- United States

- /

- Mortgage REITs

- /

- NYSE:STWD

Does Starwood Property Trust’s Declining EPS Shift the Long-Term Outlook for STWD Investors?

Reviewed by Sasha Jovanovic

- Starwood Property Trust reported its third quarter and nine-month results for 2025, revealing sales of US$57.53 million and revenue of US$488.88 million for the quarter, and net income of US$72.56 million, slightly down from the previous year.

- An interesting insight is that while quarterly sales grew substantially versus a year ago, earnings per share and overall quarterly net income both saw year-on-year declines.

- With quarterly earnings per share lower than last year, we'll examine how this result reshapes Starwood Property Trust's investment narrative.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Starwood Property Trust Investment Narrative Recap

To invest in Starwood Property Trust, you need to believe in the resilience of its income-generating real estate platform and management’s ability to successfully diversify beyond legacy office loans. The latest results, higher sales but declining earnings per share and net income, do not materially shift the most important short term catalyst, which remains the successful integration and ramp-up of acquired net lease assets, nor do they ease the biggest present risk: persistent underperformance and delayed resolution of unproductive loans that tie up capital and pressure margins.

Among recent developments, the company’s large green and social bond offerings in October 2025 stand out. While these US$1.05 billion in unsecured note issuances enable eligible project financing and could shore up liquidity for growth or portfolio stabilization, they also reinforce existing risks around rising debt, capital costs, and dividend sustainability if earnings softness continues, especially as loan book headwinds linger. In contrast, investors should be aware that if credit losses on unproductive loans...

Read the full narrative on Starwood Property Trust (it's free!)

Starwood Property Trust's outlook projects $3.1 billion in revenue and $585.4 million in earnings by 2028. This requires a 109.0% annual revenue growth rate and a $223.3 million increase in earnings from the current $362.1 million.

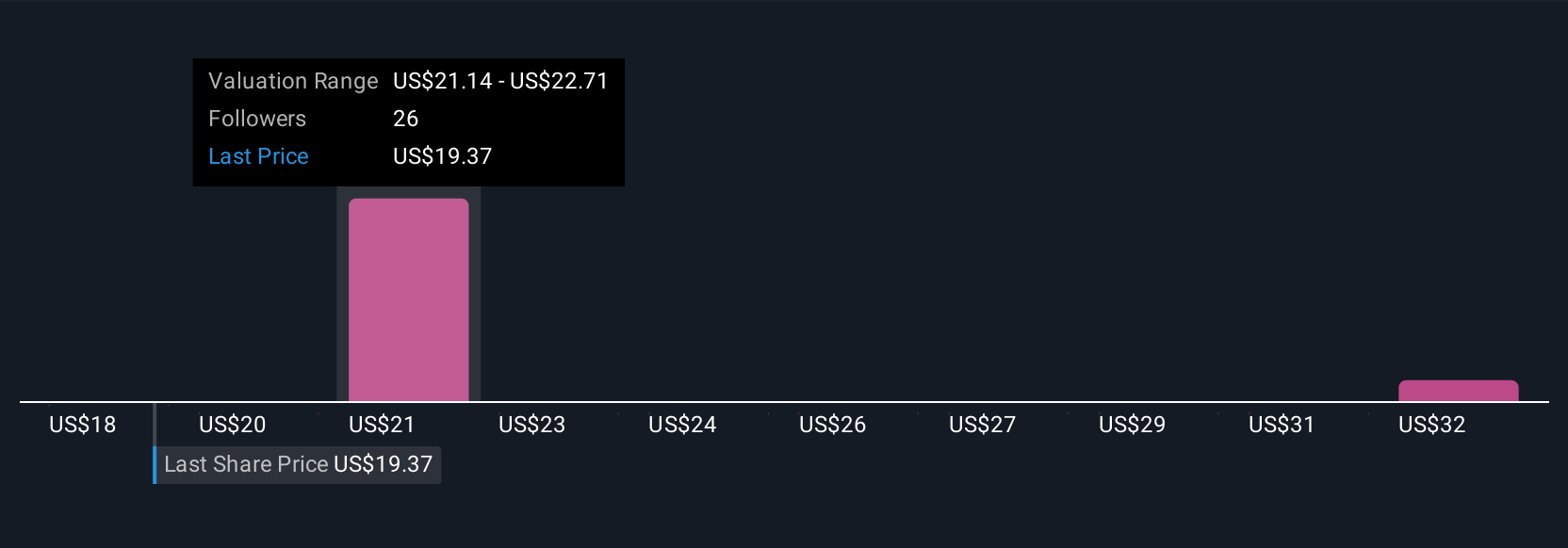

Uncover how Starwood Property Trust's forecasts yield a $21.86 fair value, a 22% upside to its current price.

Exploring Other Perspectives

Three private investors in the Simply Wall St Community valued Starwood Property Trust between US$18.00 and US$21.86 per share. While some see upside opportunity, underlying risks in commercial loan exposures may affect confidence in future growth; compare these perspectives before deciding.

Explore 3 other fair value estimates on Starwood Property Trust - why the stock might be worth as much as 22% more than the current price!

Build Your Own Starwood Property Trust Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Starwood Property Trust research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Starwood Property Trust research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Starwood Property Trust's overall financial health at a glance.

Contemplating Other Strategies?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Find companies with promising cash flow potential yet trading below their fair value.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:STWD

Starwood Property Trust

Operates as a real estate investment trust (REIT) in the United States and internationally.

Moderate growth potential second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives