- United States

- /

- Capital Markets

- /

- NYSE:PJT

Evaluating PJT Partners's Valuation After Record Revenue Growth and Strategic Advisory Momentum

Reviewed by Simply Wall St

PJT Partners reported record third quarter results, with revenue and net income both climbing sharply as the company’s strategic advisory business delivered strong growth. Investors are watching the upbeat outlook and higher earnings closely.

See our latest analysis for PJT Partners.

It has been an eventful stretch for PJT Partners, with fresh record earnings complemented by a recently reaffirmed quarterly dividend. While the short-term share price return is mixed, with the stock down 2.5% over the past month but sitting at $166.72, the bigger story is its enduring performance. In the past five years, PJT Partners delivered a total shareholder return of 161.8%, reflecting sustained momentum even as recent returns have moderated.

If you’re looking for more investment ideas beyond the headlines, now is a great time to broaden your search and discover fast growing stocks with high insider ownership

With robust revenue and earnings growth combined with a recent price climb, investors may wonder if PJT Partners still offers long-term value, or if its current share price already reflects the company’s future prospects and growth potential.

Price-to-Earnings of 22.8x: Is it justified?

PJT Partners trades with a price-to-earnings (P/E) ratio of 22.8x, closely aligned with the industry average but notably higher than many peers. At its last close of $166.72, the stock’s valuation sits near the sector norm, yet appears expensive relative to similar companies.

The price-to-earnings ratio represents how much investors are willing to pay for each dollar of company earnings. For investment banks like PJT Partners, it is a key measure of market confidence in future profitability. A higher multiple could indicate strong growth expectations or perceived earnings reliability.

PJT’s P/E ratio is slightly below the US Capital Markets industry average of 24.2x, suggesting the market values its earnings comparably to peers in the sector. However, it stands well above the peer group average of 15.7x and is significantly higher than the estimated fair price-to-earnings ratio of 13.2x. If the market readjusts to this fair ratio, PJT’s valuation could move closer to fundamentals.

Explore the SWS fair ratio for PJT Partners

Result: Price-to-Earnings of 22.8x (OVERVALUED)

However, if slowing net income growth and short-term price declines continue in coming quarters, these trends could challenge the upbeat outlook.

Find out about the key risks to this PJT Partners narrative.

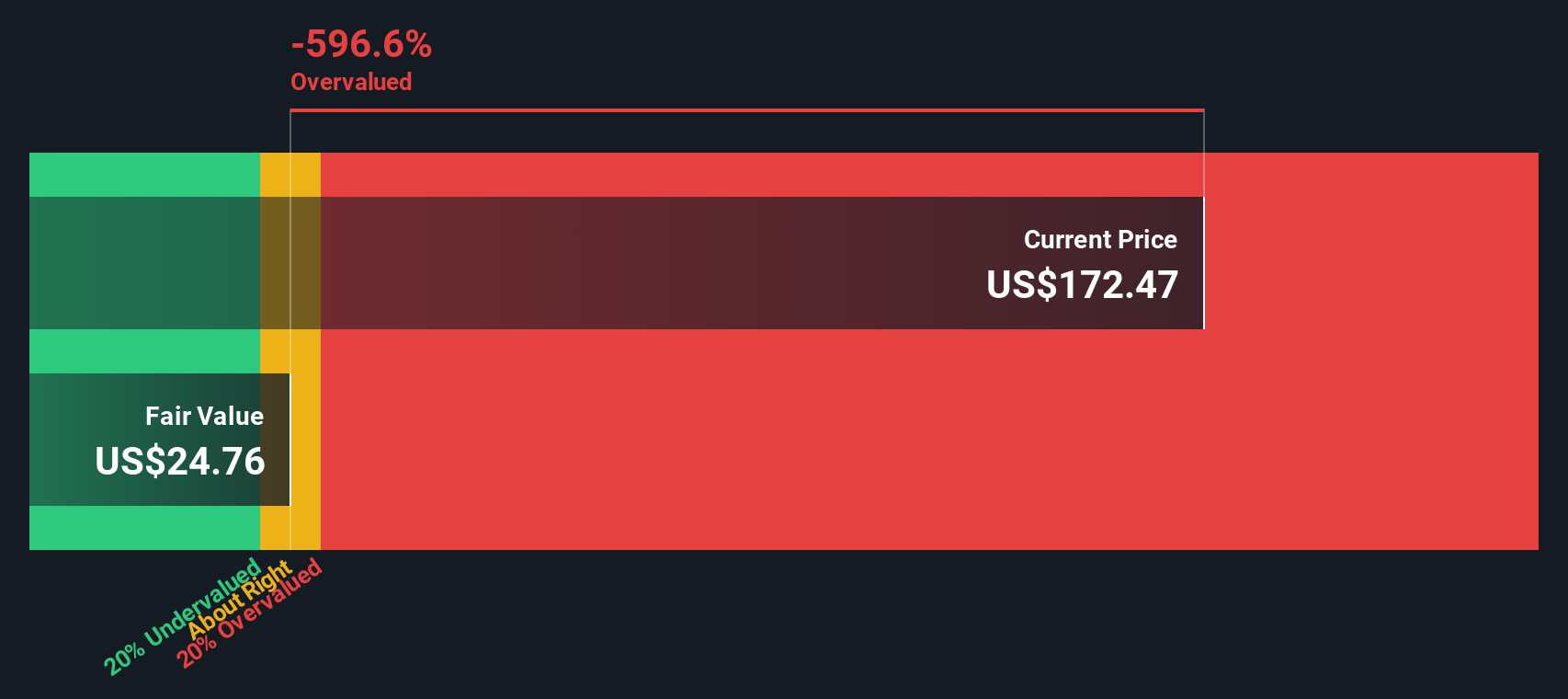

Another View: SWS DCF Model Points to Overvaluation

Taking a different approach, our DCF model suggests PJT Partners is trading well above its estimated fair value. The fair value is just $25.74 compared to the current price of $166.72. This projection signals potential downside and raises the question of whether future cash flows truly justify today’s premium price.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out PJT Partners for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 872 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own PJT Partners Narrative

If you would rather rely on your own insights than these estimates, you can dive into the data and build your own perspective in just a few minutes with Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding PJT Partners.

Looking for More Opportunities?

Expand your investing horizons now. Remarkable companies are out there, and some may be the game-changer your portfolio needs. Don’t let these opportunities slip away.

- Tap into the world of rising small-caps and seize potential exponential growth with these 3585 penny stocks with strong financials.

- Catch tomorrow’s market leaders in artificial intelligence by targeting these 25 AI penny stocks positioned for rapid innovation.

- Start earning more with these 16 dividend stocks with yields > 3% delivering consistent income to reward long-term shareholders.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PJT

PJT Partners

An investment bank, provides various strategic advisory, shareholder advisory, capital markets advisory, and restructuring and special situations services to corporations, financial sponsors, institutional investors, and governments worldwide.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives