- United States

- /

- Capital Markets

- /

- NYSE:SPGI

Does S&P Global’s (SPGI) New Compliance Tech Signal a Shift in Its Private Markets Strategy?

Reviewed by Sasha Jovanovic

- In recent announcements, S&P Global unveiled WSO Compliance Insights, a real-time compliance management tool for private credit and CLO managers, and launched the iLEVEL Snowflake integration, enabling private markets investors to seamlessly extract and analyze portfolio data within their Snowflake environments.

- These technology-driven offerings highlight S&P Global's expanded focus on compliance solutions and data integration for the fast-growing private credit and alternatives market, alongside the opening of a new Manchester office to support regional and global growth.

- We’ll explore how S&P Global’s move to automate compliance in private credit shapes the company’s investment narrative going forward.

Find companies with promising cash flow potential yet trading below their fair value.

What Is S&P Global's Investment Narrative?

For anyone considering S&P Global as an investment, the central narrative is still about owning a leader in financial intelligence, data, and analytics, particularly as markets get more complex and data-driven. The recent launches of WSO Compliance Insights and the iLEVEL Snowflake integration both reinforce S&P Global’s push to serve the growing demands of private markets and alternatives, broadening its appeal in fast-changing finance subsectors. In the short term, these product developments may help strengthen client relationships and support organic growth, but they’re unlikely to move the company’s financials in a material way given the scale of its broader operations and the stock's current valuation premium. That said, these innovations could recalibrate key risks: competitors are also investing heavily in automation and integrated data solutions, making S&P Global’s ability to drive adoption and protect margins a key watchpoint. Investors should also weigh in the sizable buyback program and steadily rising dividends, which continue to underpin shareholder returns even as underlying growth remains mid-single-digit. On the other hand, fresh product rollouts do not guarantee faster growth or market share gains.

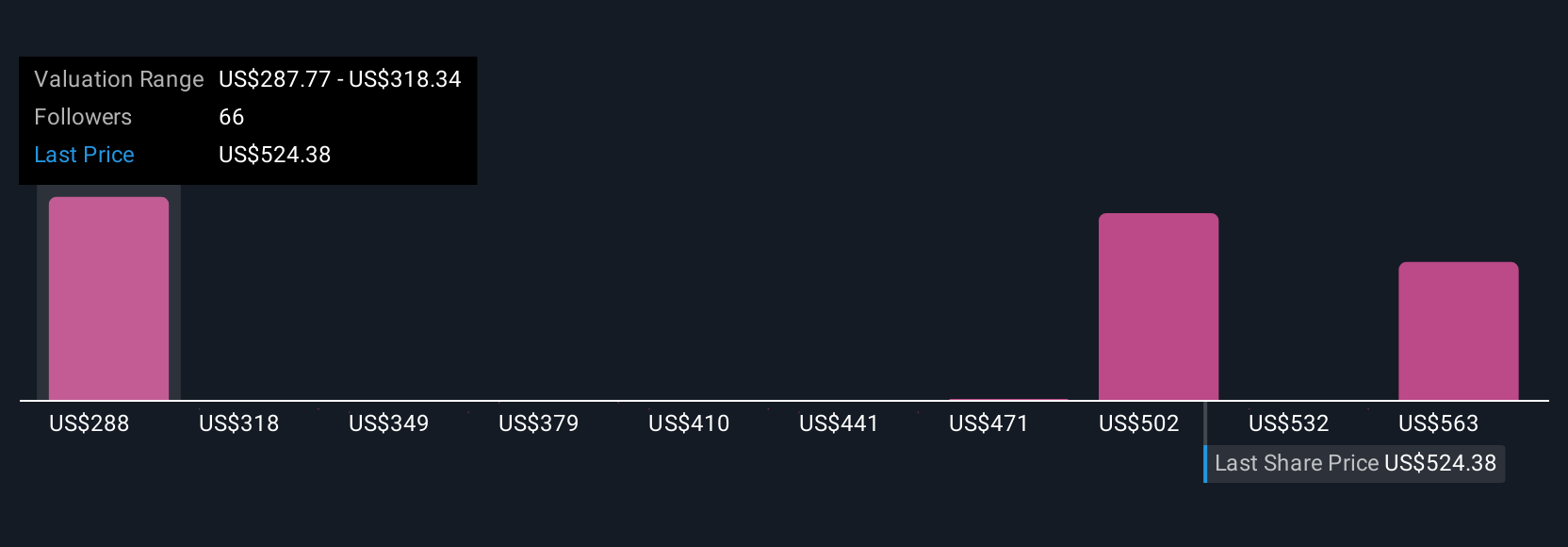

S&P Global's shares are on the way up, but could they be overextended? Uncover how much higher they are than fair value.Exploring Other Perspectives

Explore 24 other fair value estimates on S&P Global - why the stock might be worth 37% less than the current price!

Build Your Own S&P Global Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your S&P Global research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free S&P Global research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate S&P Global's overall financial health at a glance.

Want Some Alternatives?

Our top stock finds are flying under the radar-for now. Get in early:

- We've found 14 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 35 best rare earth metal stocks of the very few that mine this essential strategic resource.

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SPGI

S&P Global

Provides credit ratings, benchmarks, analytics, and workflow solutions in the global capital, commodity, and automotive markets.

Solid track record with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success