- United States

- /

- Capital Markets

- /

- NYSE:STT

Does Recent Digital Expansion Make State Street a Value Opportunity for 2025?

Reviewed by Bailey Pemberton

- Wondering if State Street is a hidden gem or well-priced for what it offers? You are not alone, as plenty of investors are buzzing about whether it is trading at a discount or has already run its course.

- The stock has surged 28.9% over the past year and is up an impressive 94.5% over the last five years. It dipped slightly by 2.1% in the last week and is almost flat for the month.

- State Street has grabbed headlines with its strategic moves in global asset servicing and custody, as well as notable expansions into digital assets. These developments have fueled optimism among investors who are closely watching for transformational industry opportunities.

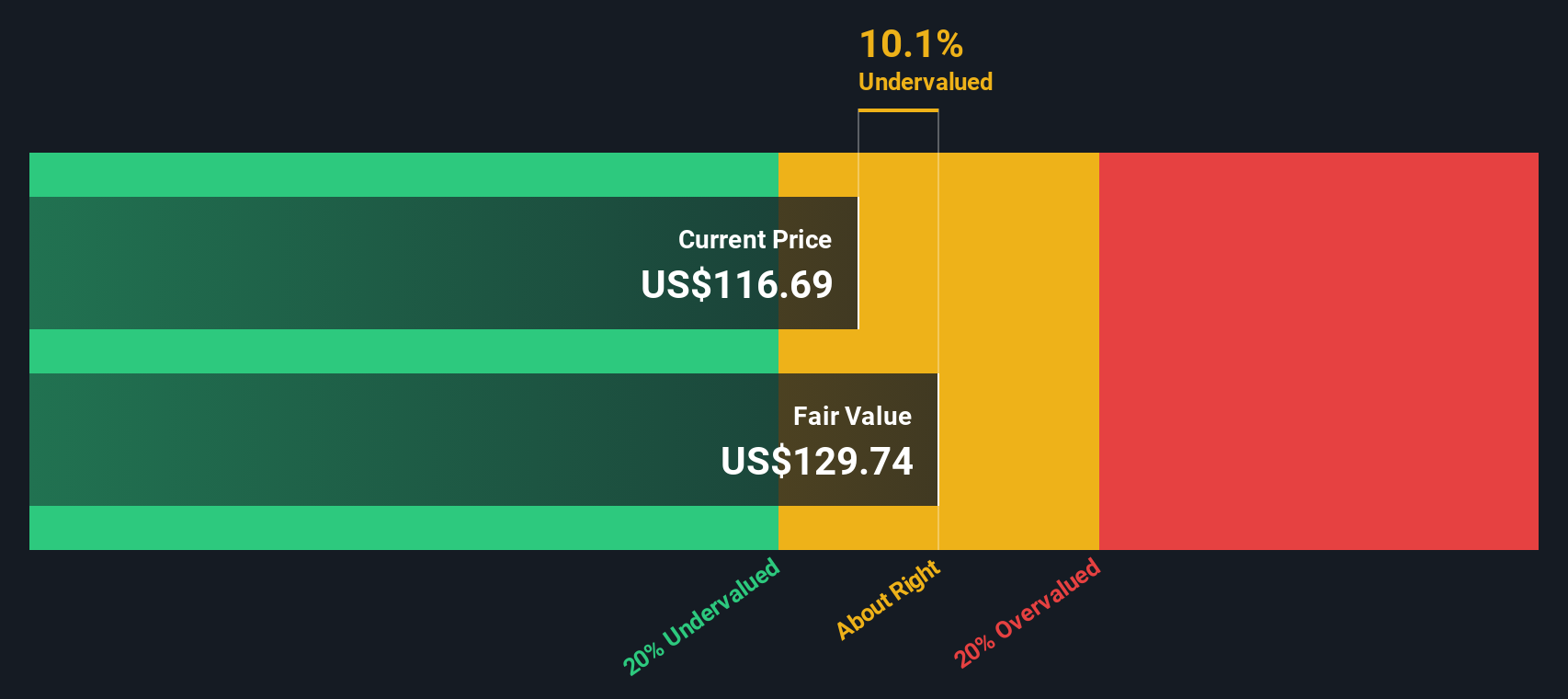

- On our valuation checklist, State Street scores 4 out of 6 possible points for being undervalued. The numbers look compelling on paper. Let's break down the major valuation approaches used by analysts and keep an eye out for an even more practical way to judge real value near the end of this article.

Approach 1: State Street Excess Returns Analysis

The Excess Returns valuation model focuses on how much profit State Street generates above its cost of equity, measuring the effectiveness of its capital deployment. This approach is particularly useful for financial companies, as it zeroes in on return on equity and growth in book value rather than relying on cash flow projections.

For State Street, the current book value stands at $85.33 per share, while analysts project a stable book value of $93.92 per share. Its stable earnings per share (EPS) are estimated at $12.04, drawn from weighted future Return on Equity estimates by eight analysts. The company's cost of equity is calculated at $9.13 per share, resulting in an excess return of $2.91 per share. State Street's average return on equity is a solid 12.82%, highlighting efficient management of shareholder capital.

Based on the Excess Returns model, State Street’s estimated intrinsic value per share is $137.76. This places the stock at a 15.7% discount to its calculated fair value and suggests that shares are currently undervalued relative to their underlying fundamentals.

Result: UNDERVALUED

Our Excess Returns analysis suggests State Street is undervalued by 15.7%. Track this in your watchlist or portfolio, or discover 840 more undervalued stocks based on cash flows.

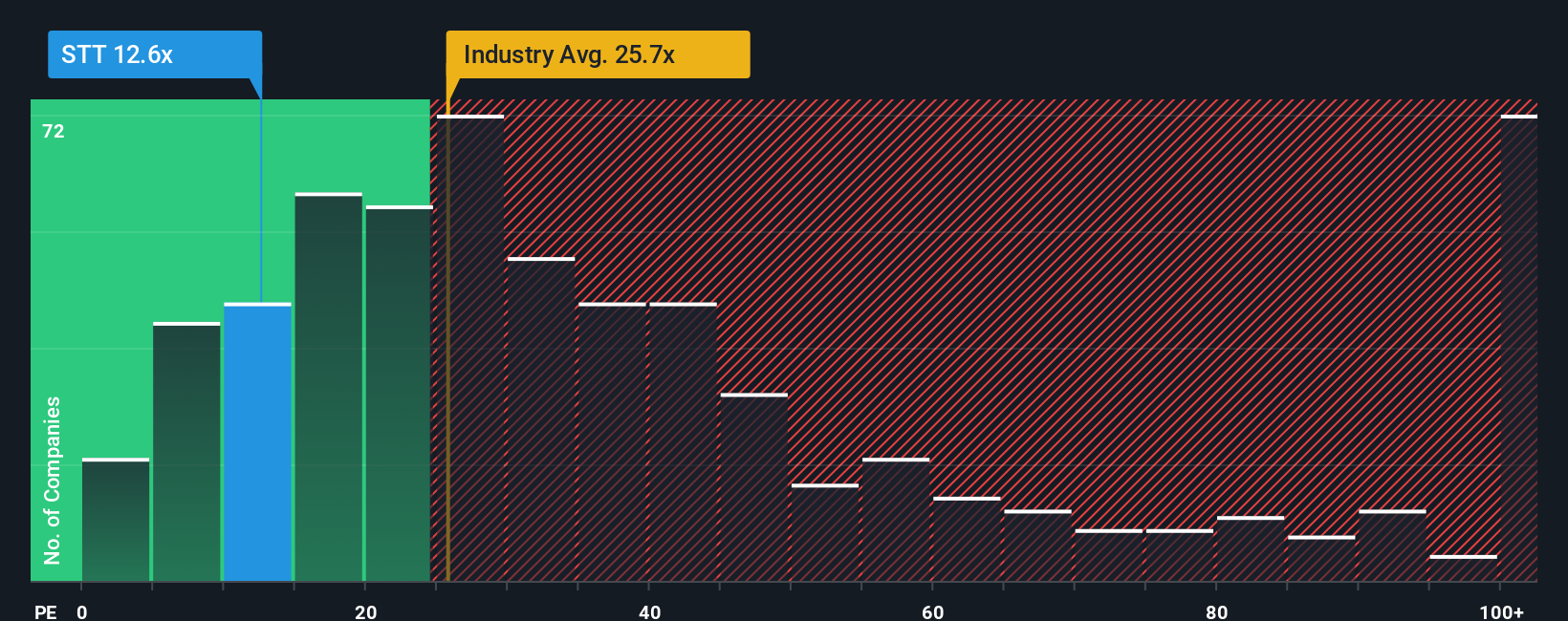

Approach 2: State Street Price vs Earnings (PE Ratio)

The price-to-earnings (PE) ratio is widely considered the most useful valuation metric for profitable companies like State Street. It provides a direct look at how much investors are willing to pay for each dollar of earnings, making it especially relevant when those earnings are consistent and substantial.

What counts as a “normal” PE ratio depends on factors such as growth prospects and risk. Higher-growth, lower-risk companies typically command a higher PE, while slow-growing or riskier businesses usually trade at lower multiples.

Currently, State Street’s PE ratio is 11.8x, which stands out as notably lower than the Capital Markets industry average of 23.7x and the average among its peer companies at 25.3x. This apparent discount can catch an investor’s eye, but simple comparisons do not always tell the whole story.

This is where Simply Wall St’s proprietary “Fair Ratio” comes into play. The Fair Ratio, calculated at 16.0x for State Street, accounts for nuanced factors such as the company’s specific earnings growth expectations, risk profile, profit margins, market capitalization, and industry dynamics. Unlike a basic peer or sector comparison, this benchmark adjusts for what truly makes State Street unique.

Since State Street’s current PE ratio is well below its Fair Ratio, there is strong support for the view that shares remain undervalued by this important metric.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1408 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your State Street Narrative

Earlier we mentioned that there's an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is your story about a company. It links your view of State Street’s business, competitive edge, and the trends that matter most directly to a forecast of future revenues, earnings, and margins, and ultimately to your own estimate of fair value.

Narratives turn investing from just crunching numbers into a more intuitive process by letting you tie what you believe about State Street’s future to the metrics that drive its share price, such as revenue growth and profit margin. On Simply Wall St’s Community page, millions of investors create and update these Narratives, making it a simple, accessible tool for anyone, whether you are new to investing or a seasoned pro.

By comparing your Narrative’s fair value to the latest share price, you can see in real time whether now could be a buying or selling opportunity. Narratives are always up to date. As soon as news breaks or earnings are released, your Narrative is automatically refreshed with the latest numbers so your view is never outdated.

For example, some investors see strong asset and fee growth lifting State Street to a fair value as high as $131.00. Others, concerned about fee pressure and competition, set their fair value as low as $95.00, showing how every Narrative captures a unique perspective on what the company is really worth.

Do you think there's more to the story for State Street? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:STT

State Street

Provides various financial products and services to institutional investors.

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives