- United States

- /

- Capital Markets

- /

- NYSE:MIAX

Miami International Holdings (MIAX): Assessing Current Valuation After Recent Share Price Rise

Reviewed by Kshitija Bhandaru

Miami International Holdings (MIAX) has seen its stock performance shift recently, sparking some curiosity among investors. Over the past month, the price has climbed 13%, even as annual revenue declined and net income growth posted a sharp increase.

See our latest analysis for Miami International Holdings.

Momentum appears to be building for Miami International Holdings, as the stock’s 1-month share price return of 13% has caught attention against a backdrop of shifting fundamentals and ongoing sector movement. While the company is navigating a period of evolving financial metrics, the latest rise signals that investor sentiment may be shifting in anticipation of future growth potential.

If you’re interested in spotting other standouts making waves this season, now is an ideal moment to broaden your search and discover fast growing stocks with high insider ownership

With shares now trading just above analyst targets despite mixed financial results, investors must consider whether Miami International Holdings is presenting an undervalued opportunity, or if the market has already factored in the company’s next growth phase.

Price-to-Sales Ratio of 2.8x: Is it justified?

At a Price-to-Sales (P/S) ratio of 2.8x, Miami International Holdings trades well below both its peer average of 7.9x and the US Capital Markets industry average of 4x. Despite the share price hovering just over analyst targets, this comparatively lower multiple signals the market may be undervaluing MIAX’s current and potential revenue streams relative to those of its competitors.

The Price-to-Sales ratio measures how much investors are willing to pay per dollar of revenue. This metric is particularly relevant for financial companies since earnings can be volatile or heavily influenced by one-time items. For Miami International Holdings, a lower P/S ratio implies that investors are cautious about paying a premium for its sales. This may reflect uncertainty surrounding recent revenue declines or an expectation of lower future growth.

Compared to both peer and industry averages, MIAX appears to offer more value for each dollar of revenue generated. This positioning suggests there could be a disconnect between market expectations and the company’s long-term fundamentals, as reflected by its favorable ratio. However, with no fair ratio regression available, it remains to be seen if the market is poised to bridge this gap.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Sales of 2.8x (UNDERVALUED)

However, ongoing annual revenue declines and a slight premium to analyst targets still pose notable risks. These factors could challenge the current bullish outlook.

Find out about the key risks to this Miami International Holdings narrative.

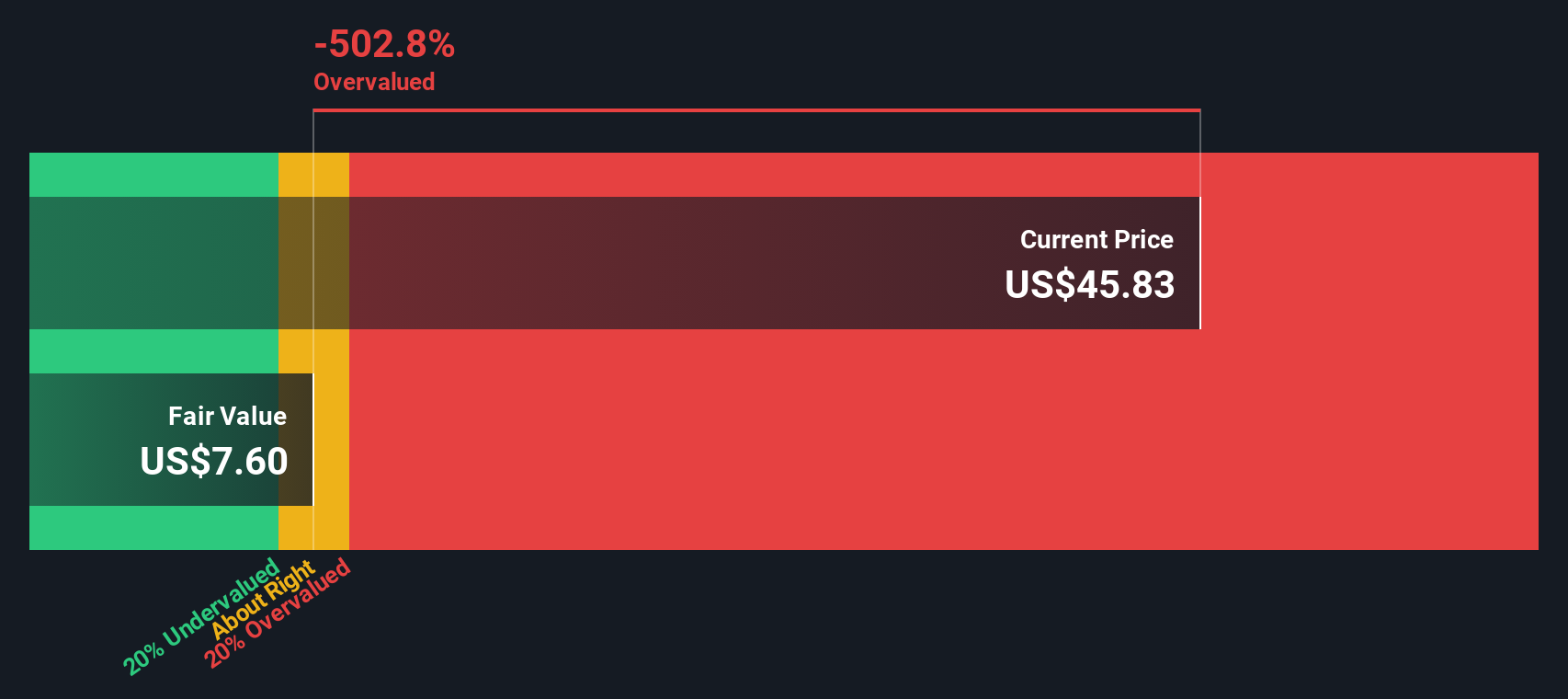

Another View: Discounted Cash Flow Comes to a Different Conclusion

While Miami International Holdings looks like good value using its price-to-sales ratio, our DCF model offers a sharply different perspective. According to this method, the stock appears overvalued, with shares trading significantly above what the model calculates as fair value. Does the growth outlook justify this kind of premium or is caution warranted?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Miami International Holdings for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Miami International Holdings Narrative

If you prefer independent analysis or want to explore different angles, you can easily craft your own Miami International Holdings story in minutes: Do it your way

A great starting point for your Miami International Holdings research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Unlock smarter opportunities by targeting stocks set for growth, innovation, or stable returns. Expand your watchlist and make sure you never let great ideas slip away.

- Generate income beyond the market average when you tap into these 19 dividend stocks with yields > 3%. These offer attractive yields with the potential for consistent payouts.

- Get ahead of technology trends by reviewing these 24 AI penny stocks. These stocks are leading advancements in artificial intelligence, automation, and digital disruption.

- Supercharge your search for value by uncovering these 909 undervalued stocks based on cash flows. These are priced well below their cash flow potential but are primed for a rebound.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MIAX

Miami International Holdings

Through its subsidiaries, operates various markets across options, futures, and cash equities.

Excellent balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives