- United States

- /

- Capital Markets

- /

- NYSE:SF

Should Stifel Financial's Record Client Asset Growth Lead SF Investors to Reconsider Its Competitive Edge?

Reviewed by Sasha Jovanovic

- On November 20, 2025, Stifel Financial Corp announced that it reached record highs in total client assets and fee-based client assets, increasing by 12% and 18% year-over-year, and saw treasury deposits grow by 35% compared to the previous year due to the success of its venture and fund banking initiatives.

- This strong business performance was fueled by market appreciation, solid net client asset inflows, and growth across residential, securities-based, and commercial lending.

- We'll now examine how Stifel's record growth in client assets and deposits may influence its overall investment outlook.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Stifel Financial Investment Narrative Recap

To have confidence in Stifel Financial as a shareholder, an investor needs to believe in the firm’s ability to keep growing client assets and fee-based business through market appreciation, adviser productivity, and expanding banking initiatives. The record growth in client assets and treasury deposits is a positive signal, but it does not fully offset the biggest short-term risk: the impact of ongoing market volatility, especially as capital flows and policy uncertainty can still weigh on revenue and asset levels.

Among recent announcements, the appointment of new senior bankers from Silicon Valley Bank to grow expertise in venture and fund banking stands out in relation to Stifel’s latest deposit gains. This move further supports the firm’s momentum in driving client asset growth and aligns with catalysts like adviser recruitment and expanded banking services, but sustaining this trend relies on broader stability in the wealth and lending markets.

On the other hand, investors should be aware that legal and regulatory issues could affect earnings through...

Read the full narrative on Stifel Financial (it's free!)

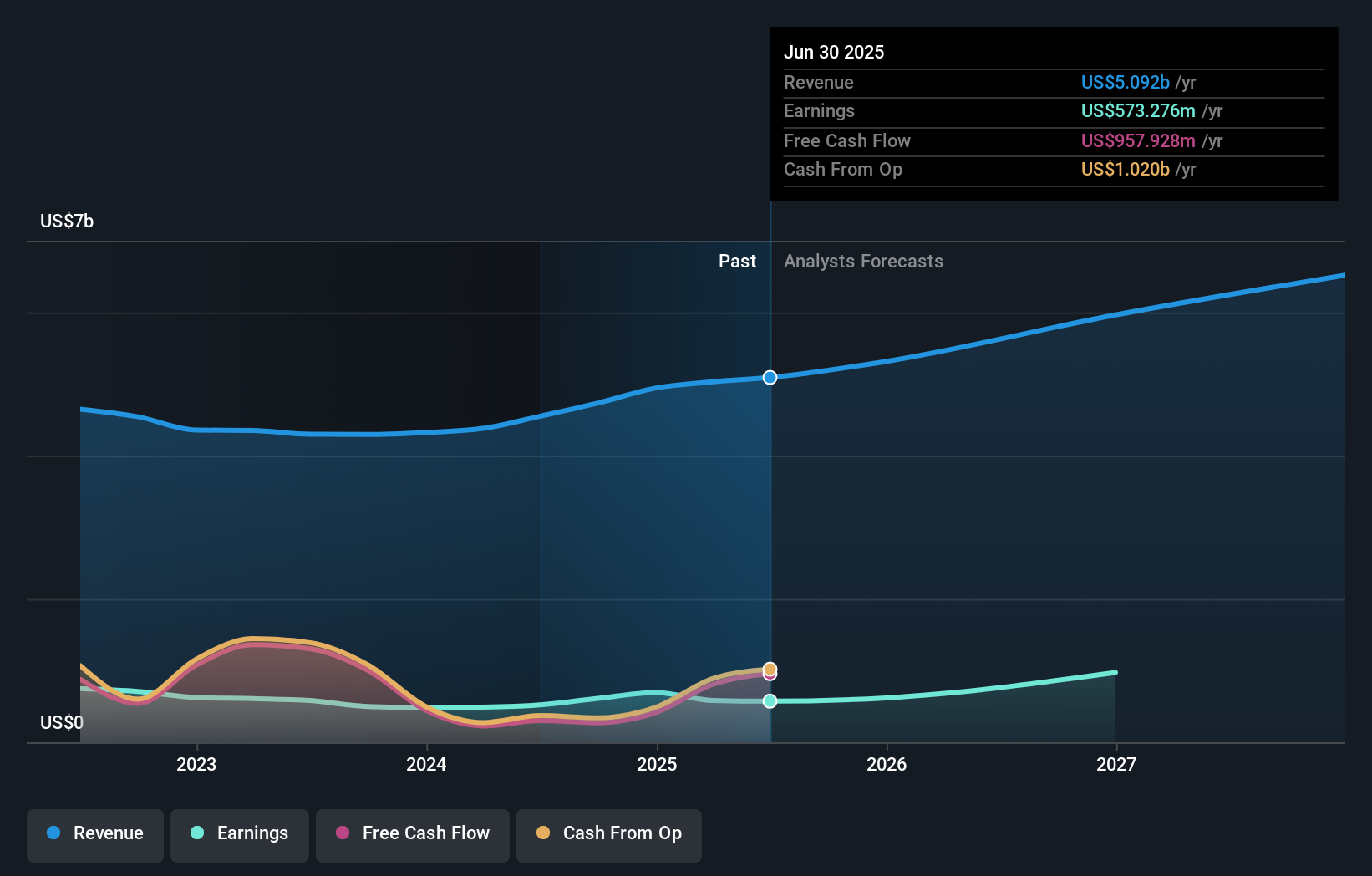

Stifel Financial is projected to achieve $6.5 billion in revenue and $1.3 billion in earnings by 2028. This outlook assumes an annual revenue growth rate of 8.8% and reflects an increase in earnings of approximately $716 million from the current $583.5 million.

Uncover how Stifel Financial's forecasts yield a $131.38 fair value, a 12% upside to its current price.

Exploring Other Perspectives

Two retail investors from the Simply Wall St Community set fair value for Stifel between US$72.42 and US$131.38 per share. This wide spread comes as some focus on adviser recruitment and deposit growth, while others weigh near-term risks such as market volatility that could affect revenue and returns; reviewing several viewpoints may help clarify your stance.

Explore 2 other fair value estimates on Stifel Financial - why the stock might be worth 38% less than the current price!

Build Your Own Stifel Financial Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Stifel Financial research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free Stifel Financial research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Stifel Financial's overall financial health at a glance.

Searching For A Fresh Perspective?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Find companies with promising cash flow potential yet trading below their fair value.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SF

Stifel Financial

Operates as the bank holding company for Stifel, Nicolaus & Company, Incorporated that provides retail and institutional wealth management, and investment banking services to individual investors, corporations, municipalities, and institutions in the United States and internationally.

Adequate balance sheet second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives