- United States

- /

- Diversified Financial

- /

- NYSE:PAGS

How PagSeguro's Stock Rally and Regulatory News Impact Its 2025 Valuation

Reviewed by Bailey Pemberton

- Wondering if PagSeguro Digital’s stock is actually a hidden value play or just another tech name riding the market momentum? Let's dig into what truly drives its current price tag.

- PagSeguro’s shares have been on the move, climbing 1.4% in the past week, 4.7% over the last month, and an impressive 50.2% year-to-date. Over longer periods, though, returns are mixed, with a 22.1% gain in the past year but steep drops when you look back three and five years.

- Several headlines have shaped investor sentiment recently, including industry-wide fintech enthusiasm and regulatory updates that affect digital payment firms in Brazil. These have put a spotlight on PagSeguro’s competitive positioning and its agility in navigating a dynamic marketplace.

- When it comes to classic valuation checks, PagSeguro Digital comes in strong with a score of 5 out of 6, suggesting it is undervalued by most traditional measures. Of course, that is not the whole story. Next up, we will break down how these valuation approaches compare, and at the end, I will show you what savvy investors look for beyond just the numbers.

Approach 1: PagSeguro Digital Excess Returns Analysis

The Excess Returns model measures how efficiently a company generates profits above the minimum threshold required by investors. It looks at whether PagSeguro Digital earns more on shareholders' equity than the cost to fund that equity, with future growth factored in. This approach helps determine if the company is creating real value or just holding its place in the market.

For PagSeguro Digital, analysts estimate a Book Value of $49.97 per share and a Stable EPS of $9.08 per share based on weighted future Return on Equity projections. The Cost of Equity stands at $5.93 per share, meaning PagSeguro is producing an Excess Return of $3.16 per share beyond what shareholders require to keep their money invested. The company's average Return on Equity is 15.98%, indicating it is generating strong profits from its assets. Furthermore, the stable Book Value is projected to grow to $56.85 per share, underlining robust capital strength. These forward-looking figures are sourced from multiple analyst forecasts.

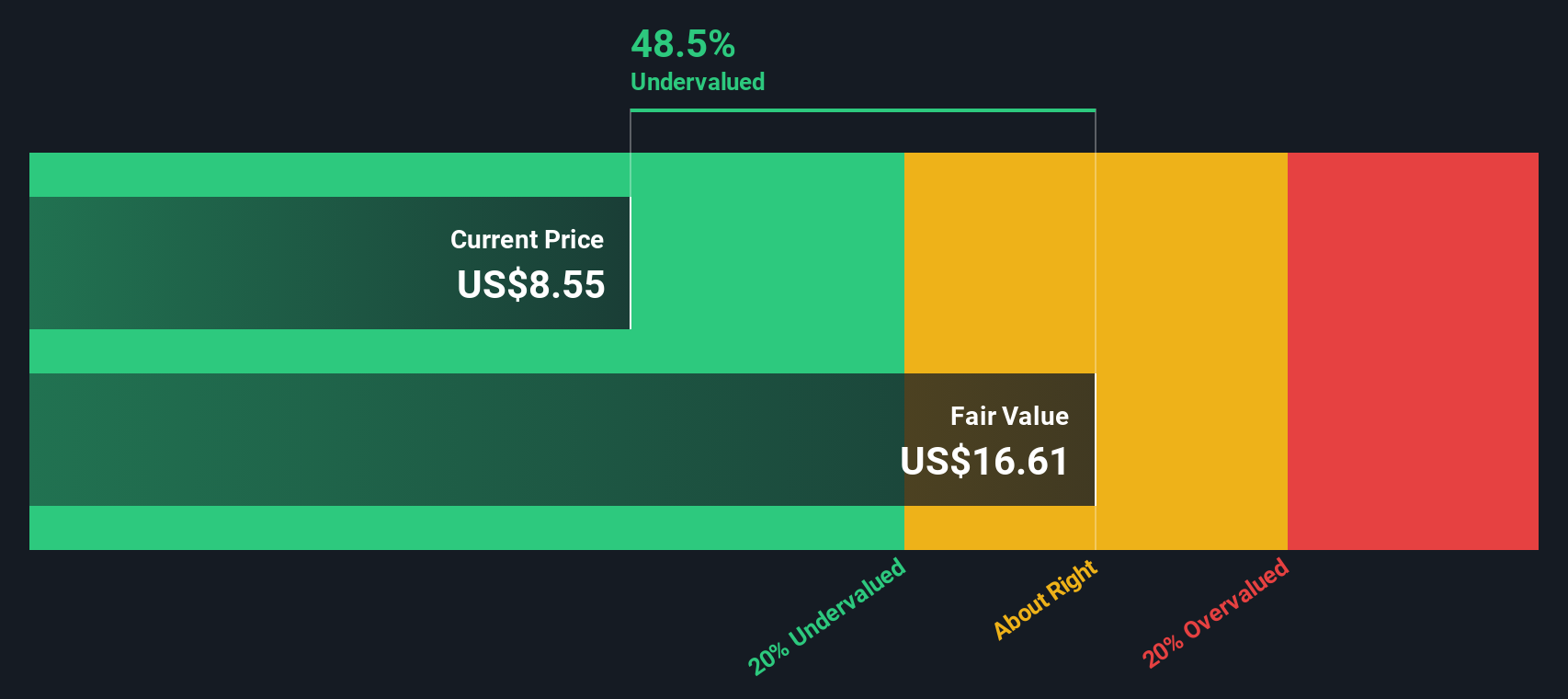

Based on this projection, the Excess Returns valuation sets PagSeguro Digital’s intrinsic value at a significant discount to its trading price. The model suggests the stock is currently 48.3% undervalued, implying that investors may be underestimating the company's ability to sustain value creation over time.

Result: UNDERVALUED

Our Excess Returns analysis suggests PagSeguro Digital is undervalued by 48.3%. Track this in your watchlist or portfolio, or discover 838 more undervalued stocks based on cash flows.

Approach 2: PagSeguro Digital Price vs Earnings

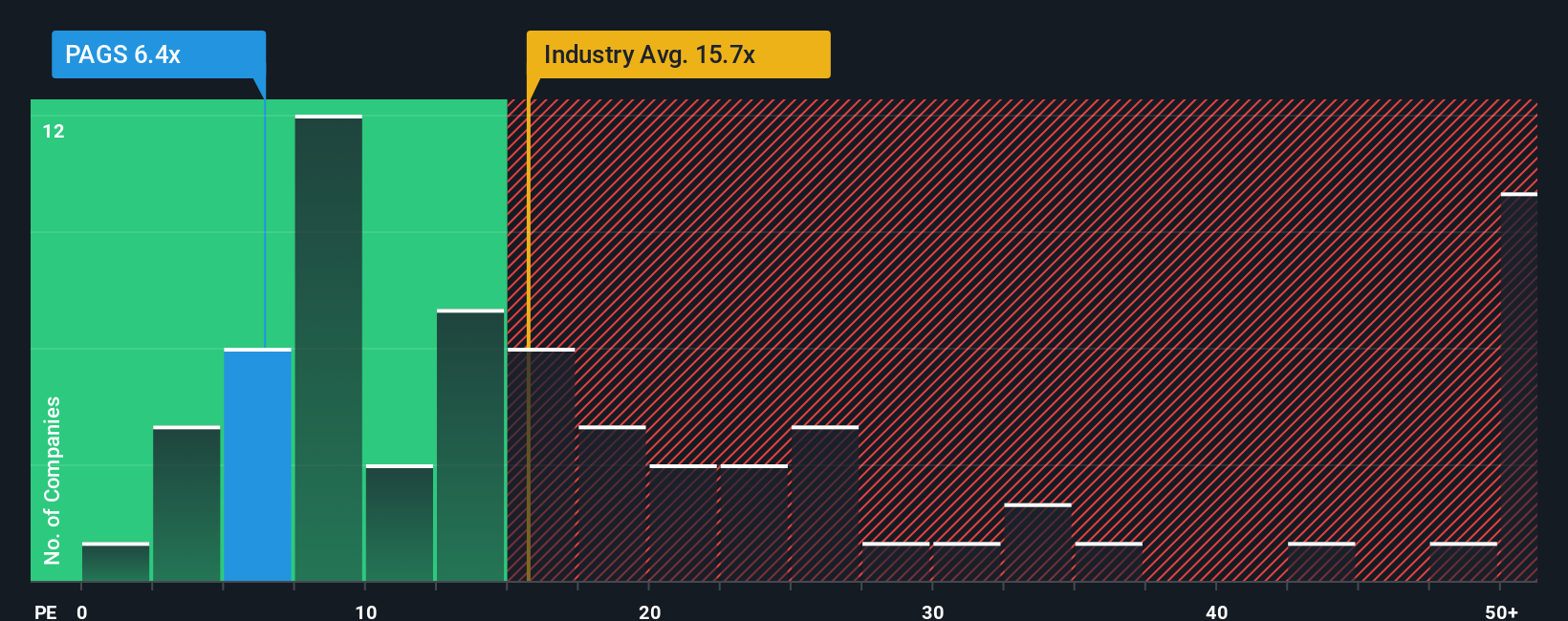

The Price-to-Earnings (PE) ratio is a widely used valuation metric for profitable companies like PagSeguro Digital, as it shows how much investors are willing to pay for each dollar of earnings. It is especially relevant when companies have established profitability, as it ties the share price directly to ongoing earnings power rather than future projections alone.

Interpreting a “normal” or “fair” PE ratio depends on factors like earnings growth expectations and perceived risk. Rapidly expanding businesses or those in lower-risk industries typically warrant higher PE ratios, while slower-growing or riskier companies tend to deserve lower multiples. Essentially, the PE ratio reflects both what a business is earning today and how much its future earnings are expected to grow or fluctuate.

PagSeguro Digital currently has a PE ratio of 6.87x, which is notably lower than both the peer average of 12.05x and the Diversified Financial industry’s average of 15.18x. On the surface, this discount might suggest the stock is cheap compared to peers or sector benchmarks. However, Simply Wall St’s Fair Ratio, which blends factors such as growth, profit margin, market cap, and risk into a tailored multiple for the company, is 14.81x. This personalized approach provides a more nuanced and company-specific benchmark than simply using broad industry or peer comparisons.

Comparing PagSeguro’s actual PE to its Fair Ratio highlights a substantial gap between price and expected value. With the company trading at less than half of its Fair Ratio, the stock appears attractively priced based on its current earnings profile and outlook.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1403 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your PagSeguro Digital Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is simply your story or perspective on a company. It combines your assumptions about PagSeguro Digital’s future revenue, earnings, and profit margins with your estimate of fair value. By connecting the company’s underlying story to financial forecasts and then linking that to what you believe is a fair price, Narratives turn raw data into actionable insights tailored to your viewpoint.

Narratives are easy to use and available on Simply Wall St’s Community page, making them accessible to millions of investors who want to make smarter, more personalized decisions. They let you see at a glance if the Fair Value based on your Narrative is above or below the current price, helping you decide whether to buy, hold, or sell. Narratives are also dynamic. Whenever major news, earnings, or forecasts emerge, your story and valuation can quickly adapt in real time.

For example, with PagSeguro Digital, some investors might use conservative earnings growth assumptions and see a fair value as low as $5.17, while others with a more optimistic outlook could set targets as high as $13.98. Your Narrative puts you in control of what matters most to your investment approach.

Do you think there's more to the story for PagSeguro Digital? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PAGS

PagSeguro Digital

Engages in the provision of financial and payment solutions for consumers, individual entrepreneurs, micro-merchants, and small and medium-sized companies in Brazil and internationally.

Undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives