- United States

- /

- Mortgage REITs

- /

- NYSE:NLY

How Investors Are Reacting To Annaly Capital Management (NLY) Posting Surging Earnings Without Share Buybacks

Reviewed by Sasha Jovanovic

- Annaly Capital Management recently reported third quarter earnings for the period ended September 30, 2025, with net income rising to US$832.45 million and basic earnings per share from continuing operations reaching US$1.21, both much higher than the same quarter last year.

- While a share repurchase plan was previously announced, the company reported no shares were bought back during the recent quarter, highlighting a focus on other capital allocation priorities.

- We’ll examine how Annaly Capital Management’s sharp increase in quarterly earnings shapes its broader investment narrative going forward.

These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Annaly Capital Management Investment Narrative Recap

To be a shareholder in Annaly Capital Management you need confidence in its ability to generate income from mortgage assets while managing risks from interest rate changes and market volatility. The recent surge in quarterly earnings is a standout, but it does not materially change the short-term catalysts or the main risks facing the business, especially as interest rate trends and mortgage spread movements remain crucial factors.

Of Annaly's recent announcements, the Q3 2025 earnings report is the most relevant here: net income jumped to US$832.45 million, a sharp increase from a year ago. This strong quarter comes amid attractive Agency MBS spreads and suggests resilience, yet the company’s future earnings sensitivity to interest rate volatility is unchanged and continues to shape the near-term outlook.

However, investors should be aware that despite strong recent results, the biggest risk could still be shifting interest rates and the possibility that...

Read the full narrative on Annaly Capital Management (it's free!)

Annaly Capital Management's outlook anticipates $3.4 billion in revenue and $3.2 billion in earnings by 2028. This scenario is based on 46.9% annual revenue growth and an increase in earnings of approximately $2.6 billion from current earnings of $575.1 million.

Uncover how Annaly Capital Management's forecasts yield a $21.72 fair value, in line with its current price.

Exploring Other Perspectives

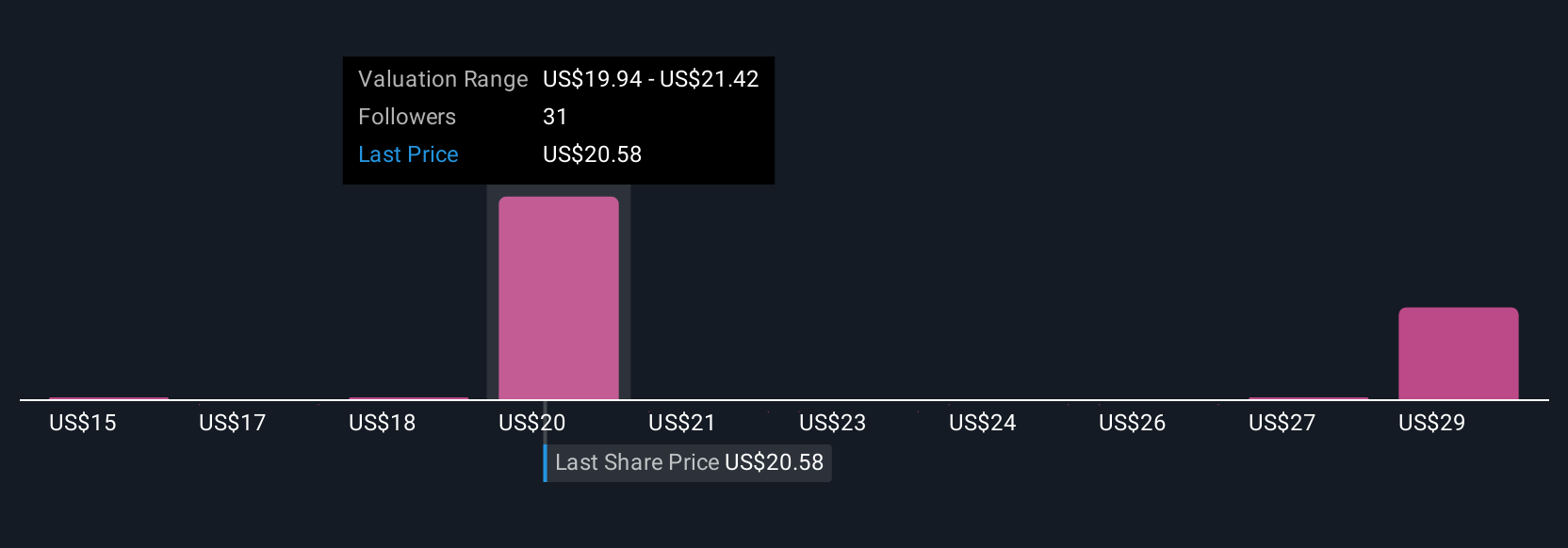

Twelve fair value estimates from the Simply Wall St Community for Annaly Capital Management range from US$16 to US$42.18 per share. Some anticipate upside potential given forecast revenue growth of 33 percent per year, but opinions on both risk and reward widely differ, consider several viewpoints before deciding for yourself.

Explore 12 other fair value estimates on Annaly Capital Management - why the stock might be worth 26% less than the current price!

Build Your Own Annaly Capital Management Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Annaly Capital Management research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Annaly Capital Management research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Annaly Capital Management's overall financial health at a glance.

Looking For Alternative Opportunities?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- We've found 20 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NLY

Annaly Capital Management

A diversified capital manager, engages in the mortgage finance business.

Undervalued with high growth potential.

Similar Companies

Market Insights

Community Narratives