- United States

- /

- Diversified Financial

- /

- NYSE:PAY

Paymentus (PAY): Margin Uptick Reinforces High-Growth Narrative, But Valuation Remains a Sticking Point

Reviewed by Simply Wall St

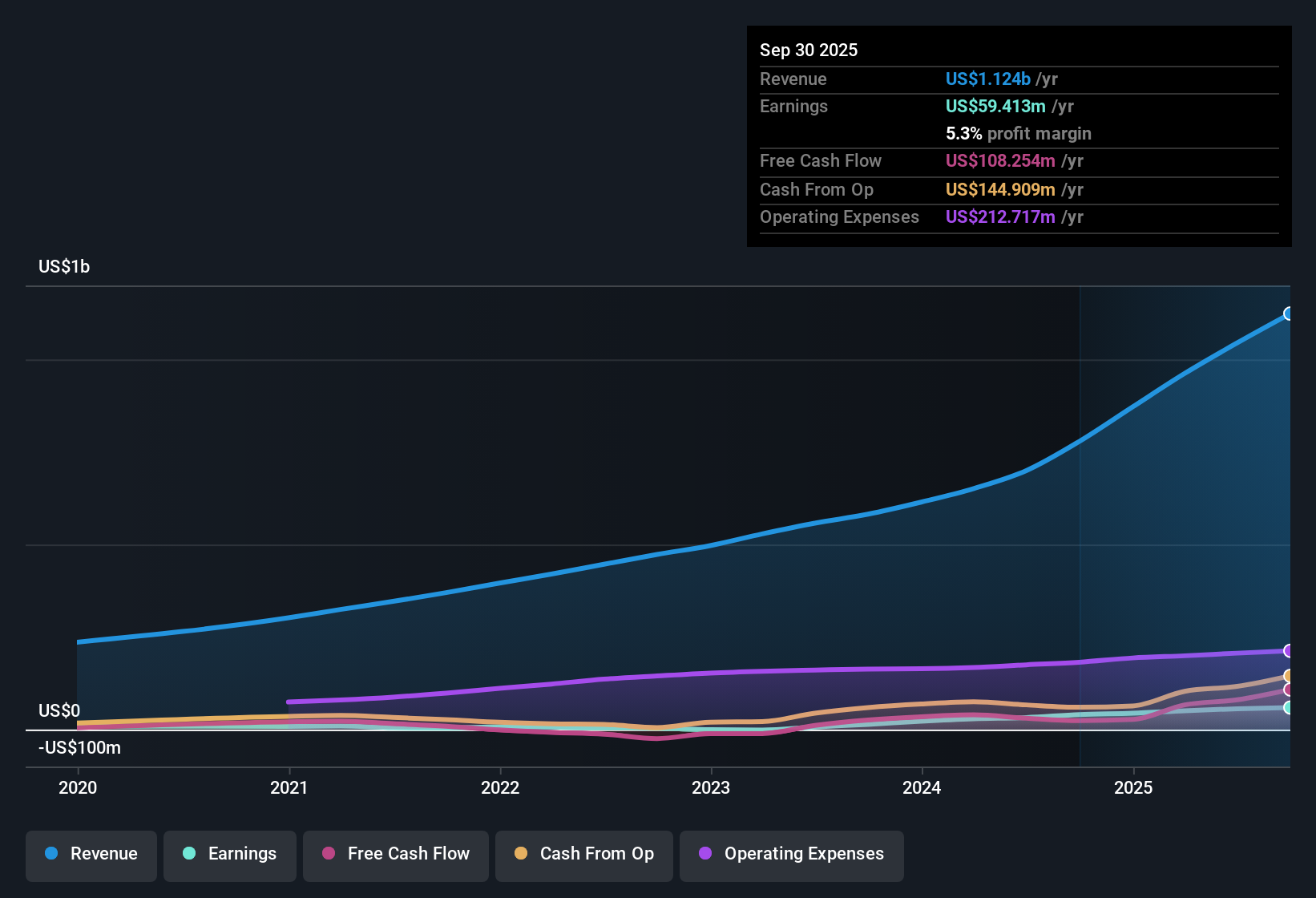

Paymentus Holdings (PAY) posted net profit margins of 5.3%, a slight uptick from last year's 5.2%. Over the past five years, earnings have surged at an impressive 57.4% annual rate, but the latest annual earnings growth of 47% fell short of this pace. Looking ahead, analysts expect earnings to grow 28.1% per year and revenue to expand 19.6% annually. Both figures outpace the broader US market, yet shares trade well above DCF-based estimates with a price-to-earnings ratio of 76.1x.

See our full analysis for Paymentus Holdings.Next, we will examine how these headline numbers compare to the main narratives circulating in the market, highlighting where the story aligns and where it may encounter some scrutiny.

See what the community is saying about Paymentus Holdings

Margin Expansion Backed by Cloud Scale

- Profit margins have risen modestly from 5.2% to 5.3%, as Paymentus leverages new investments in its scalable, secure cloud platform and achieves improving incremental EBITDA margins.

- According to the analysts' consensus view, ongoing platform investment and digital adoption are expected to fuel further margin expansion. However, increasing reliance on large enterprise clients may put future margins at risk.

- Margin strength is anchored in operating leverage as Paymentus adds enterprise clients while holding fixed costs steady. Critics argue that large clients often demand discounts, which could cap eventual profitability.

- The consensus narrative notes that, although technology upgrades protect margins now, Paymentus may still face intensifying competition and margin pressure from regulatory changes and industry consolidation.

Consensus narrative highlights both Paymentus' defenses and the industry shifts that could test its margins. See detailed peer takes and risk watchouts in the full narrative below. 📊 Read the full Paymentus Holdings Consensus Narrative.

Revenue Growth Dwarfs Industry Average

- While the US market expects around 10.5% annual revenue growth, Paymentus is projected at a robust 19.6% per year over the next three years, supported by accelerated onboarding of large enterprise clients across multiple sectors.

- The analysts' consensus view is that diversified revenue from utilities, government, and healthcare customers evidences Paymentus' expanding addressable market, with recent record bookings and backlog positioning the company to sustain outperformance.

- Momentum from digital transformation and integration with partners (banks, ERPs, major software providers) is cited as a structural growth catalyst. This reinforces durability even as broader fintech competition intensifies.

- Consensus highlights that deeper diversification reduces revenue volatility, helping buffer future slowdowns. However, enterprise concentration could challenge these growth rates if any major client is lost.

Valuation Gap: Price Far Above DCF Fair Value

- Shares now trade at $36.10 compared to a DCF fair value of $3.02 and peer P/E ratios of 14.8x (vs. Paymentus at 76.1x), making the stock a notable outlier on traditional value metrics.

- From the analysts' consensus perspective, the small 8.6% gap between the $36.10 share price and the $38.83 average analyst target suggests that bullish growth assumptions are already priced in. The steep premium to both DCF fair value and sector multiples reveals real sensitivity to any disappointment.

- Consensus warns that if Paymentus delivers earnings closer to the lower end of estimates or if margin targets slip, the stock’s elevated valuation would leave little cushion for error.

- If Paymentus outperforms revenue and margin forecasts, current multiples may prove less of a hurdle but set a high bar for sustained long-term compounding.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Paymentus Holdings on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Got a different read on these figures? Take just a few minutes to craft and share your own narrative: Do it your way

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Paymentus Holdings.

See What Else Is Out There

Paymentus’s shares are trading at a steep premium to intrinsic value and sector peers. This leaves little margin for error if growth lags expectations.

If you want stronger value for your money, check out these 843 undervalued stocks based on cash flows to uncover companies with upside potential based on proven cash flow fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PAY

Paymentus Holdings

Provides cloud-based bill payment technology and solutions in the United States and internationally.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives