- United States

- /

- Diversified Financial

- /

- NYSE:MA

Assessing Mastercard’s True Value After Expansion Into New Payment Technologies

Reviewed by Bailey Pemberton

- Ever wondered if Mastercard’s stock is truly worth its lofty price tag, or if there is a hidden opportunity the market might be overlooking?

- Mastercard’s shares have seen a slight uptick of 2.7% in the past week, even though they are down 4.8% over the last month. This could suggest shifting investor sentiment or short-term uncertainty.

- Sector-wide optimism around electronic payments and ongoing discussions about increased cross-border transaction volumes have helped power recent price moves, even as broader markets remain shaky. Notably, analysts have highlighted Mastercard’s expansion into new payment technologies following several strategic partnership announcements in recent months.

- Looking at our valuation framework, Mastercard scores 2 out of 6 on undervaluation checks (see the full breakdown). There is much more to uncover about how value is really assessed, so read on to find out which methods matter most and explore a smarter approach at the end of this article.

Mastercard scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Mastercard Excess Returns Analysis

The Excess Returns valuation model estimates a company’s intrinsic value by focusing on how much return it can generate above the minimum required by investors, known as the cost of equity. This approach is particularly useful for high-quality businesses with consistent profitability because it highlights whether their returns on invested capital justify their price tag.

For Mastercard, the model uses the following key metrics:

- Book Value: $8.78 per share

- Stable Earnings per Share (EPS): $26.76 (sourced from weighted future Return on Equity estimates from 12 analysts)

- Cost of Equity: $0.94 per share

- Excess Return: $25.82 per share

- Average Return on Equity: 210.29%

- Stable Book Value: $12.73 per share (sourced from weighted future Book Value estimates from 8 analysts)

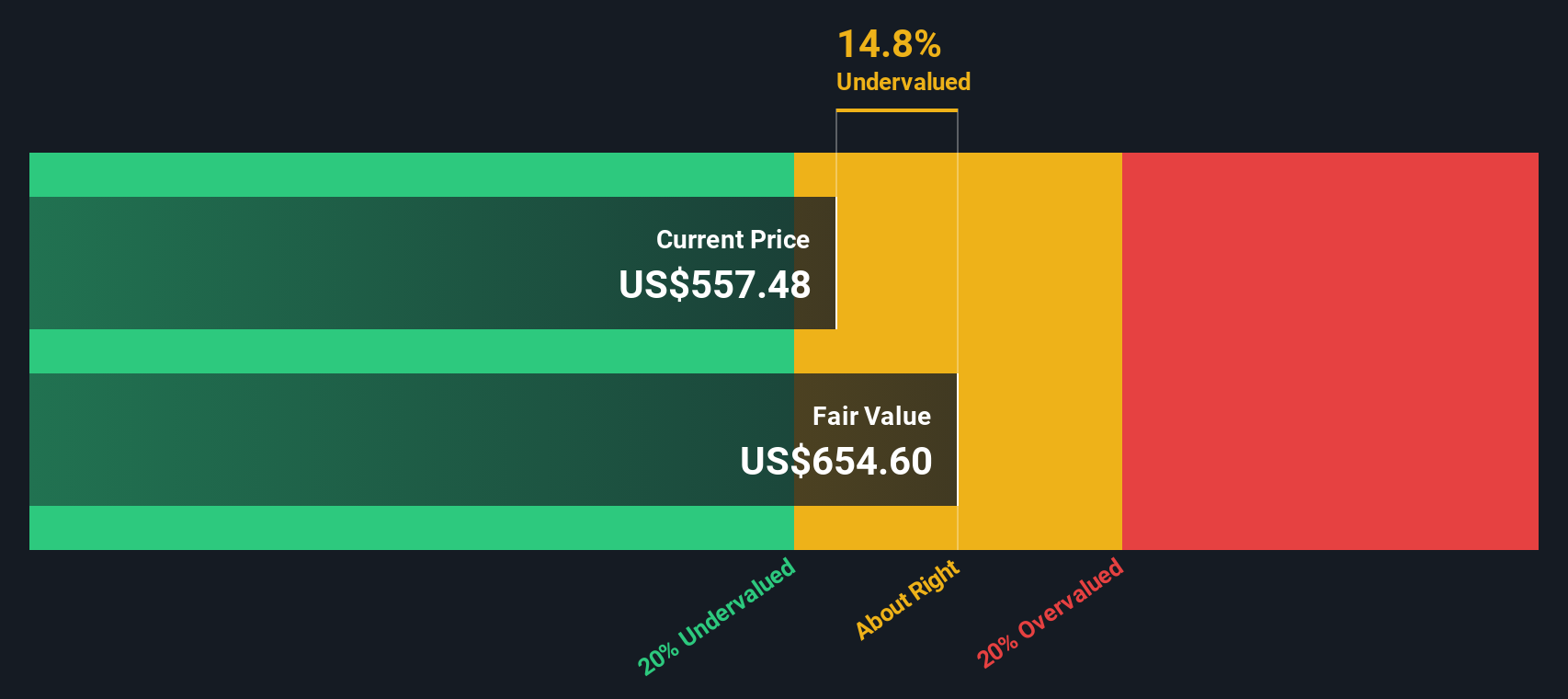

Based on these figures, the Excess Returns model calculates an intrinsic value that indicates Mastercard is trading at a 14.5% discount to its fair value. This suggests the current share price underestimates the company’s ability to generate high returns above its cost of equity and grow profitably over time.

Result: UNDERVALUED

Our Excess Returns analysis suggests Mastercard is undervalued by 14.5%. Track this in your watchlist or portfolio, or discover 927 more undervalued stocks based on cash flows.

Approach 2: Mastercard Price vs Earnings

For well-established, profitable companies like Mastercard, the Price-to-Earnings (PE) ratio is a widely trusted valuation measure. The PE ratio shines because it relates a company’s share price to its underlying earnings power, providing a quick sense of how much investors are willing to pay for each dollar of profit the business generates.

What makes a “normal” or fair PE ratio can differ greatly depending on expected earnings growth, perceived risks, and broader industry trends. Fast-growing or less risky companies often enjoy higher PE ratios, while those facing slower growth or more uncertainty are typically assigned lower multiples by the market.

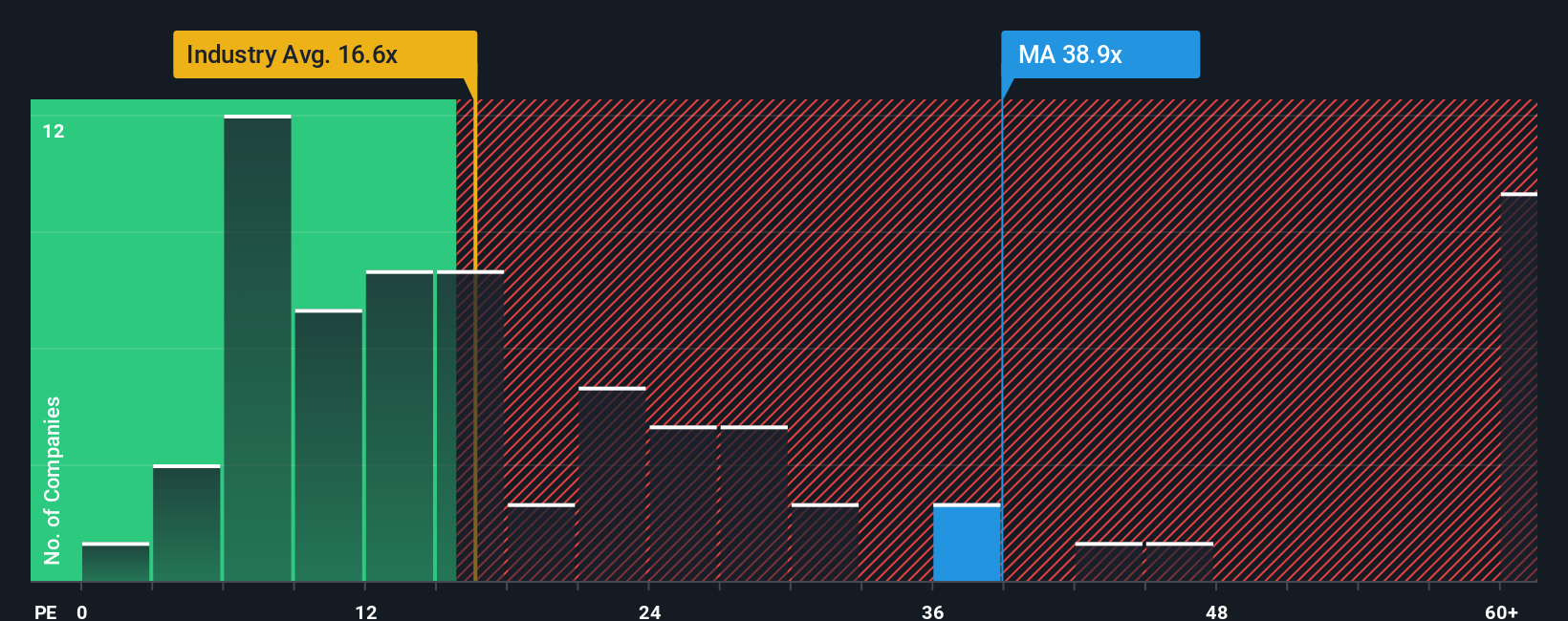

Currently, Mastercard is trading at a PE ratio of 34.34x. This is well above the Diversified Financial industry average of 13.56x and higher than its peer group’s average of 16.40x. At first glance, such a premium might raise eyebrows, but it is important to dig deeper before drawing conclusions.

This is where Simply Wall St’s proprietary “Fair Ratio” comes in. Rather than simply benchmarking Mastercard to its peers or the broader industry, the Fair Ratio evaluates a stack of company-specific variables, including earnings growth prospects, profit margins, risk profile, market cap, and industry dynamics, to calculate what multiple the market should realistically assign. For Mastercard, the Fair Ratio is 20.42x.

Because Mastercard’s PE ratio of 34.34x is noticeably higher than its Fair Ratio of 20.42x, the stock appears overvalued based on earnings relative to its forecast growth and risk profile.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1434 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Mastercard Narrative

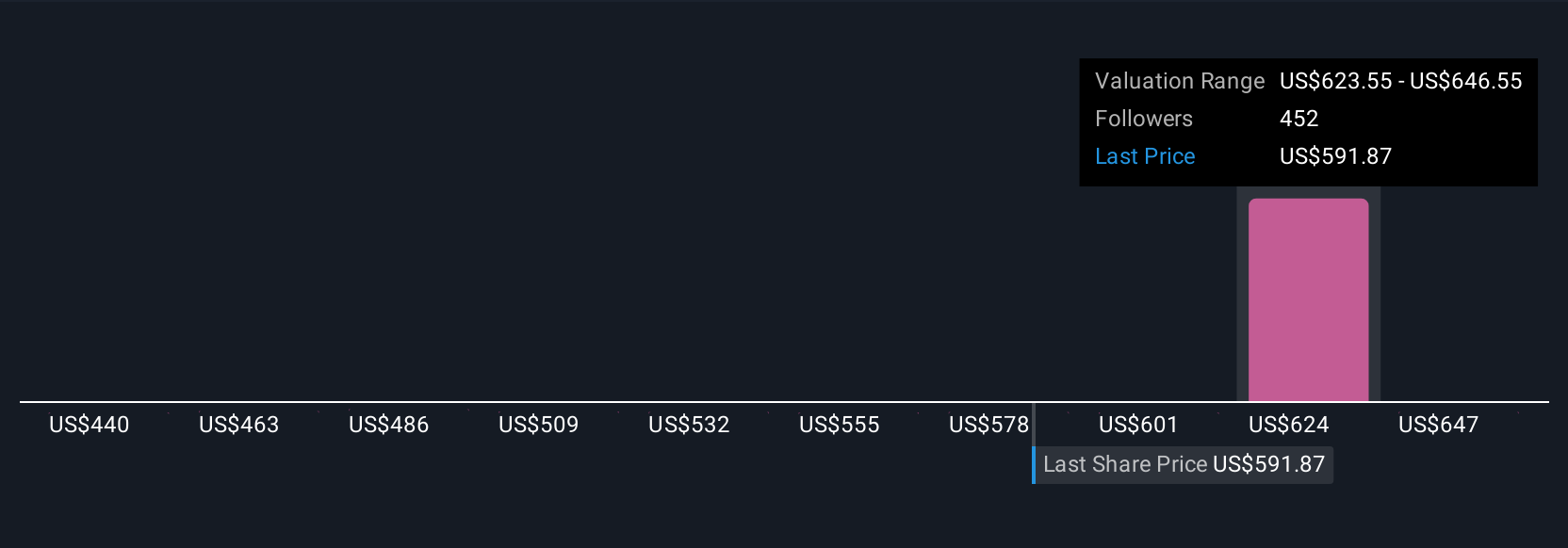

Earlier, we mentioned there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is your personal story about a company, describing how you see its business unfolding, what you expect for its future revenues, earnings, and margins, and how you believe all those numbers add up to a fair value. Narratives connect everything by linking your perspective on Mastercard’s growth drivers or risks to a set of future financial estimates and then directly to a fair value you can compare to the company’s share price.

On Simply Wall St’s Community page, trusted by millions of investors, you can easily explore and contribute Narratives for Mastercard and thousands of other stocks. This accessible tool helps you make smarter buy or sell decisions by showing if your version of fair value is higher or lower than today’s price, based on your own assumptions. Narratives are updated in real time as new information, like fresh earnings results or news, is released. This means your insights always stay relevant.

For example, one Mastercard Narrative estimates a bullish fair value of $690, expecting digital expansion to outpace competition. A more cautious Narrative sets fair value at $520, focusing on margin pressure from new payment rails. These examples demonstrate how different investor perspectives can lead to very different conclusions and empower you to decide which story makes the most sense for you.

Do you think there's more to the story for Mastercard? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MA

Mastercard

A technology company, provides transaction processing and other payment-related products and services in the United States and internationally.

Solid track record with moderate growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success