- United States

- /

- Capital Markets

- /

- NYSE:KKR

A Fresh Look at KKR (KKR) Valuation After Surpassing Third-Quarter Earnings Forecasts

Reviewed by Simply Wall St

KKR (NYSE:KKR) announced third-quarter results that surpassed expectations, driven by record fee-related earnings and significant capital deployment across its key business lines. The stock responded with a noticeable premarket move.

See our latest analysis for KKR.

Despite this sharp earnings beat, KKR’s share price has struggled in 2025, with a year-to-date return of -18.7%. Even with a pickup following the latest results, one- and three-year total shareholder returns stand at -20% and 117% respectively. Momentum remains subdued for now, but management’s record fundraising and active investments suggest there may be potential for a shift if fundamentals keep improving.

If KKR’s ability to seize opportunities in changing markets got your attention, it’s worth exploring fast growing stocks with high insider ownership.

With KKR delivering bumper results and the stock lagging behind its historical highs, the key question is whether investors have an overlooked value opportunity or if the market already reflects all of KKR’s future growth in its share price.

Most Popular Narrative: 22.8% Undervalued

With KKR’s last close at $121.32 and the narrative’s fair value estimate at $157.17, the current price reflects a significant discount to the potential upside analysts see if key drivers materialize. This valuation hinges on the company’s ability to sustain fee growth and successfully monetize its portfolio in the evolving private markets landscape.

Expansion of credit and asset-based finance platforms, with KKR now a leader in a $6 trillion+ market poised for further growth, provides a broader and more durable base of fee-related earnings. This also increases the potential for performance fees as these businesses scale. This diversification reduces earnings volatility and supports long-term earnings growth.

Want to know why this valuation leans so bullish? A few surprising assumptions power its fair value, especially impressive growth in profit margins and aggressive earnings projections. Curious what numbers are behind this bullish target? Dive into the narrative to see how these bold forecasts could shape KKR’s future.

Result: Fair Value of $157.17 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent credit risks and rising competition could quickly derail KKR’s momentum if market conditions worsen or if fee growth slows unexpectedly.

Find out about the key risks to this KKR narrative.

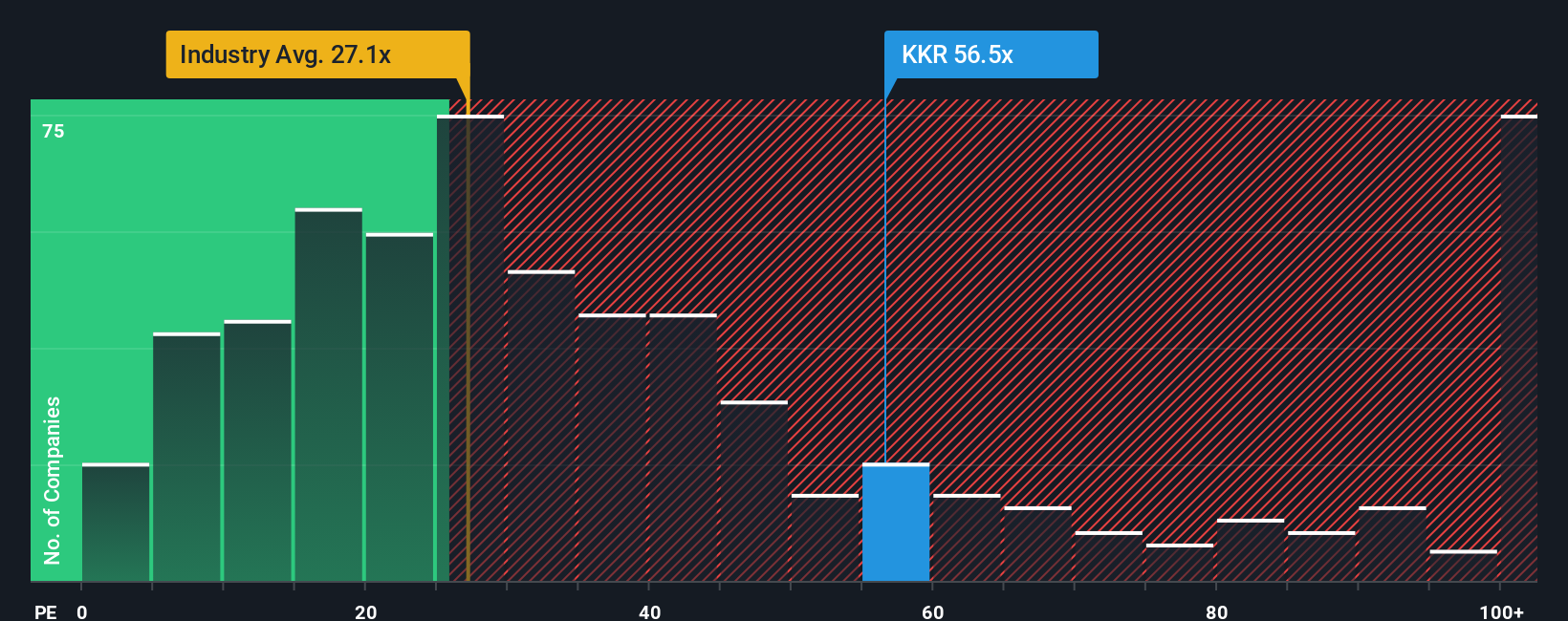

Another View: Multiples Tell a Different Story

While analysts see plenty of upside based on future growth and margins, the current price-to-earnings ratio puts KKR at 47.6 times earnings. That is notably higher than both the peer average of 34.7 and the broader US Capital Markets average of 24.1. Even compared to its fair ratio of 32.2, KKR appears expensive. This could mean higher valuation risk if growth disappoints. Can KKR grow fast enough to justify such a premium, or could this price point limit returns?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own KKR Narrative

If you’re inclined to question these conclusions or would rather dig into the numbers yourself, you can shape your own analysis in just a few minutes with Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding KKR.

Ready for More Smart Investment Moves?

Why limit yourself to just one story? Take five minutes now and see what other fast-moving opportunities are waiting. Don’t let the next breakout pass you by.

- Capitalize on generous income potential by checking out these 16 dividend stocks with yields > 3% with yields above 3%, a choice that could strengthen your portfolio’s cash flow.

- Capture the early growth of tomorrow’s technology with these 25 AI penny stocks and find AI innovators showing real promise in this transforming market.

- Ride the momentum of cutting-edge digital assets by browsing these 82 cryptocurrency and blockchain stocks, where blockchain and cryptocurrency leaders are creating new wealth frontiers.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if KKR might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:KKR

KKR

A private equity and real estate investment firm specializing in direct and fund of fund investments.

Moderate growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives