- United States

- /

- Capital Markets

- /

- NYSE:SF

Stifel Financial (SF): Assessing Valuation After Recent Gains and Analyst Projections

Reviewed by Simply Wall St

Stifel Financial (SF) has shown a steady climb over the past month, with its stock delivering notably higher returns compared to recent weeks. Investors are keeping an eye on these changes in momentum for clues about the company’s outlook.

See our latest analysis for Stifel Financial.

Stifel Financial’s recent bounce isn’t happening in isolation; despite some volatile days, the stock has posted a 1-month share price return of 5.5% and is now well above where it started the year. Zooming out, its 1-year total shareholder return stands at 3.4%, while long-term holders have benefited from an impressive 95% total return over three years. This momentum suggests investors haven’t lost faith in the business or its growth story.

If you’re interested in what else the market is rewarding right now, it’s worth taking a moment to broaden your search and discover fast growing stocks with high insider ownership

But with the stock’s valuation edging higher and growth expectations rising, investors have to ask if Stifel Financial is still undervalued or if the market is already factoring in all the potential ahead, leaving limited room for further upside.

Most Popular Narrative: 11.5% Undervalued

With the widely followed narrative assigning a fair value of $131.38 for Stifel Financial, the current share price of $116.27 suggests headroom for further gains. This apparent disconnect between stock price and projected value frames the next key catalyst.

The firm’s strong pipelines in financial advisory and institutional banking, particularly in sectors like technology, industrial services, and a growing appetite for bank M&A, suggest potential for increased investment banking revenue as market conditions stabilize. Stifel's strategic flexibility to prioritize share repurchases over loan growth reflects an opportunity to enhance earnings per share (EPS) and returns on investment, given current market conditions and undervalued stock prices.

The narrative focuses on Stifel Financial’s potential driven by bold expansion plans and changing profitability levers. The real surprise may be in the anticipated increase in both revenue growth and profit margins, a scenario that could influence investor expectations. Do you want to see what assumptions power this valuation?

Result: Fair Value of $131.38 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, key risks remain, including ongoing legal challenges and continued market volatility. Either of these factors could quickly dampen Stifel Financial’s growth story.

Find out about the key risks to this Stifel Financial narrative.

Another View: A Second Look at Valuation

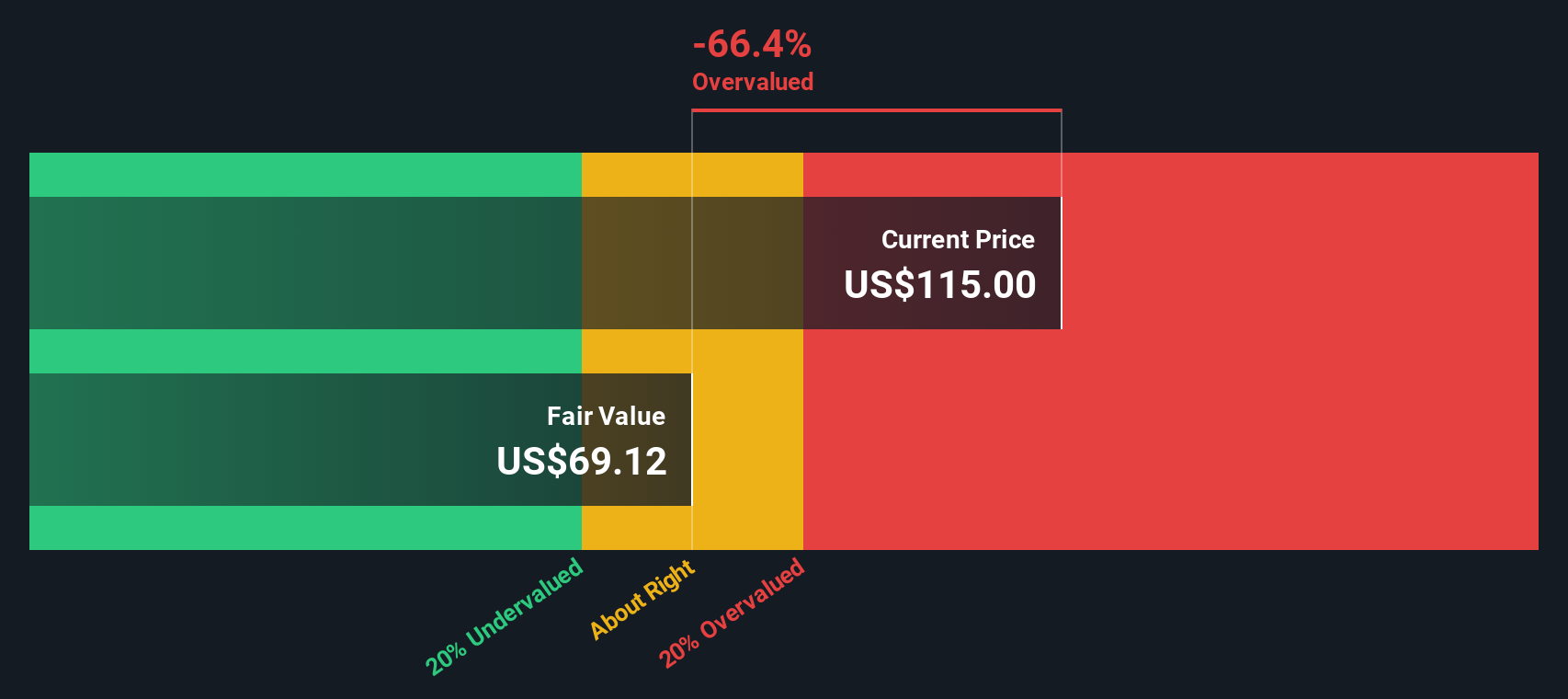

While the analyst fair value suggests Stifel Financial is undervalued, our DCF model points to a very different conclusion. According to this approach, the current share price is well above estimated fair value. This raises fresh questions about the optimism embedded in market expectations.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Stifel Financial for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 894 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Stifel Financial Narrative

If you’re someone who trusts their own research or sees the numbers differently, you can build your own Stifel Financial story in just a few minutes, and Do it your way

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Stifel Financial.

Looking for more investment ideas?

Don’t let fresh opportunities slip by while you’re focused on just one stock. Make the most of your investing toolkit and see what else is moving the market today.

- Boost your passive income by checking out these 18 dividend stocks with yields > 3% offering attractive yields and potential for consistent cash flow.

- Get ahead of emerging tech trends by scanning these 27 AI penny stocks. These stocks are pioneering the AI revolution and transforming entire industries.

- Take advantage of undervalued gems by reviewing these 894 undervalued stocks based on cash flows. These stocks could be hiding in plain sight with significant upside potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SF

Stifel Financial

Operates as the bank holding company for Stifel, Nicolaus & Company, Incorporated that provides retail and institutional wealth management, and investment banking services to individual investors, corporations, municipalities, and institutions in the United States and internationally.

Adequate balance sheet second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives