- United States

- /

- Diversified Financial

- /

- NYSE:KLAR

Will Klarna (KLAR) Leveraging Apple Pay in Europe Reinforce Its Competitive Position or Stretch Its Focus?

Reviewed by Sasha Jovanovic

- On November 18, 2025, Klarna Group announced the launch of its flexible payment products on Apple Pay in Denmark, Spain, and Sweden, building on recent expansions in the US, UK, and Canada, and coinciding with its first earnings release as a public company.

- This move positions Klarna as one of the first buy now, pay later options available on Apple Pay in these European countries, reflecting the company’s efforts to broaden its global reach and product accessibility following rapid consumer adoption of the Klarna Card.

- We’ll examine how Klarna’s partnership with Apple Pay in new European markets shapes its investment appeal and future growth potential.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

What Is Klarna Group's Investment Narrative?

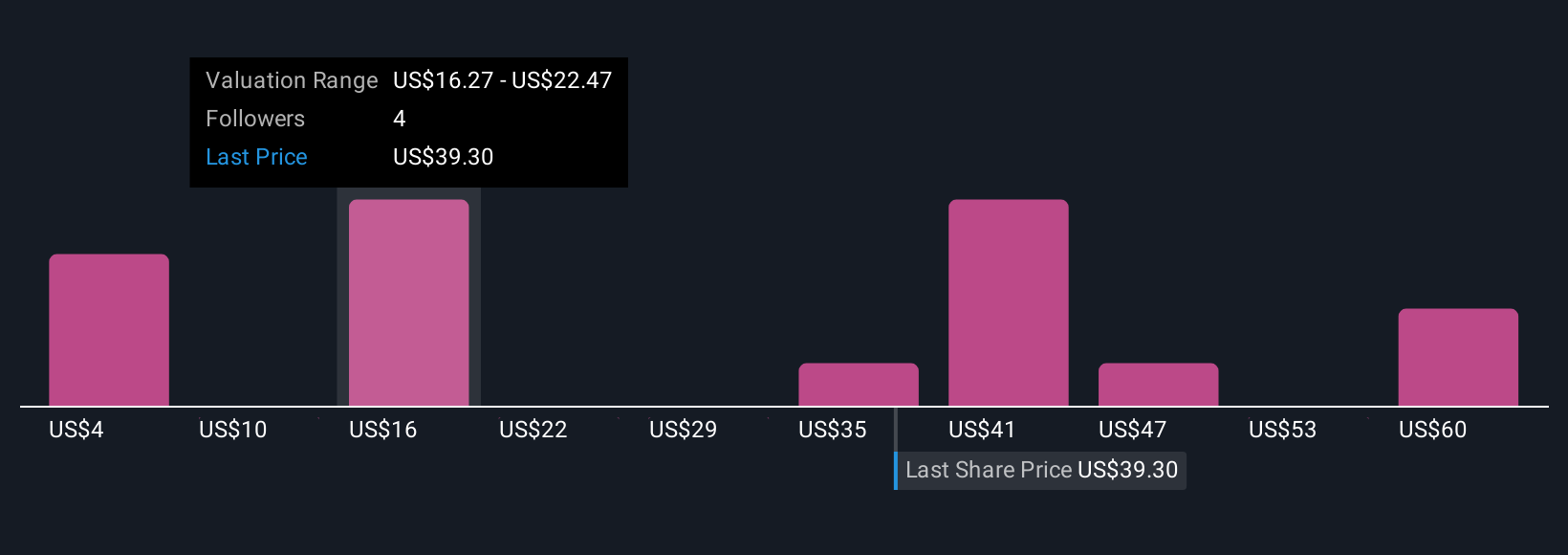

To see value in Klarna Group today, an investor needs confidence that expanding payment integration, like the latest Apple Pay launch, will drive user growth without further pressuring margins. The company’s product rollouts across Europe and the increase in adoption of the Klarna Card are pivotal short-term catalysts, as they widen Klarna’s footprint and could boost transaction volumes. However, Klarna’s recent 10% stock drop after its Q3 earnings miss highlights how quickly market sentiment can shift, especially with ongoing concerns over borrower defaults, rising funding costs, and fierce fintech competition. The Apple Pay partnership is appealing for its potential to broaden Klarna’s reach, but given the stock’s sharp decline and only moderate earnings impact so far, its influence on immediate financials appears marginal for now. Risks around profitability, high valuation relative to peers, and continued unprofitability remain front of mind even as investors monitor new growth levers. But short-term optimism may be tested if competition and credit defaults accelerate.

Klarna Group's share price has been on the slide but might be dropping deeper into value territory. Find out whether it's a bargain at this price.Exploring Other Perspectives

Explore 13 other fair value estimates on Klarna Group - why the stock might be worth as much as 97% more than the current price!

Build Your Own Klarna Group Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Klarna Group research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free Klarna Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Klarna Group's overall financial health at a glance.

Want Some Alternatives?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Find companies with promising cash flow potential yet trading below their fair value.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 27 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Klarna Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:KLAR

Klarna Group

Operates as a technology-driven payments company in the United Kingdom, the United States, Germany, Sweden, and internationally.

Flawless balance sheet with reasonable growth potential.

Market Insights

Community Narratives