- United States

- /

- Diversified Financial

- /

- NYSE:MA

Can Mastercard's (MA) New $8 Billion Credit Line Signal a Shift in Its Growth Strategy?

Reviewed by Sasha Jovanovic

- Earlier in November 2025, Mastercard entered into a new five-year, unsecured US$8 billion revolving credit facility with a syndicate of international banks, amending and extending its previous agreement by one year with similar terms and expanded lender participation.

- This financing move underscores Mastercard's ongoing financial flexibility for general corporate purposes, while it comes shortly after a proposed settlement that would introduce five years of lower and capped credit interchange rates and enhanced acceptance options for U.S. merchants pending court approval.

- We'll examine how the expanded US$8 billion credit facility helps reinforce Mastercard's investment narrative centered on continued digital payment growth.

Find companies with promising cash flow potential yet trading below their fair value.

Mastercard Investment Narrative Recap

To be a Mastercard shareholder, you generally need confidence in the ongoing global shift from cash to digital payments and Mastercard's continued ability to harness this growth amid heavy competition. The recent expansion of Mastercard’s US$8 billion credit facility reflects healthy financial flexibility, but in itself does not materially alter the company’s most important current catalyst, ongoing digital payment adoption, or shift immediate focus away from regulatory and alternative payments risks.

Among recent announcements, the proposed settlement of long-running U.S. merchant interchange litigation stands out for its relevance. If approved, it will cap and lower credit interchange fees for five years, providing regulatory clarity but also introducing margin pressures that may influence Mastercard’s near-term revenue profile even as payment growth opportunities persist.

Yet, in contrast, investors should be aware that regulatory changes in the U.S. could still limit...

Read the full narrative on Mastercard (it's free!)

Mastercard's narrative projects $42.6 billion revenue and $19.9 billion earnings by 2028. This requires 12.1% yearly revenue growth and a $6.3 billion earnings increase from $13.6 billion today.

Uncover how Mastercard's forecasts yield a $654.98 fair value, a 23% upside to its current price.

Exploring Other Perspectives

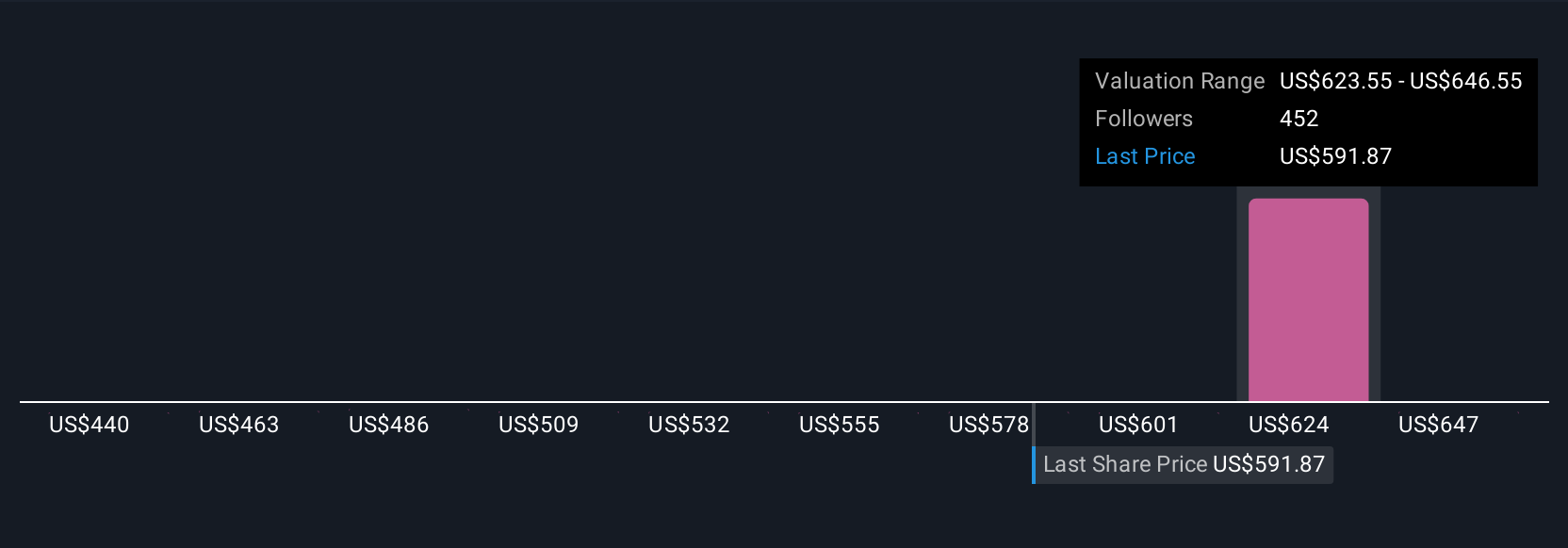

Simply Wall St Community members submitted 13 fair value estimates for Mastercard ranging from US$512.30 to US$667.21 per share. While you weigh these differing views, remember that new rules on U.S. interchange rates could impact Mastercard’s growth and margins in ways that analysts and community members may view quite differently.

Explore 13 other fair value estimates on Mastercard - why the stock might be worth just $512.30!

Build Your Own Mastercard Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Mastercard research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Mastercard research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Mastercard's overall financial health at a glance.

No Opportunity In Mastercard?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MA

Mastercard

A technology company, provides transaction processing and other payment-related products and services in the United States and internationally.

Solid track record with moderate growth potential.

Similar Companies

Market Insights

Community Narratives