- United States

- /

- Mortgage REITs

- /

- NYSE:TWO

Will a $175 Million Litigation Hit and Ongoing Losses Shift Two Harbors Investment’s (TWO) Story?

Reviewed by Sasha Jovanovic

- Two Harbors Investment Corp reported a net loss of US$127.92 million for the third quarter of 2025, significantly missing analyst expectations due to a US$175.1 million litigation settlement expense and wider operating challenges.

- Despite these losses, the company expanded its subservicing business and maintained a 17-year streak of dividend payments, highlighting resilience in certain operational areas.

- We'll explore how the substantial litigation-related loss shapes Two Harbors Investment Corp's investment narrative going forward.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

What Is Two Harbors Investment's Investment Narrative?

For shareholders of Two Harbors Investment Corp, the central thesis has long hinged on its potential to deliver meaningful dividends while managing the risks tied to mortgage-backed securities and balance sheet leverage. The recent Q3 loss, driven by a substantial US$175.1 million litigation settlement, is a material development that directly affects near-term catalysts. Previously, progress in the subservicing business and steady dividend payments were seen as strengths, but the scale of the settlement expense, and the subsequent pressure on book value and earnings, places new focus on capital preservation and risk controls. While resolving this litigation could remove a lingering overhang, the company’s reduced structural leverage and new equity issuance signal that risk management is now squarely in the spotlight. Price weakness following results suggests investors are recalibrating expectations around short-term recoveries, especially as dividend sustainability and profitability remain in question. On the flip side, reliance on healthy dividend coverage could prove more challenging after this quarter’s financial hit.

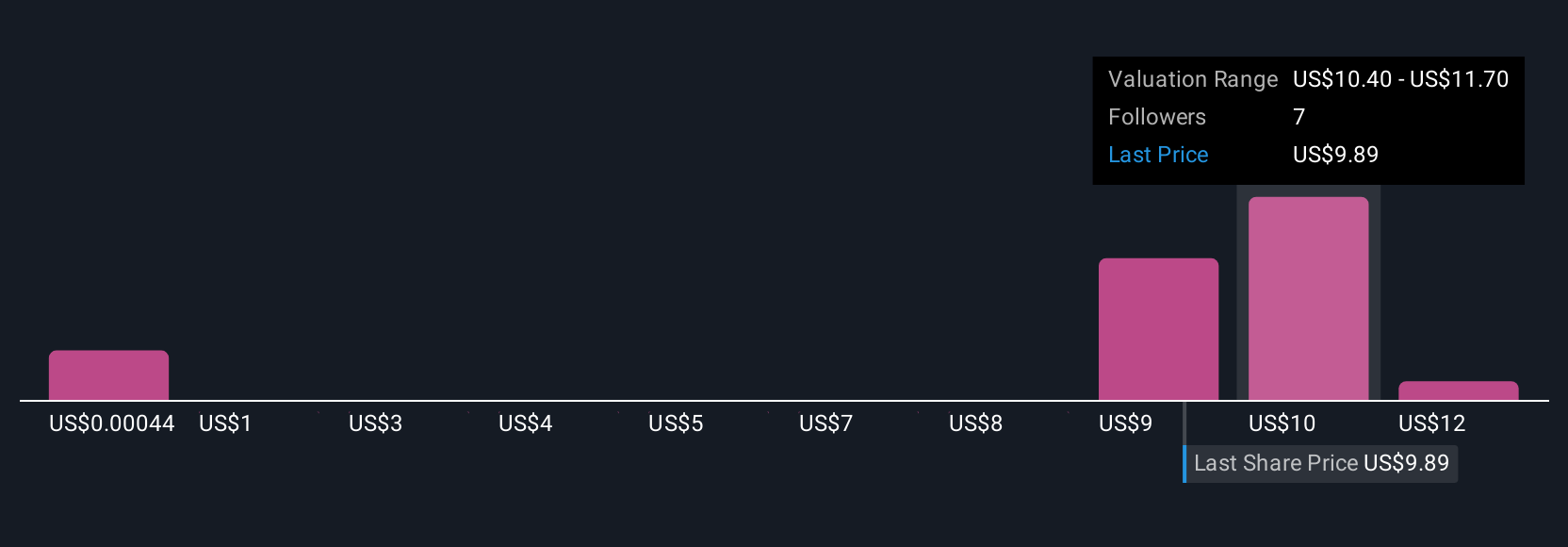

Despite retreating, Two Harbors Investment's shares might still be trading 36% above their fair value. Discover the potential downside here.Exploring Other Perspectives

Explore 6 other fair value estimates on Two Harbors Investment - why the stock might be worth as much as 57% more than the current price!

Build Your Own Two Harbors Investment Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Two Harbors Investment research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Two Harbors Investment research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Two Harbors Investment's overall financial health at a glance.

Searching For A Fresh Perspective?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 27 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 37 best rare earth metal stocks of the very few that mine this essential strategic resource.

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Two Harbors Investment might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TWO

Two Harbors Investment

Invests in, finances, and manages mortgage servicing rights (MSRs), agency residential mortgage-backed securities (RMBS), and other financial assets through RoundPoint in the United States.

Good value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives