- United States

- /

- Capital Markets

- /

- NYSE:OWL

Rising Revenue and Falling Profits Might Change the Case for Investing in Blue Owl Capital (OWL)

Reviewed by Sasha Jovanovic

- Blue Owl Capital Inc. recently reported its third-quarter 2025 results, with revenue rising to US$727.99 million from US$600.88 million a year earlier, while net income decreased to US$6.31 million compared to US$29.81 million last year, and the company affirmed a quarterly dividend of US$0.225 per Class A Share.

- Despite higher year-over-year revenue and a maintained dividend, the decline in net income and earnings per share stands out as an important development for investors monitoring Blue Owl's performance and payout consistency.

- We'll examine how Blue Owl's lower quarterly profit despite increased revenue could reshape the company's investment narrative going forward.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Blue Owl Capital Investment Narrative Recap

To be a Blue Owl Capital shareholder, you need to believe in its ability to deliver strong, recurring management fee revenue by growing permanent capital strategies, even as it pushes aggressively into private credit and real assets. The third-quarter results, with rising revenue yet significantly lower net income, add little evidence for or against the key near-term catalyst, asset growth from new funds, while simultaneously highlighting the risk that growing complexity and execution challenges might further pressure margins if integration and cost control lag.

Of the recent announcements, Blue Owl’s partnership with Meta Platforms to co-develop the Hyperion data center stands out. This initiative aligns directly with the company’s expansion into digital infrastructure, a segment considered vital for future fundraising and platform scalability, though sustained profitably will depend on execution and synergy realization amid already thinning profit margins.

However, despite strong topline momentum, investors should not overlook the stubbornly low net income margin in a period marked by...

Read the full narrative on Blue Owl Capital (it's free!)

Blue Owl Capital's narrative projects $4.2 billion in revenue and $5.1 billion in earnings by 2028. This requires 17.5% yearly revenue growth and a $5.0 billion increase in earnings from $75.4 million today.

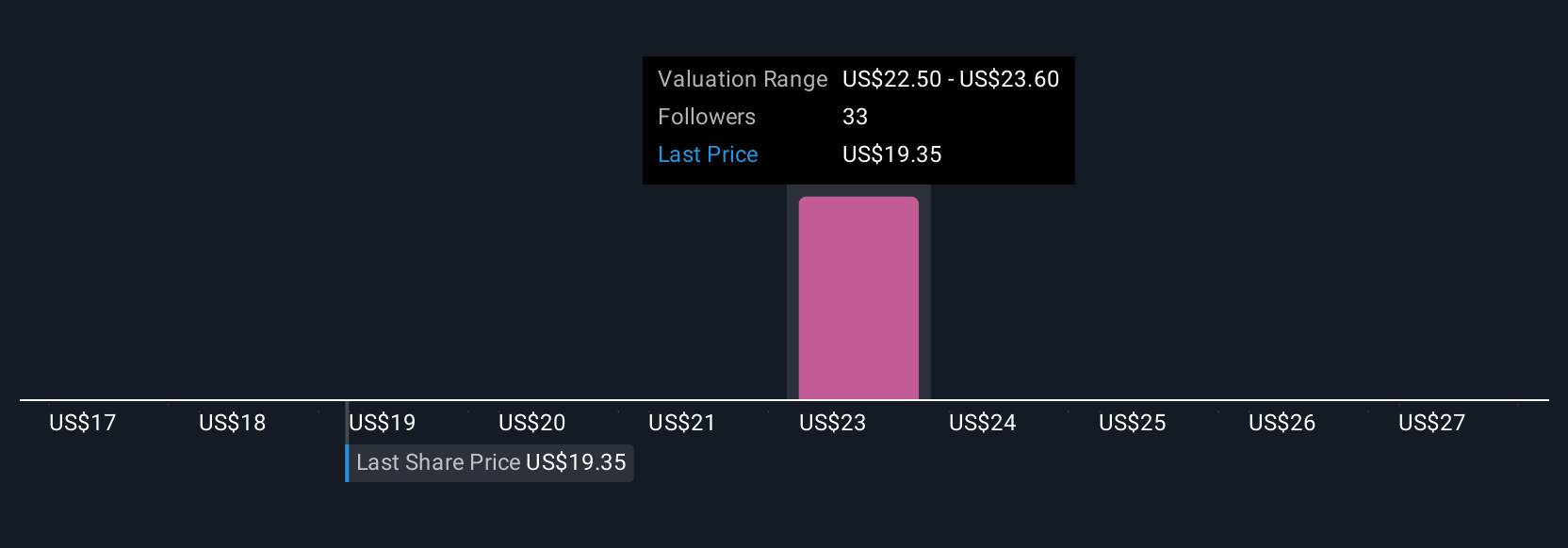

Uncover how Blue Owl Capital's forecasts yield a $23.73 fair value, a 57% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members provided six fair value estimates for Blue Owl Capital, ranging from US$0.53 to US$28 per share. With execution and integration risk still looming large, you will find a wide spectrum of outlooks and should compare several viewpoints before deciding your own stance.

Explore 6 other fair value estimates on Blue Owl Capital - why the stock might be worth as much as 86% more than the current price!

Build Your Own Blue Owl Capital Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Blue Owl Capital research is our analysis highlighting 1 key reward and 4 important warning signs that could impact your investment decision.

- Our free Blue Owl Capital research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Blue Owl Capital's overall financial health at a glance.

Seeking Other Investments?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Blue Owl Capital might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:OWL

Blue Owl Capital

Operates as an alternative asset manager in the United States.

High growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives