- United States

- /

- Capital Markets

- /

- NYSE:MCO

Moody’s (MCO): Evaluating Valuation as Entegra Partnership Showcases Innovation in Bond Analytics

Reviewed by Simply Wall St

Moody's (MCO) is teaming up with Entegra LLC to integrate its cash flow analytics into Entegra's trading-as-a-service platform. The collaboration is designed to boost transparency and provide more precise, real-time insights into bond valuations.

See our latest analysis for Moody's.

Despite a flurry of partnerships and a sharpened focus on tech-driven analytics, Moody's shares have posted only a modest 2.7% share price return year-to-date. Longer-term total shareholder returns, such as 72% over three years, reflect robust historical momentum, even if the past year has seen a slight dip.

If Moody’s strategy shift has you thinking about broader opportunities, it could be the right moment to expand your search and discover fast growing stocks with high insider ownership

With robust past returns and fresh innovation on display, the question now is whether Moody's shares still offer upside potential for new investors, or if the market has already priced in all the future growth.

Most Popular Narrative: 11% Undervalued

Moody's current narrative places its fair value about 11% above the last closing price, suggesting optimism driven by recent innovation and steady growth. The stage is set for a pivotal catalyst that could reshape perceptions of Moody's future earnings power.

Moody's is experiencing accelerating demand from the rapid evolution and expansion of private credit markets, evidenced by 75% year-over-year growth in private credit revenues, 25% of first-time mandates coming from private credit, and ongoing issuer/investor demand for independent risk assessment. This strongly supports future revenue growth and earnings resilience as private credit's share in global financing expands.

Want to know what powers this bullish view? This narrative banks on seismic shifts in Moody's addressable market, surging demand for new analytics, and bold profit margin bets. Which financial leap lands at its core? The hidden engines driving the narrative’s price target are ready to be revealed if you read on.

Result: Fair Value of $545.5 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, increasing regulatory scrutiny of private credit and intensified competition from AI-driven rivals could pose challenges to Moody's growth narrative and investor optimism.

Find out about the key risks to this Moody's narrative.

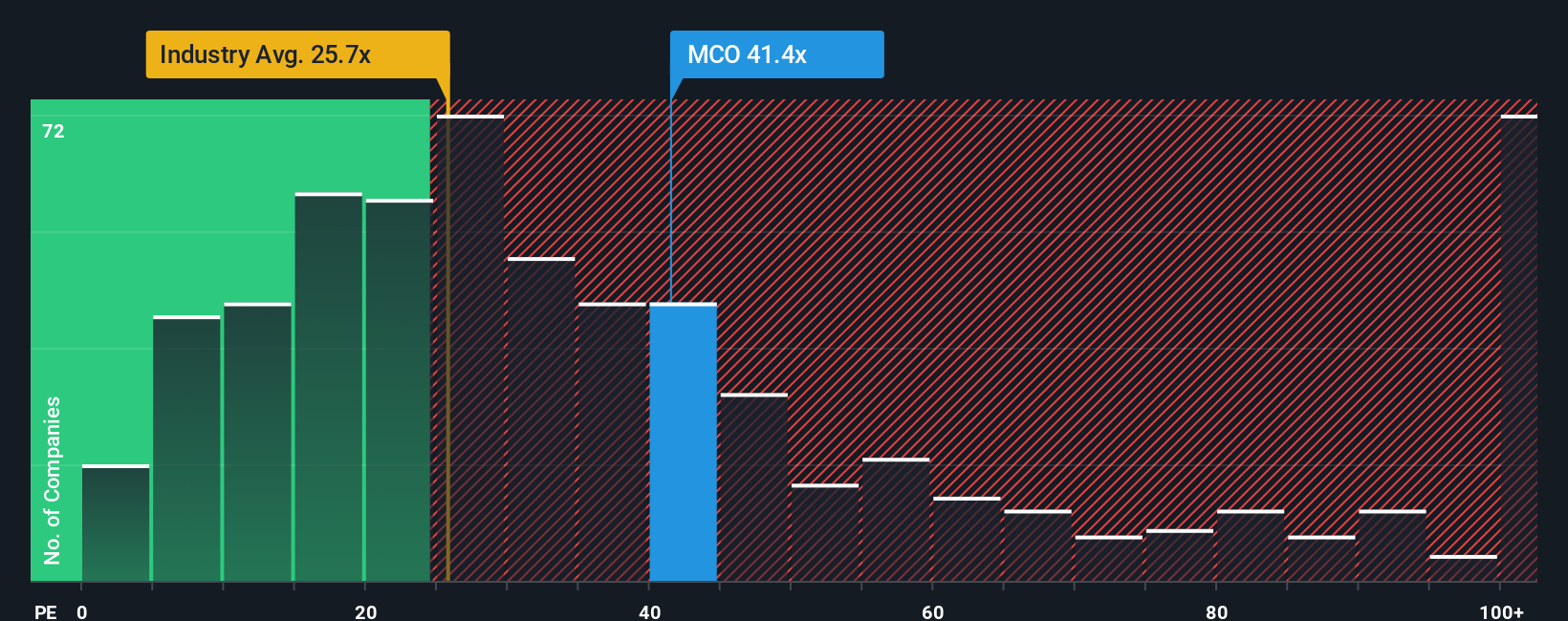

Another View: Multiple-Based Valuation Raises Questions

Looking at Moody’s through the lens of price-to-earnings, the company trades at 38.6x, which is well above the US Capital Markets industry’s 23.2x average, its peers’ 30.5x, and even higher than the fair ratio of 17.8x. This sizeable gap suggests investors are paying a premium, heightening valuation risk if expectations aren’t met. But does this premium signal quality, or over-optimism?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Moody's Narrative

If you see things differently or want to dive deeper on your own terms, it only takes a few minutes to build your personal narrative and put your insights to the test. Do it your way

A great starting point for your Moody's research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Opportunities?

Catch the next big wave in the market before everyone else. There are untapped corners and high-potential themes waiting for sharp investors like you.

- Unleash your potential by hunting for value among these 924 undervalued stocks based on cash flows, where companies priced below their cash flows could deliver above-average gains.

- Catch the momentum with these 26 AI penny stocks, featuring innovators set to ride the AI boom and transform their industries with bold new tech.

- Secure passive income streams and boost your returns by considering these 14 dividend stocks with yields > 3%, filled with stocks offering yields over 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MCO

Proven track record with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success