- United States

- /

- Capital Markets

- /

- NYSE:IVZ

Does the Recent 32% Rally Make Invesco a Smart Pick in 2025?

Reviewed by Bailey Pemberton

- Curious whether Invesco is a bargain or just another overhyped financial stock? You're not alone; understanding its true value is on a lot of investors' minds right now.

- After climbing an impressive 32.4% so far this year, Invesco shares have pulled back slightly over the past month, reminding us that even strong performers experience volatility.

- Recent headlines have focused on industry shifts in asset management and changing investor flows, offering useful context for Invesco's price swings. Developments like heightened attention on passive investing and fee compression across the sector have brought both challenges and opportunities for the company.

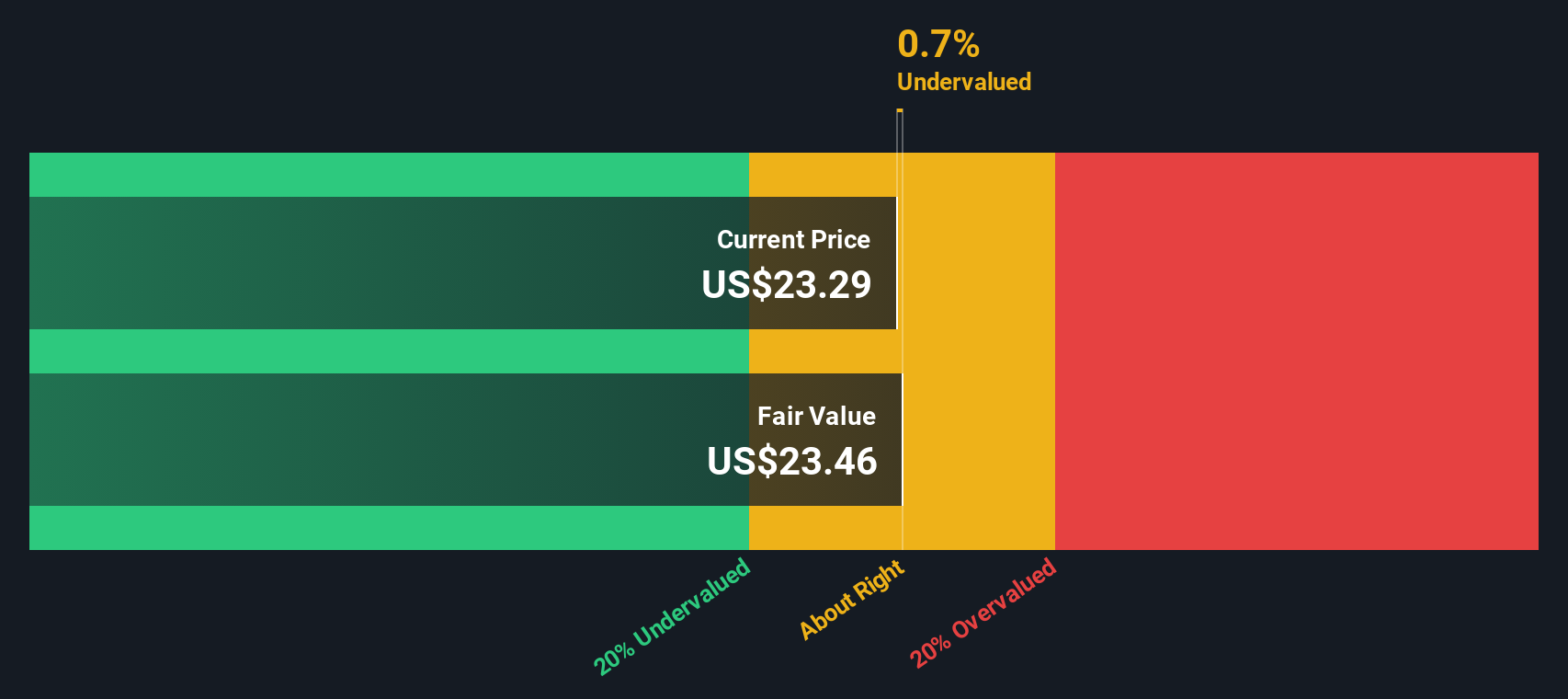

- By our count, Invesco scores a 4 out of 6 on our undervaluation checks; solid, but there's more to valuation than a single number. Let's break down what these approaches really say about the stock's value and, by the end, explore an even better way to get the full story.

Approach 1: Invesco Excess Returns Analysis

The Excess Returns valuation model measures how much additional profit a company generates beyond its cost of equity. This approach highlights the efficiency of its invested capital. By contrasting what shareholders expect to earn with what the company actually delivers, it provides an insightful view into Invesco's long-term value creation potential.

For Invesco, recent figures show a Book Value of $31.47 per share and an expected Stable Earnings Per Share (EPS) of $2.54, based on a consensus of future Return on Equity from four analysts. The company's Cost of Equity is $2.72 per share, leading to a calculated Excess Return of $-0.18 per share. This indicates that projected returns fall just short of the equity cost required by shareholders. The average Return on Equity sits at 7.81%, suggesting modest profitability relative to the capital invested. Looking ahead, the Stable Book Value is estimated at $32.50 per share by two analyst sources.

From this model, the estimated intrinsic value of Invesco's shares stands at $29.02. Compared to the current market price, this valuation implies the stock is 19.5% undervalued. This suggests the market may be overlooking long-term profit potential despite average near-term returns.

Result: UNDERVALUED

Our Excess Returns analysis suggests Invesco is undervalued by 19.5%. Track this in your watchlist or portfolio, or discover 836 more undervalued stocks based on cash flows.

Approach 2: Invesco Price vs Earnings

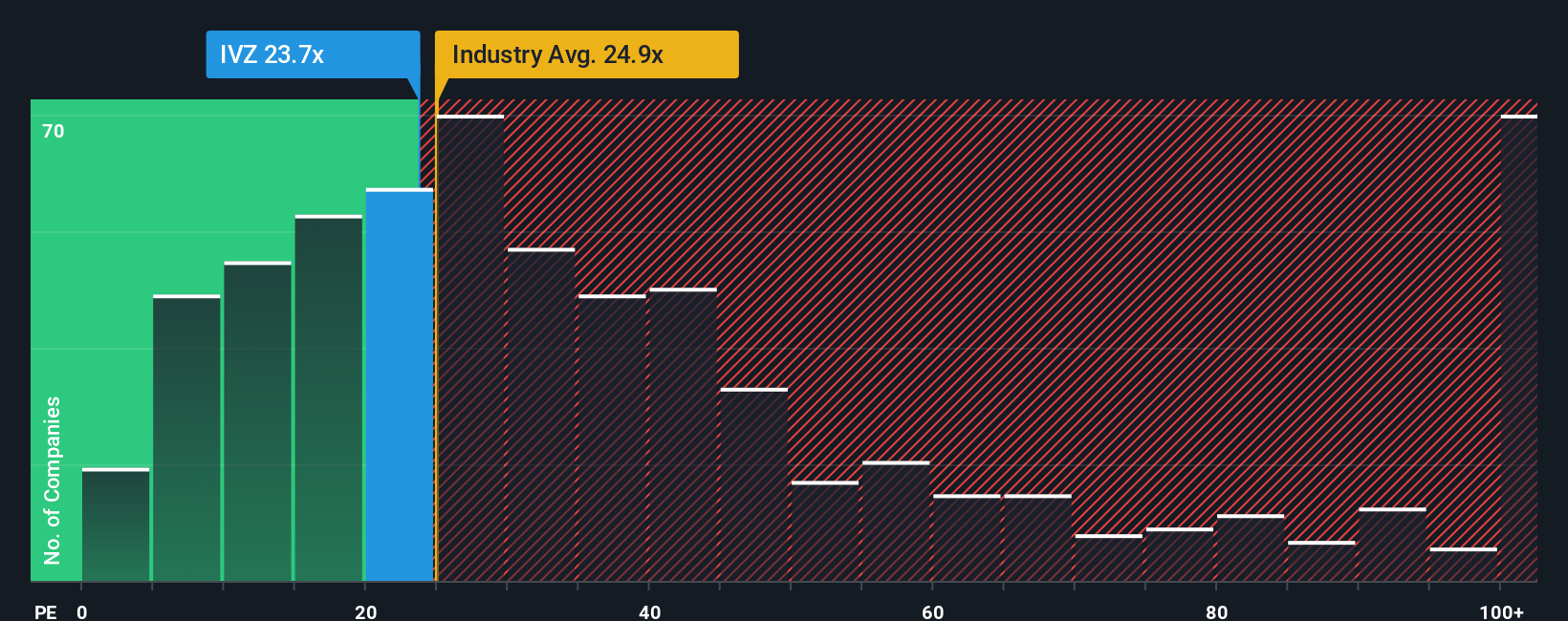

For profitable companies like Invesco, the Price-to-Earnings (PE) ratio remains a reliable tool because it directly connects a company's current share price with its ongoing earnings. This metric helps investors grasp how much they are paying for every dollar of profit and provides a quick snapshot of valuation within the broader market context.

Growth prospects and perceived risk both affect what is considered a “fair” or typical PE ratio for a given stock. Fast-growing and lower-risk businesses often justify a higher PE, while slow growers or riskier companies tend to trade at a discount. That is why it is important to look beyond the raw numbers and include context.

Invesco currently trades at a PE of 15.5x. For comparison, the average PE ratio among Capital Markets industry peers sits at 21.1x, while the broader industry average is 23.7x. However, benchmarks alone do not tell the full story. Simply Wall St’s proprietary “Fair Ratio” for Invesco is 18.9x, a tailored metric that weighs factors such as the company's growth potential, risk profile, profit margins, industry, and market cap. Relying on this Fair Ratio is more insightful than simply leaning on peer or sector averages, as it focuses on fundamentals specific to Invesco’s unique business characteristics.

With Invesco’s actual PE multiple at 15.5x and the fair value estimate at 18.9x, the stock appears undervalued on this metric. The market may be underestimating the company’s earnings outlook or overemphasizing sector challenges, offering a potential margin of safety for buyers.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1402 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Invesco Narrative

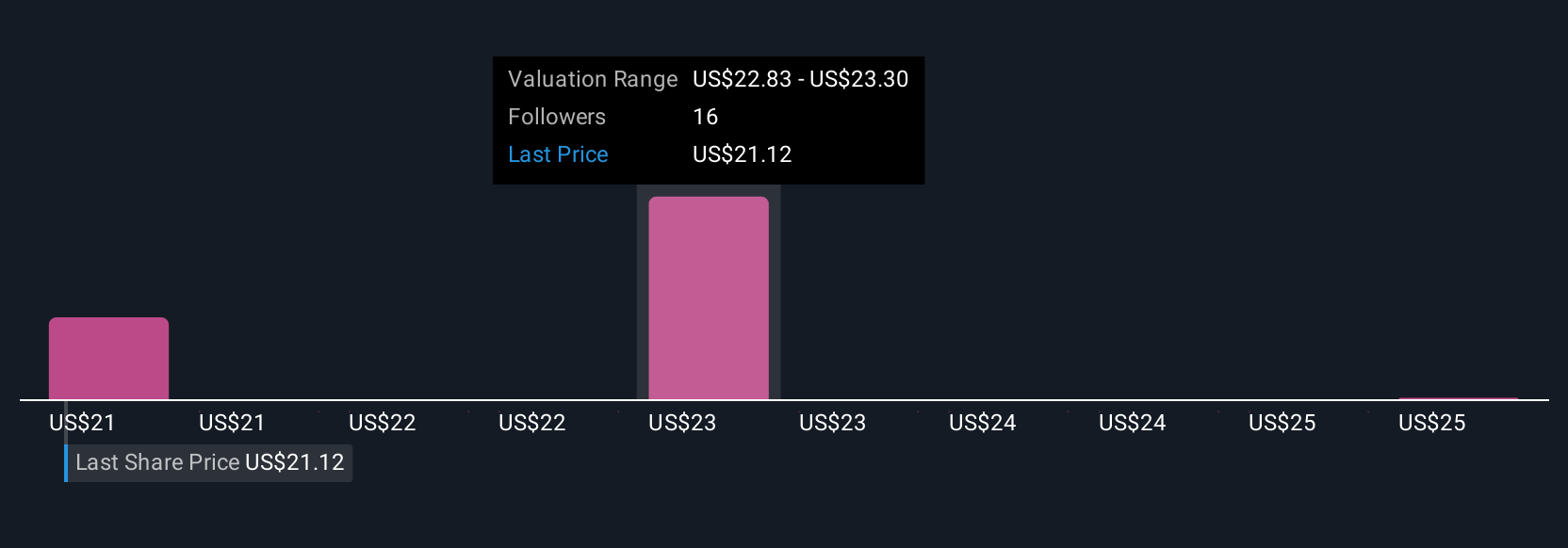

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives, a feature that helps you link the story behind Invesco’s business directly to your own financial forecasts and fair value estimates.

A Narrative is your personal investment take, combining your understanding of how Invesco’s strategy, industry trends, and risks could shape its financial future. This includes what revenue and earnings might look like, what profit margins Invesco could achieve, and what you believe is a fair price for its shares.

This approach goes beyond the numbers by showing how your view of the company’s journey translates into a real-world fair value, making your research more actionable and focused.

Narratives are easy to use and available for every company, including Invesco, within the Community page on Simply Wall St’s platform, trusted by millions of investors worldwide.

By comparing your Narrative’s Fair Value to today’s market price, you can quickly assess whether Invesco aligns with your unique expectations. Narratives are updated automatically whenever new news or company results are released, keeping your view up to date.

For example, some investors believe Invesco’s innovations and cost discipline justify a fair value as high as $29.00, while others are more cautious, setting their target as low as $17.00. This demonstrates how different Narratives produce actionable, tailored insights.

Do you think there's more to the story for Invesco? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:IVZ

Good value with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives