- United States

- /

- Diversified Financial

- /

- NYSE:NATL

NCR Atleos (NATL): Evaluating Valuation After New AI Partnership With Kuwait Finance House

Reviewed by Simply Wall St

NCR Atleos (NYSE:NATL) has teamed up with Kuwait Finance House to roll out AI-powered video avatars at in-branch kiosks. The goal is to make banking more interactive and personalized for customers in Kuwait.

See our latest analysis for NCR Atleos.

NCR Atleos’s splashy AI partnership comes as the stock is quietly regaining momentum, with an 11.01% year-to-date share price return and an impressive 28.90% total shareholder return over the past year. Recent bylaw changes and the upcoming earnings release add to the sense that the company’s tech-forward strategy is fueling optimism about both growth and resilience.

If you’re intrigued by how innovative moves can shape a stock’s story, it is a great time to expand your search and discover fast growing stocks with high insider ownership

With shares still trading below analyst price targets and continued innovation on display, investors are left wondering whether NCR Atleos remains undervalued or if the market is already factoring in every bit of future upside.

Most Popular Narrative: 15% Undervalued

Compared to the latest closing price of $37.82, the most widely followed narrative estimates fair value at $44.67. This sets the stage for a bold claim about NCR Atleos’s future.

High recurring revenue mix (over 70% in Q2), significant productivity gains through AI-driven service optimization, and a rapidly scaling backlog are driving strong margin expansion and robust free cash flow. These factors underpin announced share buybacks and sustained EPS growth, suggesting current valuation does not reflect enhanced long-term earnings power.

Curious what financial assumptions led to this bullish price target? The narrative’s foundation lies in durable margins, accelerating digital growth, and a shifting revenue mix. Want the specifics behind this projection? Unlock the full narrative for the numbers making this thesis so compelling.

Result: Fair Value of $44.67 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, intensified fintech competition or a sharper shift to digital banking could still undermine NCR Atleos's recurring revenue and long-term growth trajectory.

Find out about the key risks to this NCR Atleos narrative.

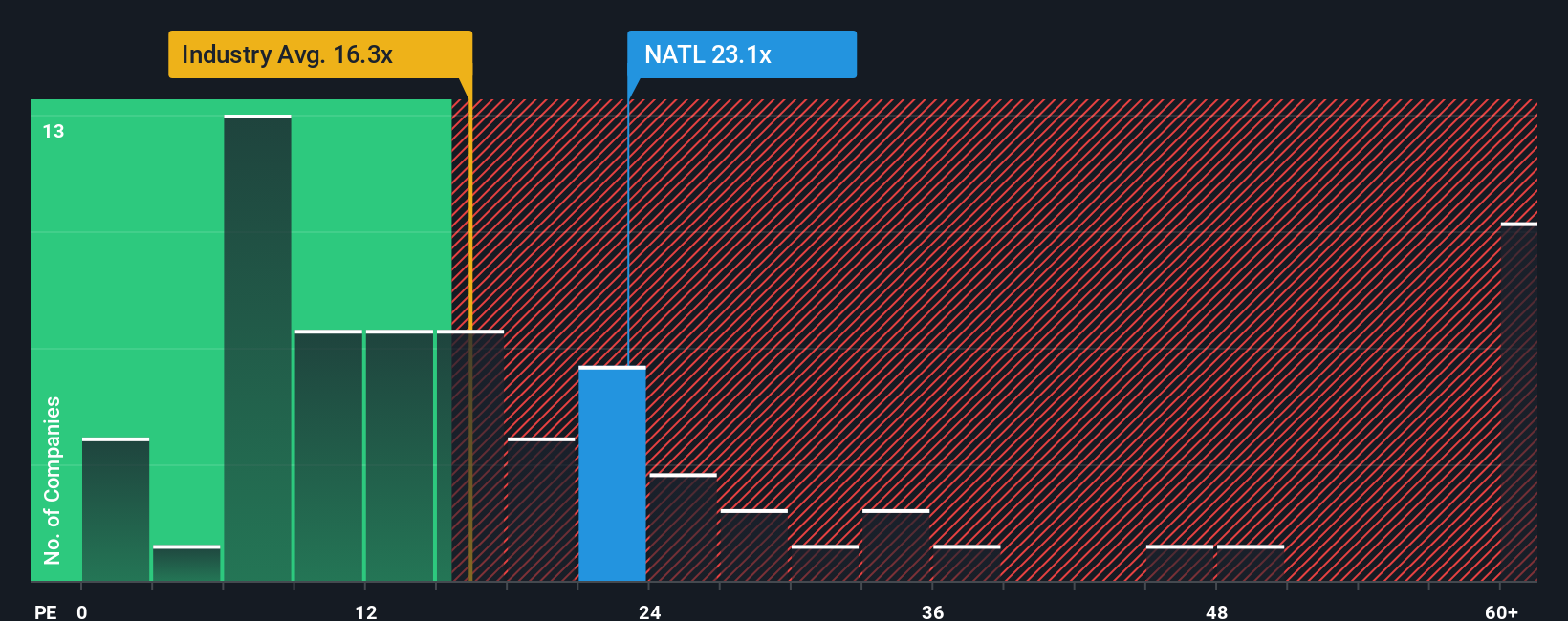

Another View: Price Ratios Highlight Caution

Looking beyond analyst price targets, NCR Atleos trades at a price-to-earnings ratio of 21.1x. This is higher than both the industry average of 14.8x and the peer average of 10x. Even compared to its estimated fair ratio of 19.3x, shares appear relatively expensive, which raises concerns about valuation risk if the market reverts. Does the current optimism fully stack up?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own NCR Atleos Narrative

If you feel inspired to dig deeper or follow a different path, you can assemble your own NCR Atleos narrative in just a few minutes. Do it your way

A great starting point for your NCR Atleos research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Make your next investing move with confidence by searching beyond today’s headlines. The right tools can uncover opportunities others overlook, and there is always another angle to consider.

- Tap into tomorrow’s fintech trends by checking out these 26 AI penny stocks, which merge artificial intelligence with real-world business impact.

- Maximize income potential when you scan these 20 dividend stocks with yields > 3% to reveal companies offering robust yields in today’s market.

- Position yourself early in the digital finance revolution and browse these 81 cryptocurrency and blockchain stocks, which show momentum in blockchain innovation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NCR Atleos might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NATL

NCR Atleos

A financial technology company, provides self-directed banking solutions to financial institutions, merchants, manufacturers, retailers, and consumers in the United States, rest of the Americas, Europe, the Middle East, Africa, and the Asia Pacific.

Reasonable growth potential with very low risk.

Similar Companies

Market Insights

Community Narratives