- United States

- /

- Capital Markets

- /

- NYSE:MSCI

Weighing MSCI's Value After Expanding Climate Risk Data and Recent Share Price Swings

Reviewed by Bailey Pemberton

- Thinking about whether MSCI's stock is a bargain right now? If you've ever wondered how to weigh up price versus value, you're in the right place.

- Recently, MSCI's stock price has been a bit of a rollercoaster. It rose 4.2% in the past month, slipped 4.7% over the last week, and is down 6.7% year-to-date.

- These moves have come after news that MSCI has been expanding its climate risk data offerings and making strategic acquisitions in risk analytics. This has fueled investor debate about growth versus valuation. Markets are digesting these developments, leading to some changes in risk perception and excitement about the company's future direction.

- According to our valuation checks, MSCI scores a 0 out of 6 on undervaluation metrics. Next, we'll dig into the standard valuation approaches and also reveal a smarter way to figure out what MSCI could really be worth.

MSCI scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: MSCI Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model is a widely used valuation approach that estimates a company's true worth by projecting its future cash flows and discounting them back to today's value. For MSCI, this means forecasting the cash the business generates and determining what that stream of money is worth in today's terms.

Currently, MSCI generates approximately $1.4 billion in free cash flow. Analysts forecast that by the end of 2029, annual free cash flow could reach around $2.1 billion. Only the first five years of projections are based on analyst estimates. Figures beyond that period are extrapolated by Simply Wall St. These calculations are all in US dollars.

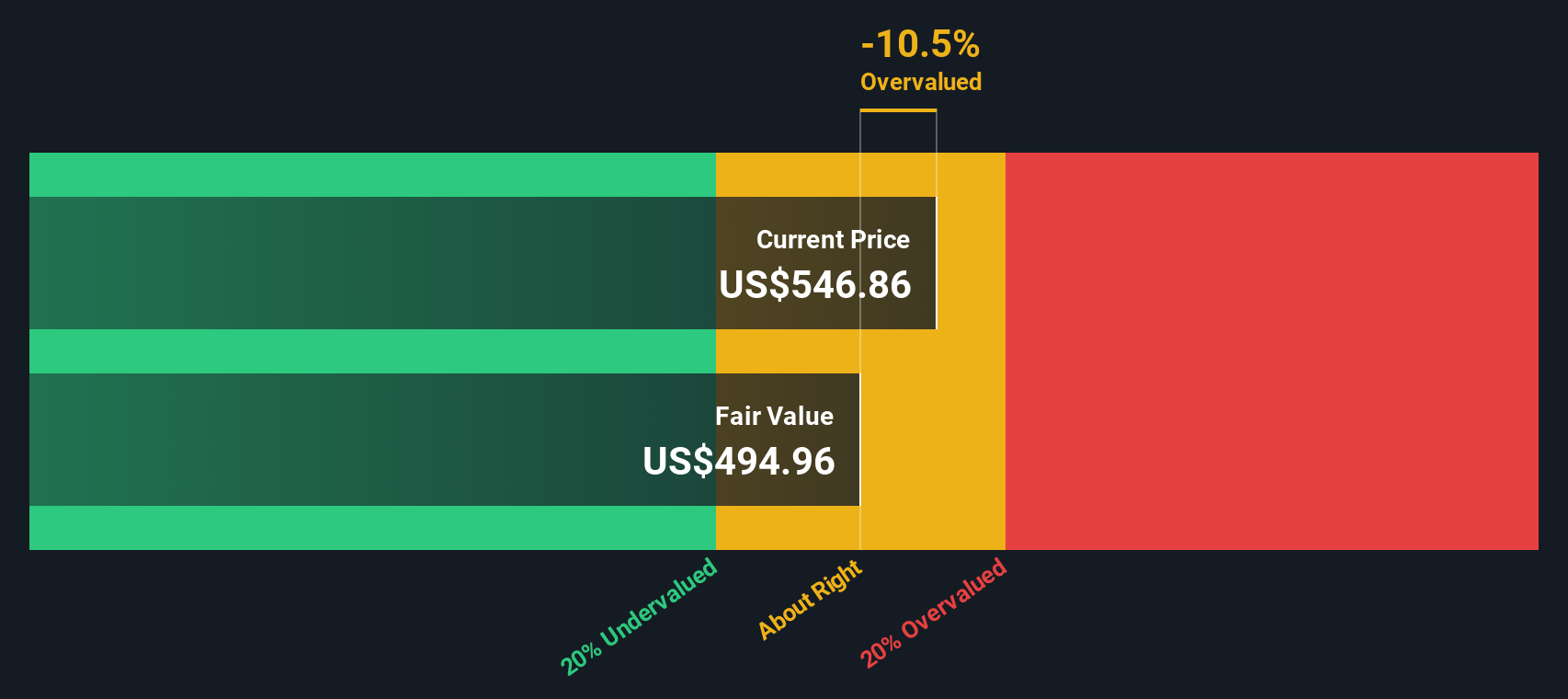

Based on these cash flow projections, our DCF analysis results in an estimated intrinsic value of $528 per share. Compared to MSCI's current share price, the model suggests the stock is approximately 5.5% overvalued.

Result: ABOUT RIGHT

MSCI is fairly valued according to our Discounted Cash Flow (DCF), but this can change at a moment's notice. Track the value in your watchlist or portfolio and be alerted on when to act.

Approach 2: MSCI Price vs Earnings (PE)

The price-to-earnings (PE) ratio is a widely accepted valuation metric for profitable companies like MSCI, as it directly relates the company’s share price to its earnings. Since earnings provide insight into a business’s profitability, the PE ratio is a convenient way to assess whether the stock’s price reflects those profits.

A “normal” or “fair” PE ratio will often depend on factors such as the company’s expected earnings growth and the risks associated with its business. Companies with stronger growth prospects or lower perceived risk typically command a higher PE ratio, while slower-growing or riskier firms tend to trade at lower multiples.

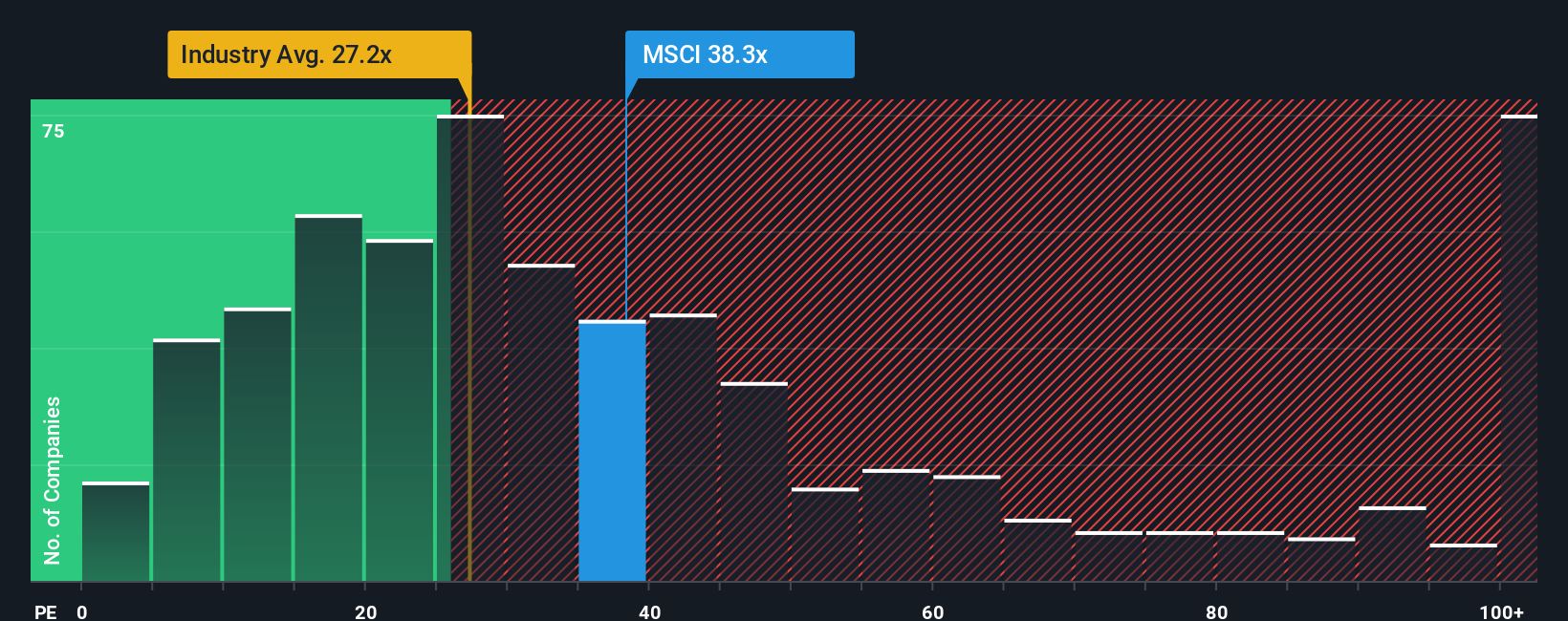

MSCI currently trades at a PE ratio of 34.2x. For context, the Capital Markets industry average sits at 23.7x, and the average among close peers is 30.6x. These benchmarks suggest MSCI is priced at a notable premium to both its industry and peers, likely reflecting market optimism about its growth and profitability.

To get a more tailored view, Simply Wall St’s Fair Ratio goes beyond industry and peer averages by factoring in details like MSCI’s growth rate, profit margins, scale, and business risks. According to this proprietary metric, MSCI’s Fair PE Ratio is 16.6x, substantially lower than the company’s actual PE. This suggests that, based on its specific profile, the market may be overvaluing MSCI compared to what would be justified by fundamentals alone.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1412 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your MSCI Narrative

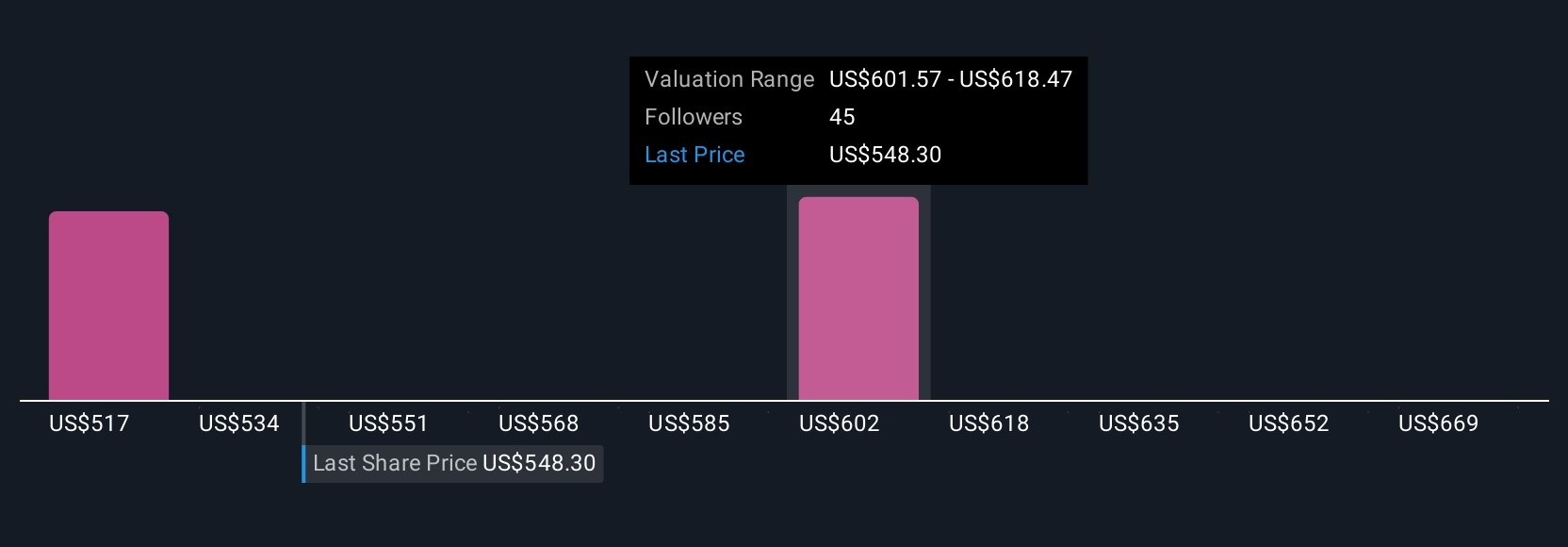

Earlier we mentioned that there's an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is more than just numbers on a page; it’s your story, your perspective on a company’s future, tied to specific estimates of revenue, profit margins, and what you believe is a fair value for the stock.

By connecting the company's unique story to a concrete financial forecast, Narratives help you translate “why” you believe in an investment into “what” you think it’s worth today. Narratives are built right into Simply Wall St's Community page, empowering millions of investors to craft, compare, and monitor their investment ideas with just a few clicks.

Using Narratives, you can easily decide if MSCI is a buy or sell by comparing each Narrative’s up-to-date Fair Value with the current share price. Whenever fresh news, earnings, or key metrics are released, Narratives are dynamically updated, so your investment view always reflects the latest facts.

For example, some MSCI Narratives forecast robust recurring revenue streams, rising profit margins, and aggressive buybacks, leading to bullish price targets as high as $700. Others focus on slower growth, fee compression, or stiff competition, bringing the lowest price targets closer to $520. All of these are based on real investor perspectives available for you to explore.

Do you think there's more to the story for MSCI? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MSCI

MSCI

Provides critical decision support tools and solutions for the investment community to manage investment processes worldwide.

Average dividend payer with questionable track record.

Similar Companies

Market Insights

Community Narratives