- United States

- /

- Capital Markets

- /

- NYSE:PX

P10 (PX): Assessing Valuation After Recent 5% Decline and Ongoing Share Price Slide

Reviewed by Simply Wall St

See our latest analysis for P10.

Even with the recent 5% slip, P10’s share price has been trending lower for most of 2024, and the 19.7% year-to-date decline reflects fading momentum. Over the past year, the total shareholder return was a milder -6.3%. This hints that long-term holders have fared better than recent entrants as sentiment continues to shift.

If you’re eyeing other opportunities alongside P10, now is a good chance to expand your search and discover fast growing stocks with high insider ownership

With shares well below analyst price targets and a 20% year-to-date loss, P10 trades at a steep discount by some metrics. However, does this represent a genuine bargain, or is the market simply factoring in modest growth ahead?

Price-to-Earnings of 77.6x: Is it justified?

P10 shares currently trade at a price-to-earnings ratio of 77.6x, while the stock last closed at $10.31. This places the company at a significant premium compared to comparable firms.

The price-to-earnings ratio (P/E) is a simple but telling yardstick. It shows how much investors are willing to pay today for a dollar of earnings. In the capital markets space, it can reflect confidence in future growth or suggest the market is betting on an earnings rebound.

With P10’s P/E at 77.6x, the premium stands well above the US Capital Markets industry average of 24.3x and the peer average of just 7.6x. Such a wide gap signals the stock is currently judged expensive based on trailing earnings, despite big profit growth recently. This could be factoring in expectations for a strong turnaround, or possibly overstating future growth given the company’s recent earnings swing and forecasts for moderate revenue expansion. No fair ratio estimate is available to help frame how much this multiple might revert, but the existing premium is hard to dismiss.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Earnings of 77.6x (OVERVALUED)

However, slowing revenue growth and a lack of clear earnings visibility could challenge hopes for a near term turnaround in sentiment.

Find out about the key risks to this P10 narrative.

Another View: Discounted Cash Flow Weighs In

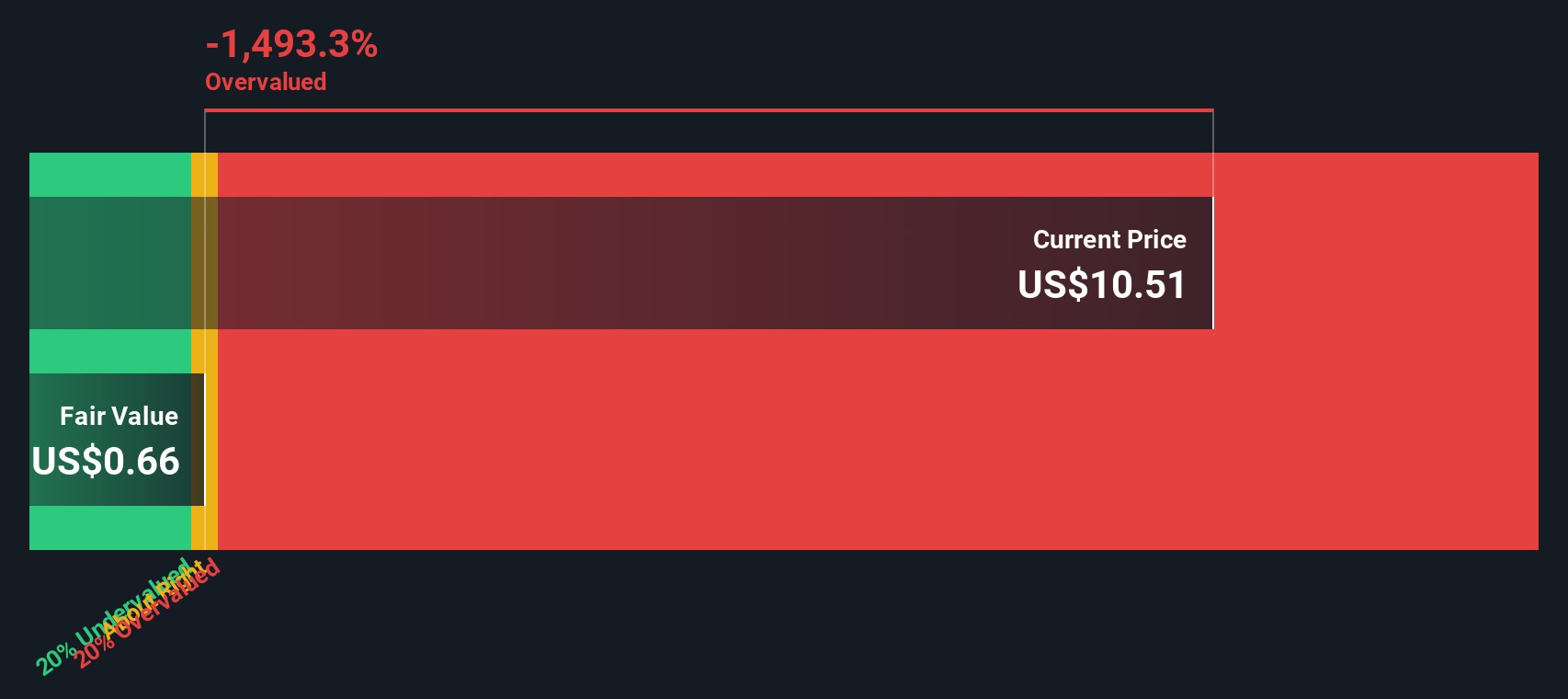

Looking from a different angle, our DCF model delivers a starkly different signal. It estimates P10's fair value at just $0.66, which suggests the stock is trading well above what the company’s future cash flows might justify. This raises the question of whether the risk of overpaying is too high, or if there are hidden strengths the market observes.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out P10 for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 840 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own P10 Narrative

If you’re looking for your own perspective or enjoy doing your own homework, you can build a narrative using the same data in just minutes, Do it your way.

A great starting point for your P10 research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors stay ahead by seeking fresh opportunities. Don’t limit yourself when the market rewards those who act. Expand your search and level up your strategy today.

- Spot extraordinary income potential by tapping into these 20 dividend stocks with yields > 3%, where high-yield companies are making payouts above 3%.

- Catch the next tech boom by seizing these 26 AI penny stocks, featuring innovators using artificial intelligence to transform industries.

- Unlock hidden value by hunting through these 840 undervalued stocks based on cash flows, and get a head start on quality stocks priced below their true worth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PX

P10

Operates as a multi-asset class private market solutions provider in the alternative asset management industry in the United States.

Slight risk with acceptable track record.

Similar Companies

Market Insights

Community Narratives