- United States

- /

- Diversified Financial

- /

- NYSE:RKT

Rocket Companies (RKT): Assessing Valuation After Q3 Revenue Surge and Increased Net Loss

Reviewed by Simply Wall St

Rocket Companies (RKT) unveiled its third quarter earnings, spotlighting a major jump in revenue but an even larger net loss compared to last year. This combination offers investors plenty to digest on growth versus profitability.

See our latest analysis for Rocket Companies.

Rocket Companies’ share price is up nearly 49% year-to-date, a move that outpaces many in its sector and hints at renewed optimism around growth or improving industry sentiment. Still, the one-year total shareholder return sits at just 7.6%, showing that much of the longer-term recovery remains to be proven as the company balances revenue gains against profitability pressures.

If you’re wondering where else momentum could strike, now is a great time to broaden your perspective and discover fast growing stocks with high insider ownership

With shares trading at a modest discount to analyst price targets and revenue growth outpacing profits, investors now face a critical question: Is Rocket Companies undervalued, or has the market already priced in its future growth?

Most Popular Narrative: 13.4% Undervalued

At $16.16 per share, Rocket Companies trades below the narrative fair value estimate of $18.67. This sets up a debate on whether current optimism justifies higher expectations or leaves room for disappointment.

Premium valuation rests on optimistic assumptions about technology-driven efficiencies and demand. There is a risk of disappointment if market conditions or customer behaviors deteriorate.

Want to uncover what makes this valuation stand out? There is a bold assumption backing Rocket’s profit surge and a future multiple usually reserved for market leaders. Curious about the forecasted leap in growth and margins? Click through to see which projections analysts are banking on.

Result: Fair Value of $18.67 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent housing affordability challenges and rapid shifts in fintech innovation remain key risks that could threaten Rocket Companies' optimistic growth narrative.

Find out about the key risks to this Rocket Companies narrative.

Another View: Multiples Tell a Different Story

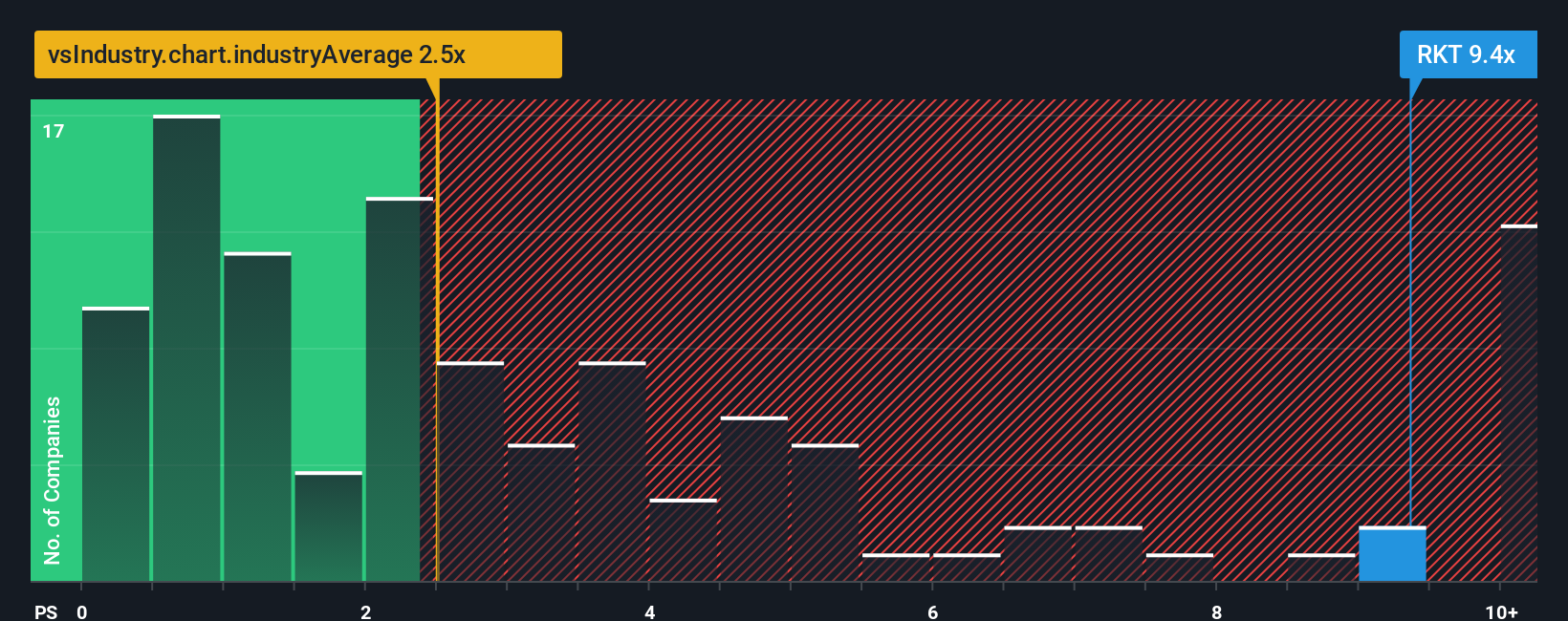

Taking a look at the price-to-sales ratio, Rocket Companies appears expensive versus its industry and peers, trading at 7.5x compared to the industry average of 2.4x. However, compared to its fair ratio of 9.2x, there is room for the market to shift higher. Does this premium signal risk or opportunity?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Rocket Companies Narrative

If these analyses spark a different perspective or you enjoy digging into the numbers yourself, you can build your own take in just minutes. Do it your way

A great starting point for your Rocket Companies research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Supercharge your watchlist and put yourself ahead of the crowd. Get hands-on with strategies designed for forward-thinking investors and never miss the next breakout star.

- Tap into future tech breakthroughs by scanning these 24 AI penny stocks, which are set to benefit from artificial intelligence’s explosive growth and industry transformation.

- Capture steady income streams when you check out these 16 dividend stocks with yields > 3%, offering attractive yields above 3% and helping you build a solid foundation for long-term wealth.

- Leap into overlooked segments with these 870 undervalued stocks based on cash flows, where potential bargains are hiding based on strong cash flow metrics and compelling fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RKT

Rocket Companies

Provides spanning mortgage, real estate, and personal finance services in the United States and Canada.

High growth potential and slightly overvalued.

Similar Companies

Market Insights

Community Narratives