- United States

- /

- Diversified Financial

- /

- NYSE:JXN

Jackson Financial (JXN): Profitability Turnaround Forecast Reinforces Bullish Valuation Narrative

Reviewed by Simply Wall St

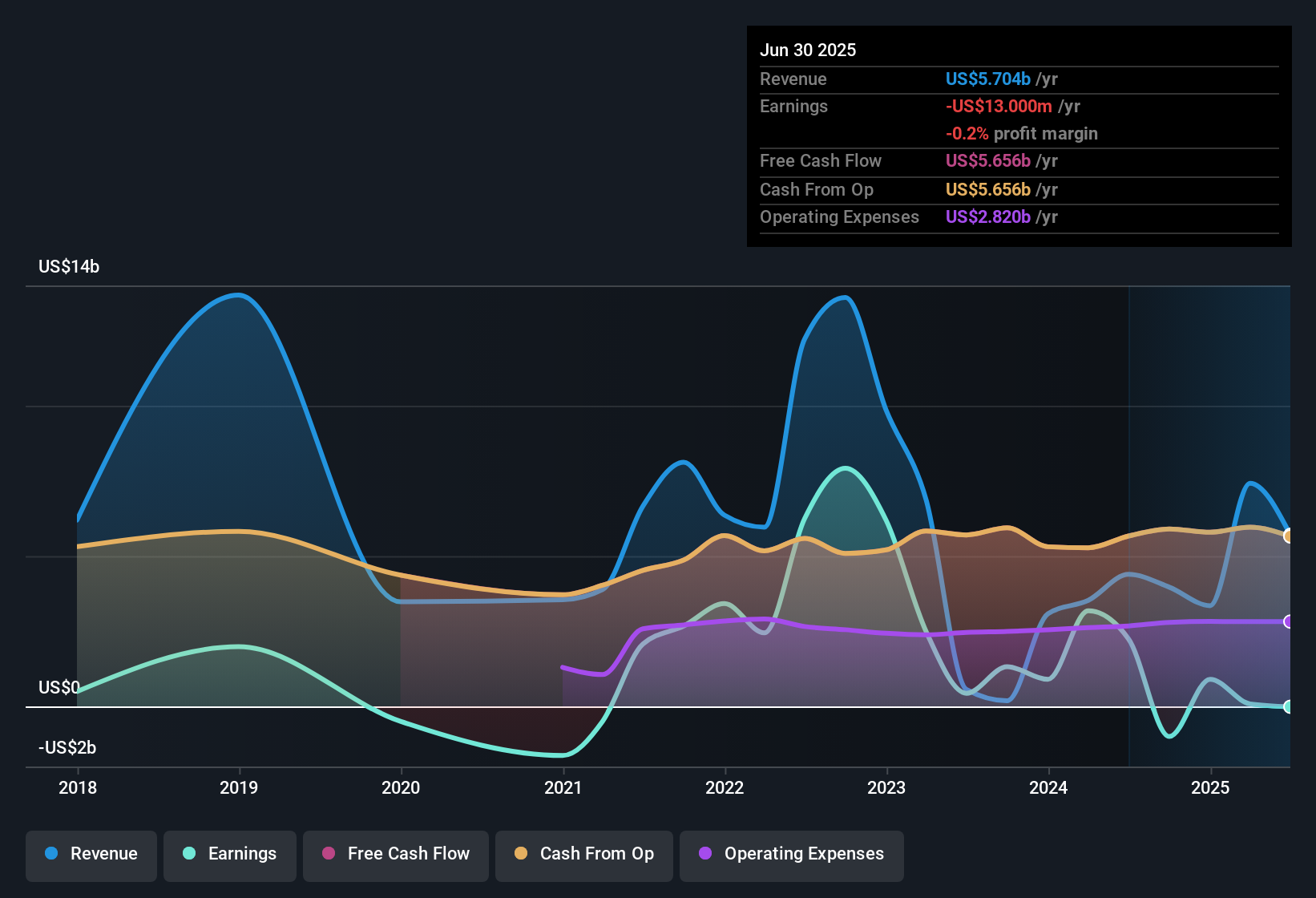

Jackson Financial (JXN) posted a net loss, with losses having deepened at a rate of 14.3% per year over the past five years. Looking ahead, analysts project revenue growth of 2.4% per year and earnings growth of 5.68% annually, with JXN expected to reach profitability within the next three years. For investors, these figures signal that the current unprofitability may be a temporary challenge. A turnaround could be on the horizon as earnings are forecast to improve.

See our full analysis for Jackson Financial.Now, let’s see how these latest earnings stats match up with the big-picture narratives investors follow. Sometimes the numbers confirm expectations, and other times they challenge them.

See what the community is saying about Jackson Financial

Margins Poised for Upswing

- Analysts expect profit margins to climb from -0.2% today to 9.2% over the next three years. This implies a significant shift in how much revenue drops to the bottom line as Jackson transitions toward profitability.

- According to the analysts' consensus view, this margin forecast is heavily supported by:

- Ongoing growth in demand for annuity and retirement products, with retail annuity sales up 4% year-over-year and RILA balances surging 80%. This increases the company’s account value and revenue base.

- The strategic move toward fee-based and spread products like RILA and fixed annuities is expanding Jackson’s margins, reducing earnings volatility, and aligning with the long-term shift in US retirement trends.

- It is particularly notable that while margins are turning positive, disciplined capital return, including share repurchases and higher dividends, is expected to further increase earnings per share and book value for shareholders.

For a full breakdown of the factors shaping Jackson's margin outlook, see the complete consensus narrative and how it fits with the latest forecasts. 📊 Read the full Jackson Financial Consensus Narrative.

Analyst Targets Hover Near Current Price

- Jackson’s current share price of $93.66 sits just 6.3% below the analyst target price of $109.80. This suggests that on average, analysts believe the stock is close to being fairly valued right now.

- From the consensus narrative, there is only a slim gap between price and targets because:

- Analysts are projecting Jackson’s earnings will reach $723.6 million by September 2028, and price targets assume a future PE ratio of 10.8x, which is notably lower than the industry average of 16.5x.

- This relative valuation reflects analysts’ balanced outlook, expecting gradual profit growth without significant re-rating upside, but also recognizing the improving earnings trajectory.

Valuation Discount to Peers and DCF Fair Value

- Jackson’s price-to-sales ratio of 1.1x is below both the US diversified financials industry average of 2.4x and its peer average of 1.2x. Meanwhile, the current share price of $93.66 is substantially under the DCF fair value estimate of $249.94 per share.

- Within the consensus narrative, this valuation gap is framed as an attractive entry point for investors:

- Good value is seen as Jackson’s catalyst, with forecasts indicating profit and earnings growth ahead but no major flagged risks. This hints at a backdrop of gradual improvement rather than sudden change.

- Despite industry growth running at 10.5% annually compared to Jackson’s 2.4%, the valuation discount supports the view that patient investors could benefit if profitability materializes as forecasted.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Jackson Financial on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Got an alternative take on the latest numbers? Use your perspective to shape a unique narrative in just a few minutes. Do it your way

A great starting point for your Jackson Financial research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

See What Else Is Out There

While Jackson’s profit and revenue outlook is improving, its growth still lags the broader industry. Future gains may require more patience from investors.

If you're seeking more consistent momentum, discover opportunities with steadier revenue and earnings growth by checking out stable growth stocks screener (2073 results) today.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:JXN

Jackson Financial

Through its subsidiaries, provides suite of annuities to retail investors in the United States.

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives