- United States

- /

- Diversified Financial

- /

- NYSE:UWMC

UWM Holdings (UWMC): Assessing Valuation After Record Loan Production and New AI-Powered Efficiency Boost

Reviewed by Simply Wall St

UWM Holdings, the wholesale mortgage giant, just reported its strongest quarterly loan production since 2021 and rolled out an AI-driven assistant that has already begun improving efficiency across its operations. At the same time, management issued guidance for continued growth in the coming quarter, underscoring the company’s ability to adapt and support shareholder value even as market conditions fluctuate.

See our latest analysis for UWM Holdings.

Alongside its operational milestones, UWM Holdings has kept investors watching closely with recent moves in its share price. After notching up a 7.5% share price return over the last 90 days and producing a record-setting quarter, sentiment is cautiously optimistic, even though the total shareholder return stands at -5.3% over the past year. However, the strong three-year total shareholder return of 62.3% points to solid momentum over the longer run.

If you're tracking how innovative lenders are changing the game, it's a great moment to broaden your investing radar and discover fast growing stocks with high insider ownership

With recent gains and bullish analyst targets in mind, investors are now asking if UWM Holdings’ momentum signals an undervalued opportunity or whether the market has already accounted for the company’s future growth prospects.

Most Popular Narrative: 17.5% Undervalued

Compared to UWM Holdings' last close of $5.44 per share, the most popular narrative suggests a fair value of $6.59. This flags an attractive valuation that is not yet fully captured by the current market price. This potential undervaluation sets the stage for a deeper dive into the core thesis behind these projections.

Continued investment and successful deployment of advanced AI tools (such as BOLT, ChatUWM, LEO, and Mia) are materially increasing broker productivity, efficiency, and borrower retention. This provides UWM with lower unit costs and the ability to handle significantly higher loan volumes without a proportional increase in costs, which should drive long-term revenue growth and operating margin expansion.

Want to unravel the secret behind this bold valuation? This narrative hinges on a dramatic transformation in efficiency and market share, driven by breakthrough technology and ambitious future financial targets. If you want to see what surprising projections are fueling this confidence, you will have to dig deeper into the details for yourself.

Result: Fair Value of $6.59 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent high interest rates or a shift away from broker-driven channels could weaken UWM Holdings' growth outlook and challenge these optimistic projections.

Find out about the key risks to this UWM Holdings narrative.

Another View: Looking Beyond the Popular Narrative

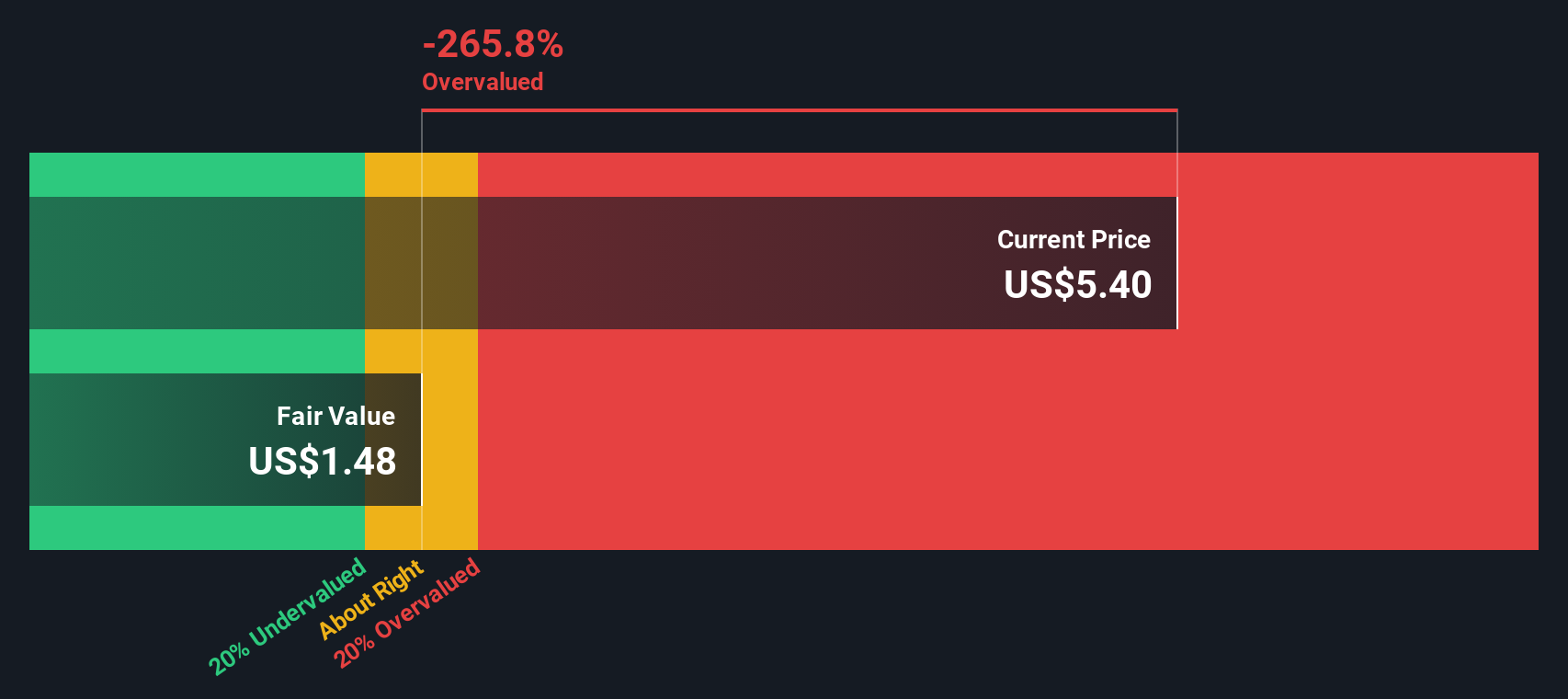

While the current fair value estimate suggests UWM Holdings is undervalued, our DCF model arrives at a far more conservative view, indicating that shares are trading well above their fair value of $1.74. This sharp contrast raises a key question: could the initial bullish projections be assuming too rapid a turnaround for growth and efficiency gains?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own UWM Holdings Narrative

If the analysis so far doesn’t quite match your perspective, don’t hesitate to dive into the numbers yourself and craft your own story in just a few minutes. Do it your way

A great starting point for your UWM Holdings research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Your next smart move is just a click away. Maximize your portfolio by checking out top opportunities other investors don’t want you to miss.

- Uncover value by checking out these 864 undervalued stocks based on cash flows and find companies with strong cash flows trading well below their intrinsic worth.

- Boost your income stream when you explore these 16 dividend stocks with yields > 3%, which features stocks with robust yields for investors seeking powerful returns.

- Tap into the high-growth potential of the digital future by researching these 82 cryptocurrency and blockchain stocks, shaping tomorrow’s financial and blockchain landscape.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:UWMC

UWM Holdings

Engages in the origination, sale, and servicing residential mortgage lending in the United States.

High growth potential with questionable track record.

Similar Companies

Market Insights

Community Narratives