- United States

- /

- Diversified Financial

- /

- NYSE:JXN

How a $1 Billion Share Repurchase and Higher Dividend at Jackson Financial (JXN) Has Changed Its Investment Story

Reviewed by Sasha Jovanovic

- Jackson Financial’s CEO Laura Prieskorn recently announced a US$1 billion increase in the company’s share repurchase authorization and confirmed a fourth-quarter dividend of US$0.80 per share.

- This signals management's expectation for capital returns to surpass its 2025 target range, highlighting an expanding focus on shareholder distributions.

- We'll examine how the expanded share repurchase authorization may reinforce Jackson Financial's long-term capital return narrative.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

Jackson Financial Investment Narrative Recap

To be a Jackson Financial shareholder, you would likely focus on the company’s ability to generate consistent capital returns through share repurchases and dividends, even as net outflows in its variable annuity segment pose ongoing risks to long-term fee revenue and assets under management. The expanded buyback authorization and dividend announcement are positive signals for capital return, but they do not fundamentally shift the key short-term catalysts or mitigate the risk tied to persistent annuity outflows. As such, the recent news reinforces Jackson’s focus on shareholder distributions without materially altering the business’s most pressing challenges.

Among recent announcements, the confirmation of the US$0.80 per share fourth-quarter dividend stands out as most relevant to the new buyback plan, reinforcing Jackson’s commitment to returning capital to shareholders. Together, these actions underscore the near-term appeal of the stock for those prioritizing yield, even as challenges in annuity retention and fee-based revenue growth continue to weigh on the company’s broader outlook.

However, beneath this emphasis on capital return, investors should be aware of the persistent risk of policyholder net outflows in Jackson’s core variable annuity business...

Read the full narrative on Jackson Financial (it's free!)

Jackson Financial's narrative projects $7.8 billion in revenue and $723.6 million in earnings by 2028. This requires an 11.1% yearly revenue growth and a $736.6 million increase in earnings from the current -$13.0 million.

Uncover how Jackson Financial's forecasts yield a $110.80 fair value, a 13% upside to its current price.

Exploring Other Perspectives

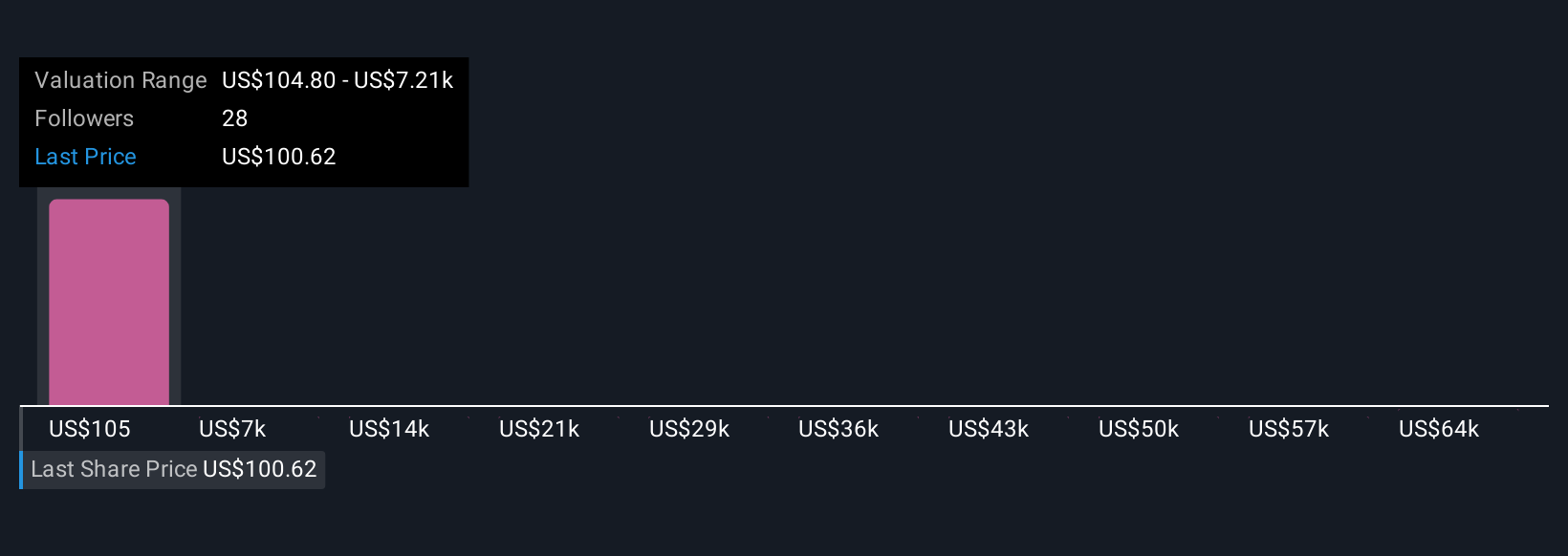

Fair value estimates from four Simply Wall St Community members range from US$110.80 to US$71,120.83. While shareholder distributions are increasing, continued annuity outflows could still pressure long-term revenue, explore how others view these risks and opportunities.

Explore 4 other fair value estimates on Jackson Financial - why the stock might be worth just $110.80!

Build Your Own Jackson Financial Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Jackson Financial research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Jackson Financial research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Jackson Financial's overall financial health at a glance.

Curious About Other Options?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Find companies with promising cash flow potential yet trading below their fair value.

- This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:JXN

Jackson Financial

Through its subsidiaries, provides suite of annuities to retail investors in the United States.

Undervalued with acceptable track record.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Not a Bubble, But the "Industrial Revolution 4.0" Engine

The "David vs. Goliath" AI Trade – Why Second Place is Worth Billions

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026