- United States

- /

- Diversified Financial

- /

- NYSE:MA

A Closer Look at Mastercard (MA) Valuation Following New Digital Payments Initiative

Reviewed by Simply Wall St

Mastercard (MA) shares edged up 2% following the company’s announcement of a new partnerships initiative focused on expanding its digital payments footprint. Investors are watching closely to see how this move might boost Mastercard’s long-term growth.

See our latest analysis for Mastercard.

Mastercard's momentum has cooled a bit since its year-to-date share price return of 5.81%. Total shareholder return over the past year reached 9.96%. Despite a modest dip over the last month, long-term investors have still enjoyed a 72.69% total return over three years, showing that Mastercard continues to deliver for those with patience.

If recent moves at Mastercard have you thinking bigger, now could be the right time to broaden your search and discover fast growing stocks with high insider ownership

But with shares trading near record highs and still about 18% below consensus price targets, the critical question is whether Mastercard is undervalued right now or if expectations for future growth are already reflected in the price.

Most Popular Narrative: 15.1% Undervalued

With Mastercard’s fair value estimated at $650.98, almost $100 above the latest $552.75 closing price, the current market may be overlooking drivers behind this bullish narrative.

Mastercard is benefiting from the accelerating global shift from cash to digital payments, as evidenced by strong growth in payment volumes, increased contactless and online transaction penetration, and ongoing expansion into underpenetrated verticals and regions, supporting sustained revenue and earnings growth.

Want to know how bold forecasts turn into this big valuation gap? The real story here weaves rapid digitization and margin surprises with analyst confidence. The engine powering this narrative relies on profit leaps, ambitious revenue growth paths, and a future multiple that could spark debate among investors. Does the story hold up under scrutiny? Find out what’s fueling the forecasted upside and which financial expectations shape this price target.

Result: Fair Value of $650.98 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, rising competition from alternative payment systems and stricter regulation in key markets could quickly alter Mastercard's growth trajectory and valuation outlook.

Find out about the key risks to this Mastercard narrative.

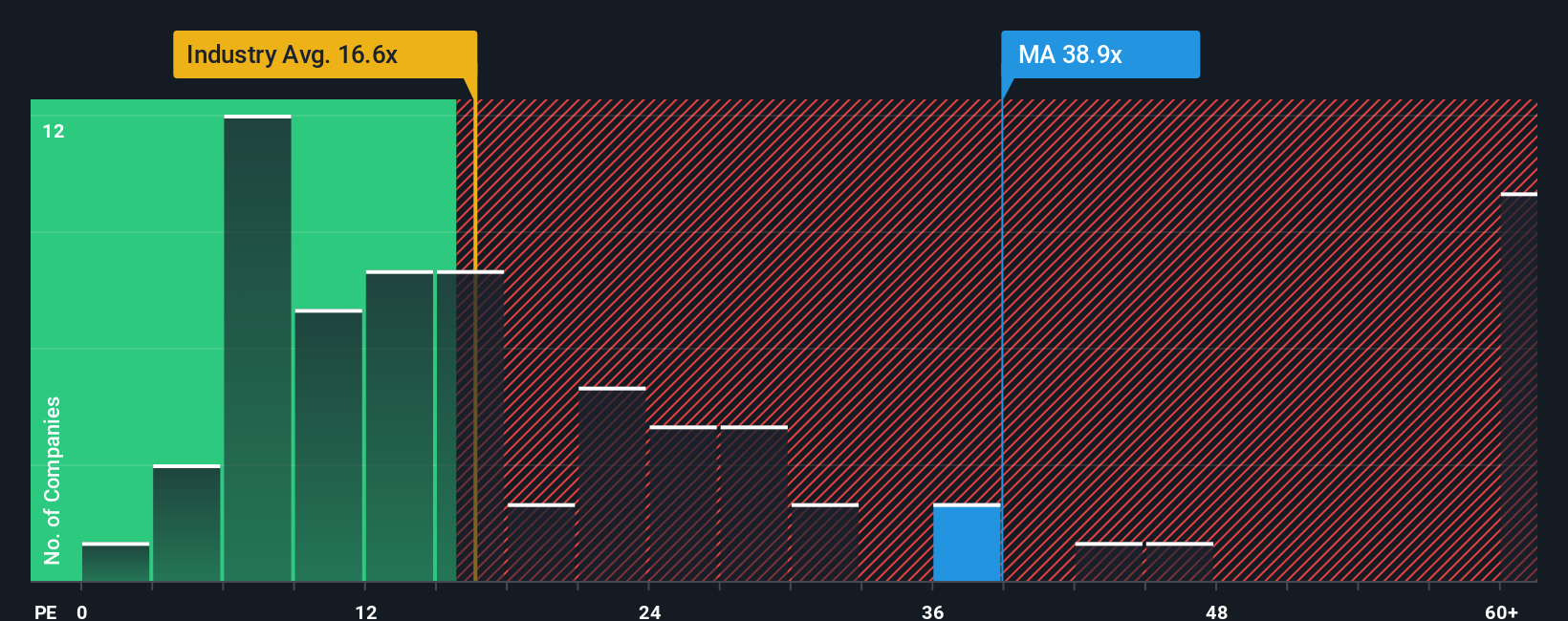

Another View: Market Ratios Send a Different Signal

Looking at standard market ratios, Mastercard is priced at about 34.8 times earnings, which is double the US Diversified Financial industry average of 15 and well above its own fair ratio of 20.4. This premium raises questions: are investors betting too much on continued outperformance, or is future growth already priced in?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Mastercard Narrative

If you want a different take or enjoy digging into the figures yourself, you can discover your own story in just a few minutes. Do it your way

A great starting point for your Mastercard research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Uncover your next opportunity by targeting breakthrough trends and proven performers. Smart investors often seek these ideas early. See what’s setting the pace beyond Mastercard.

- Capitalize on fast-growing sectors and get ahead of the crowd by browsing these 26 AI penny stocks, which show real promise in artificial intelligence innovation and adoption.

- Catch top companies offering attractive payouts by reviewing these 20 dividend stocks with yields > 3%, which features strong dividend yields that surpass current market averages.

- Spot undervalued opportunities that may be primed for future growth when you scan these 840 undervalued stocks based on cash flows, identified using discounted cash flow and solid fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MA

Mastercard

A technology company, provides transaction processing and other payment-related products and services in the United States and internationally.

Solid track record with moderate growth potential.

Similar Companies

Market Insights

Community Narratives