- United States

- /

- Mortgage REITs

- /

- NYSE:TWO

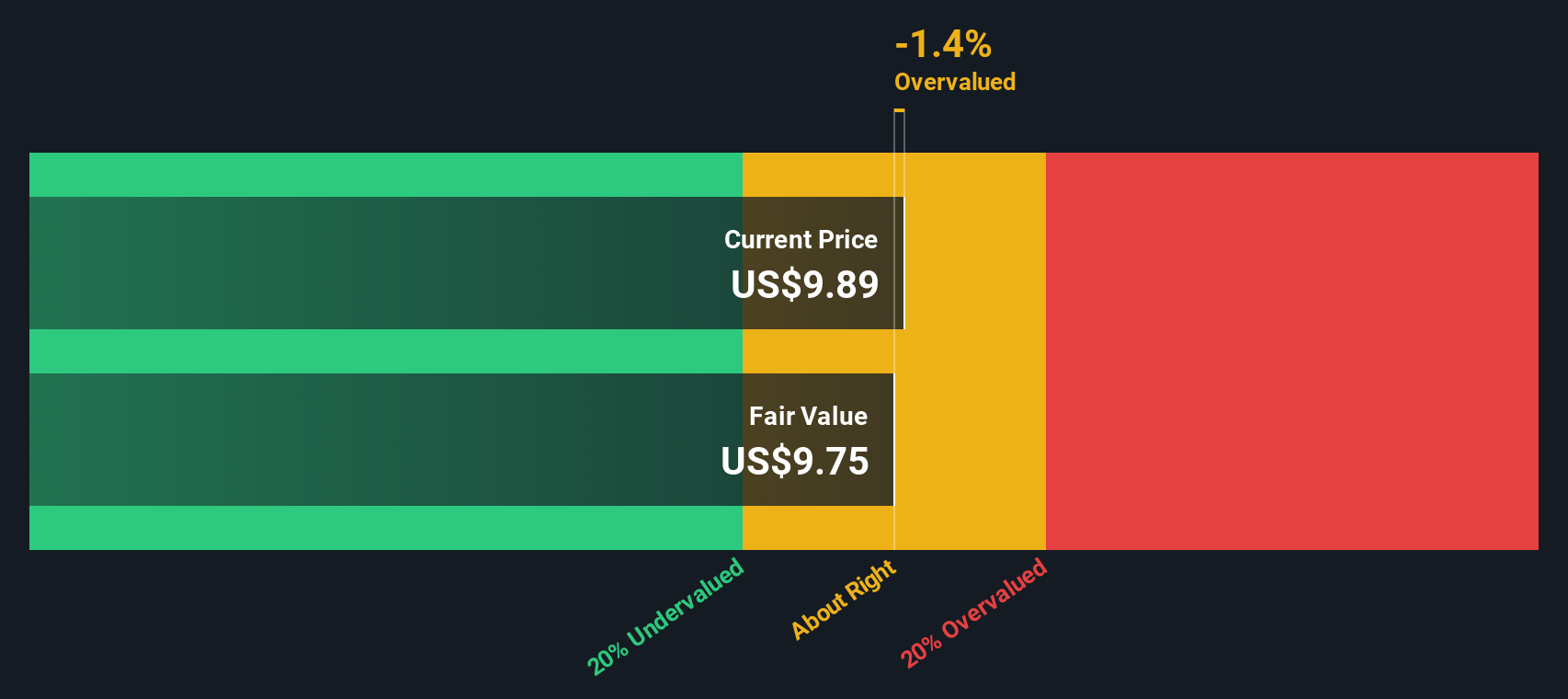

Two Harbors Investment (TWO): Examining Valuation Following Continued Quarterly Net Losses

Reviewed by Simply Wall St

Two Harbors Investment (TWO) just reported its third quarter and nine-month earnings. Continued net losses stood out compared to positive results a year ago. This ongoing trend of negative figures is catching investors’ attention.

See our latest analysis for Two Harbors Investment.

The persistent string of quarterly net losses appears to have weighed on sentiment, with Two Harbors Investment’s share price down nearly 19% year-to-date. However, the overall 1-year total shareholder return held nearly flat, which suggests recent pain but some resilience over the longer run.

If you’re weighing other options while momentum shifts in this space, it may be a good opportunity to broaden your search and discover fast growing stocks with high insider ownership

With shares trading at a notable discount to analyst targets despite recent losses, is the market underestimating Two Harbors Investment’s potential turnaround, or is the stock fairly valued given ongoing headwinds?

Price-to-Sales of 1.9x: Is it justified?

Two Harbors Investment’s shares last closed at $9.72, and its price-to-sales ratio of 1.9x stands out well below both industry and peer averages. This places the company among the lower-valued names in the US Mortgage REITs sector based on this metric.

The price-to-sales ratio compares a company’s market capitalization to its total sales, providing investors a way to assess how much they are paying per dollar of revenue. For Mortgage REITs like Two Harbors Investment, this ratio is useful because earnings can be volatile. Revenue-based comparisons offer additional perspective.

At 1.9x, Two Harbors Investment is priced at less than half of the US Mortgage REITs industry average (4x) and also below the peer group average (4.8x). However, it is worth noting that the estimated fair price-to-sales ratio is only 0.2x. This suggests that while the stock trades cheaply relative to industry norms, the market could adjust lower under more conservative assumptions. This large gap highlights how investor sentiment and future expectations can diverge sharply from statistical “fair” benchmarks.

Explore the SWS fair ratio for Two Harbors Investment

Result: Price-to-Sales of 1.9x (UNDERVALUED)

However, persistent negative revenue growth and recent net losses could further erode confidence and put pressure on valuations if these trends do not stabilize soon.

Find out about the key risks to this Two Harbors Investment narrative.

Another View: Our DCF Model's Verdict

Taking a step back from the price-to-sales ratio, our DCF model for Two Harbors Investment lands at a fair value of $15.28 per share, which is well above the current price of $9.72. By this approach, the stock appears significantly undervalued. What explains the wide gap between these methods? Could the real value lie somewhere in between?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Two Harbors Investment for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 840 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Two Harbors Investment Narrative

If you see these numbers differently or enjoy forging your own view, you can dig into the data yourself and piece together your own narrative in just a few minutes. Do it your way

A great starting point for your Two Harbors Investment research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Don’t just settle for one opportunity when there are so many smart ways to strengthen your portfolio. Let Simply Wall Street’s powerful screener help you take action in the market today.

- Spot hidden bargains before the crowd by reviewing these 840 undervalued stocks based on cash flows to see which companies have strong cash flow but low market hype.

- Unlock passive income potential and find more consistent payouts by searching through these 22 dividend stocks with yields > 3%, making sure your investments work harder for you.

- Ride the technological wave and access market leaders driving innovation in artificial intelligence by checking out these 26 AI penny stocks right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Two Harbors Investment might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TWO

Two Harbors Investment

Invests in, finances, and manages mortgage servicing rights (MSRs), agency residential mortgage-backed securities (RMBS), and other financial assets through RoundPoint in the United States.

Good value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives