- United States

- /

- Diversified Financial

- /

- NYSE:NATL

Can NCR Atleos’ (NATL) Guidance Reaffirmation Outweigh Slower Share Buybacks in Shaping Investor Sentiment?

Reviewed by Sasha Jovanovic

- NCR Atleos Corporation recently announced third quarter 2025 results, reporting US$1.12 billion in revenue and net income of US$26 million, both higher than the same period last year, and reaffirmed its full-year earnings guidance amid expected revenue growth of 1% to 3% at constant currency.

- A key detail is that despite no share buybacks taking place under the current program, management's reaffirmation of full-year guidance suggests confidence in the company's operational trajectory for the remainder of 2025.

- We'll explore how management's decision to reaffirm guidance, despite limited buyback activity, may influence NCR Atleos' investment outlook.

We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

NCR Atleos Investment Narrative Recap

To be a shareholder in NCR Atleos, one must believe in the resilience of ATM infrastructure and continued demand for physical cash access, despite society’s ongoing shift to digital payment methods. The latest earnings delivered modest revenue and earnings growth, while reaffirmed guidance keeps attention on the crucial near-term catalyst: the hardware refresh cycle. This news does little to change the broader storyline or mitigate the biggest risk relating to long-term ATM demand, so the company’s risk profile remains largely unchanged for now.

Of the recent announcements, the absence of any share repurchases under the current buyback program stands out most clearly alongside this earnings release. While buybacks can signal management’s conviction in valuation and future growth, the company’s steady guidance and profit improvement place more focus on operational execution as the main driver of near-term performance, rather than capital returns, as hardware upgrades roll out.

Yet, despite improving results, investors should be alert to how a changing mix of cash usage and digital banking might impact future recurring revenue streams...

Read the full narrative on NCR Atleos (it's free!)

NCR Atleos is projected to generate $4.9 billion in revenue and $376.6 million in earnings by 2028. This outlook assumes a 4.4% annual revenue growth rate and a $248.6 million increase in earnings from the current $128.0 million level.

Uncover how NCR Atleos' forecasts yield a $44.67 fair value, a 26% upside to its current price.

Exploring Other Perspectives

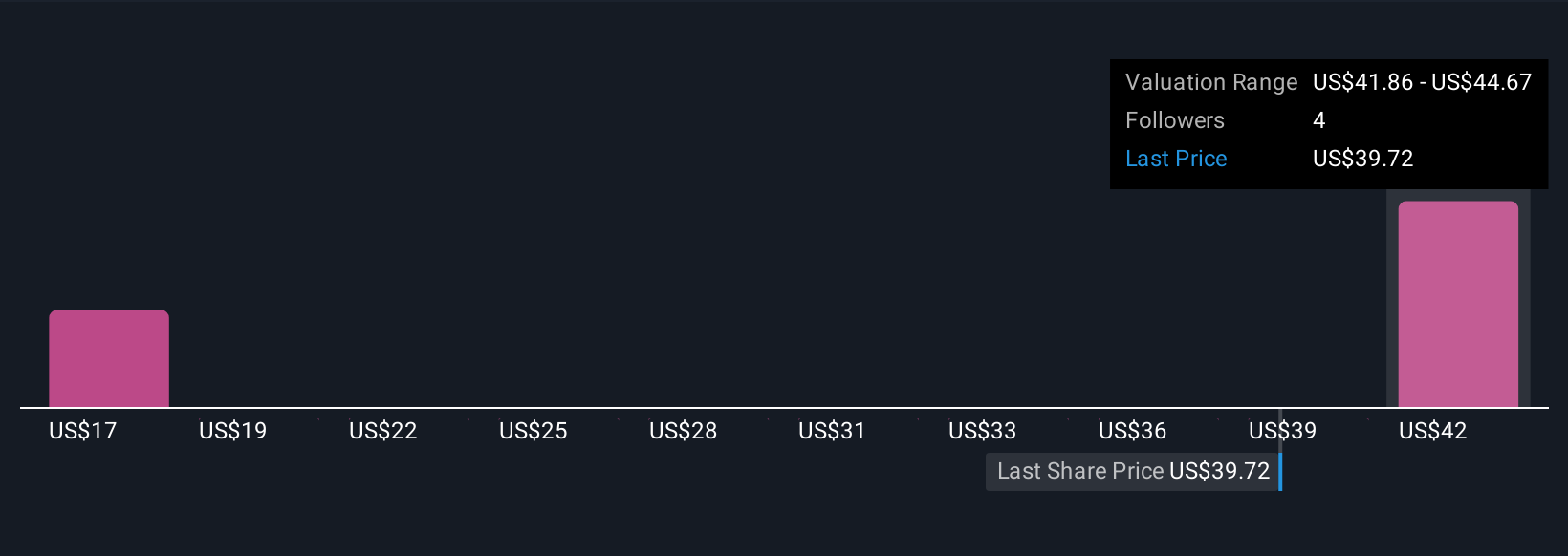

Four fair value estimates from the Simply Wall St Community range widely from US$16.92 to US$45.17 per share. This diversity reflects how future revenue growth and risks tied to shifts in cash demand can shape very different expectations among investors, explore several perspectives to inform your own view.

Explore 4 other fair value estimates on NCR Atleos - why the stock might be worth less than half the current price!

Build Your Own NCR Atleos Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your NCR Atleos research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free NCR Atleos research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate NCR Atleos' overall financial health at a glance.

Interested In Other Possibilities?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NCR Atleos might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NATL

NCR Atleos

A financial technology company, provides self-directed banking solutions to financial institutions, merchants, manufacturers, retailers, and consumers in the United States, rest of the Americas, Europe, the Middle East, Africa, and the Asia Pacific.

Reasonable growth potential with very low risk.

Similar Companies

Market Insights

Community Narratives