- United States

- /

- Capital Markets

- /

- NYSE:JHG

Janus Henderson (JHG) Margin Reduction Reinforces Ongoing Profitability Concerns Ahead of Earnings Season

Reviewed by Simply Wall St

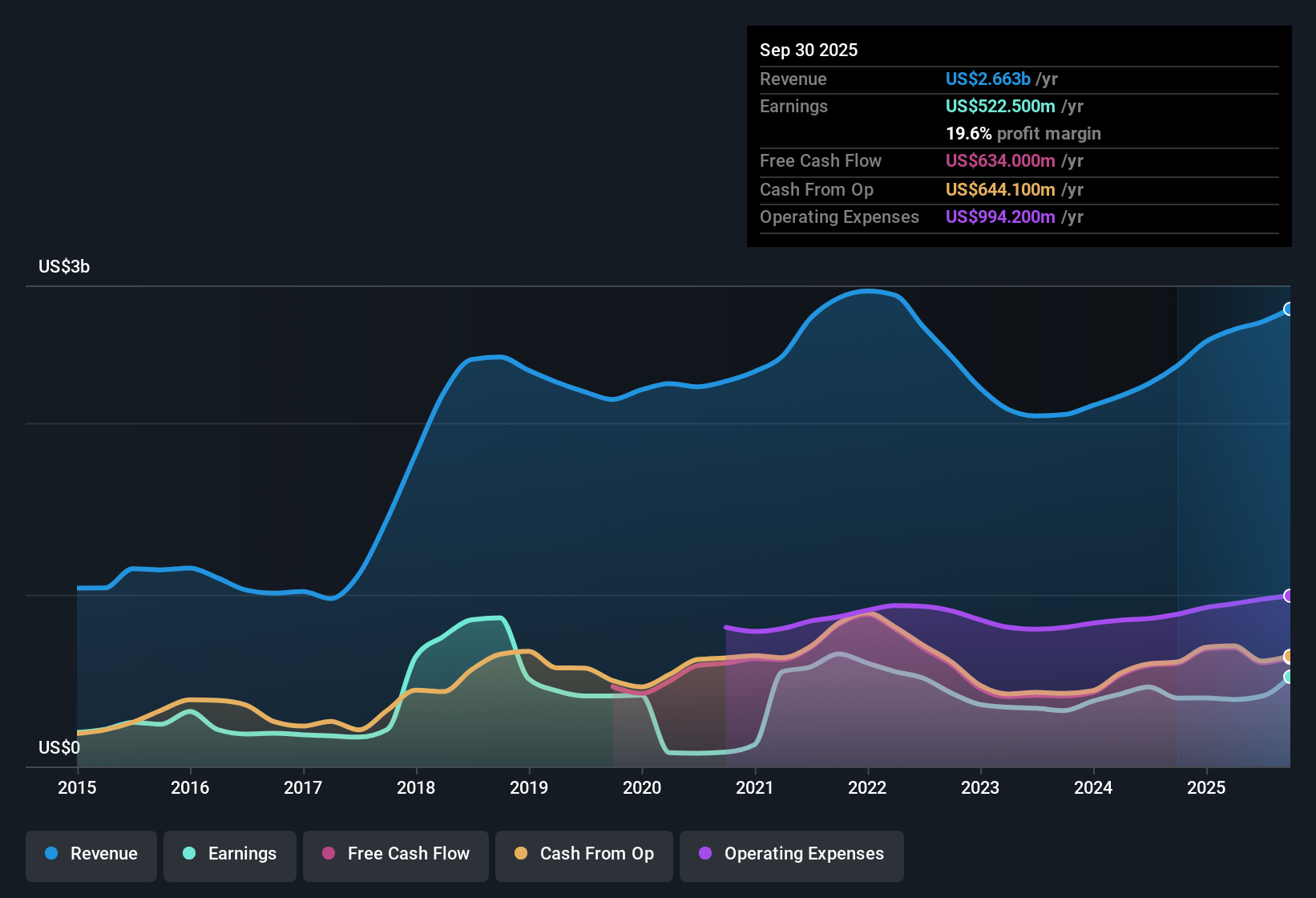

Janus Henderson Group (JHG) reported annual earnings growth forecasts of 5.15% and revenue growth of 5.8% per year, both trailing the broader US market’s pace. Net profit margins narrowed to 15.8% from 20.8% a year ago, reflecting a notable reduction. Over the last five years, earnings have slid slightly at a rate of 0.1% per year, with the most recent year also showing negative earnings growth. This provides a cautious context for investors as they digest this earnings release.

See our full analysis for Janus Henderson Group.Next, we will see how these results measure up compared to the prevailing narratives about Janus Henderson in the market. Some expectations will be confirmed, while others may be up for debate.

See what the community is saying about Janus Henderson Group

Margins Expected to Rebound to 17.9%

- Analysts project profit margins rising from today’s 15.8% to 17.9% in the next three years, reversing the recent margin reduction and signaling a possible stabilization.

- According to the analysts' consensus view, margin expansion is expected in part due to ongoing product innovation and growing client relationships.

- These efforts are aimed at offsetting industry-wide fee compression, which currently challenges market share and profitability.

- Despite recent expense pressure, consensus narrative notes global diversification and strategic partnerships could help maintain steady recurring revenue streams.

- See what analysts expect next for Janus Henderson Group in the full consensus narrative. 📊 Read the full Janus Henderson Group Consensus Narrative.

PE Ratio Discount Widens vs Peers

- Janus Henderson’s price-to-earnings ratio stands at 16.4x, meaningfully lower than the US Capital Markets industry average of 25.2x and undercutting the peer average of 17.2x.

- Consensus narrative argues this valuation gap suggests the company’s high quality earnings and improving margins are not fully priced in.

- The current share price of $43.01 trades at a notable discount to the DCF fair value of $51.26 per share.

- This discount stands out given analysts expect earnings to reach $510.9 million by 2028, further supporting the fair value case.

Slowdown in Long-Term Earnings Growth

- Over the last five years, annual earnings declined by 0.1% on average, a sluggish trend underscored by the most recent year’s negative earnings growth.

- Analysts' consensus view points out this flat growth track record increases emphasis on the success of new partnerships and product innovation.

- While revenue is forecast to grow at 5.8% per year, sustaining improved earnings will require reversing persistent client outflows and containing rising expenses.

- Critics highlight that even with strong investment performance, ongoing fee compression and industry shifts into low-cost products could challenge future earnings stability.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Janus Henderson Group on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Looking at the figures from another angle? Share your insights and shape your perspective into a narrative in just a few minutes with us. Do it your way

A great starting point for your Janus Henderson Group research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

Janus Henderson Group has struggled with flat earnings growth, margin pressure, and the challenge of sustaining improved results in the face of industry headwinds.

If steadier progress is what you need, our stable growth stocks screener (2108 results) highlights companies delivering consistent earnings and revenue expansion so you can invest with greater confidence in their outlook.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:JHG

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives