aware that despite steady dividends, the company’s mounting fixed cost base could quickly become a concern if ...

Read the full narrative on UWM Holdings (it's free!)

UWM Holdings' outlook anticipates $3.6 billion in revenue and $119.3 million in earnings by 2028. This is based on a yearly revenue growth rate of 10.8% and an increase in earnings of $107.4 million from current earnings of $11.9 million.

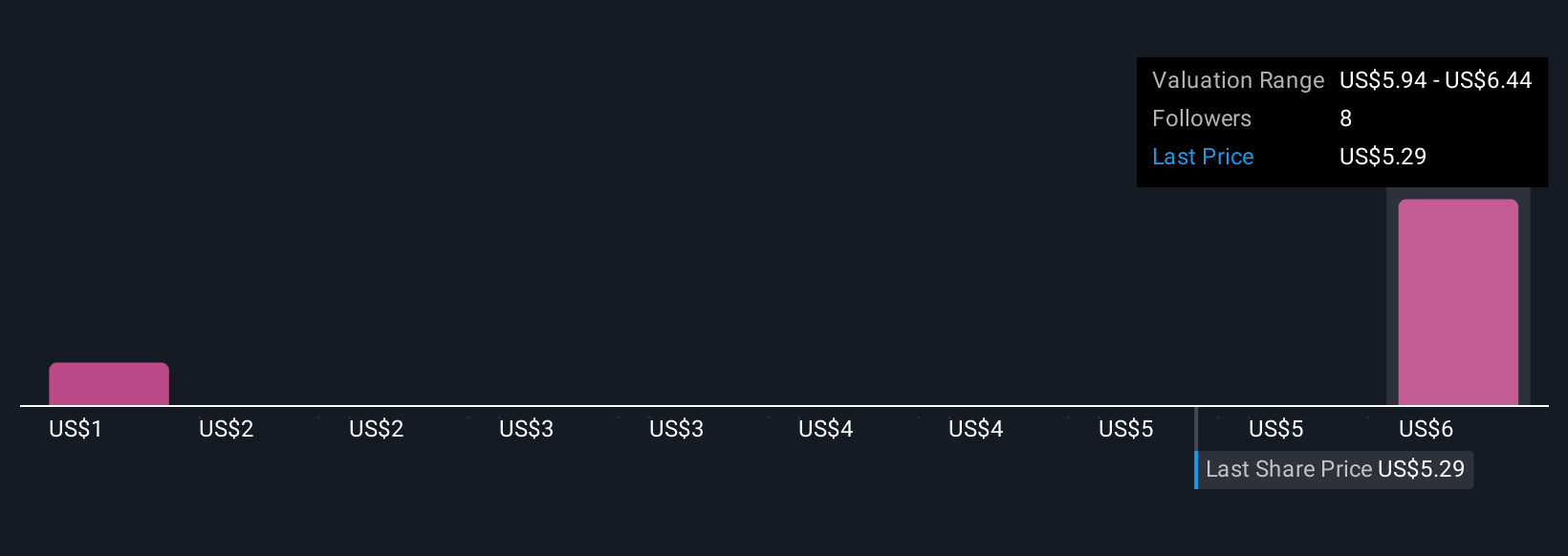

Uncover how UWM Holdings' forecasts yield a $6.59 fair value, a 26% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members have set fair value estimates for UWM Holdings between US$1.77 and US$6.59, based on three distinct forecasts. With the company’s heavy fixed cost investments highlighted as a key risk, be sure to compare these differing views when considering long-term value and exposure.

Explore 3 other fair value estimates on UWM Holdings - why the stock might be worth as much as 26% more than the current price!

Build Your Own UWM Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your UWM Holdings research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free UWM Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate UWM Holdings' overall financial health at a glance.

Want Some Alternatives?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Find companies with promising cash flow potential yet trading below their fair value.

- This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:UWMC

UWM Holdings

Engages in the origination, sale, and servicing residential mortgage lending in the United States.

Exceptional growth potential with questionable track record.

Similar Companies

Market Insights

Community Narratives