- United States

- /

- Capital Markets

- /

- NYSE:ICE

A Look at Intercontinental Exchange (ICE) Valuation Following Record Interest Rate Derivatives Activity

Reviewed by Simply Wall St

Intercontinental Exchange reported record open interest in its SONIA futures and options market, with overall interest rate derivatives also surging. This increase in trading activity signals heightened engagement and could shape perceptions around the company’s growth prospects.

See our latest analysis for Intercontinental Exchange.

Intercontinental Exchange’s latest milestones come on the heels of its partnership with AGNC to launch new fixed income indices, underscoring its ongoing efforts to broaden its reach in the financial markets. Despite a solid year-to-date share price return of 5.3%, investors have seen a -4.6% total shareholder return over the past twelve months, even as the company’s three- and five-year total returns remain an impressive 74%. This mix of short-term headwinds and long-term growth is reflective of shifting investor sentiment. Momentum may be tempered now, but ICE’s expanding product set and rising market engagement suggest its growth story is far from over.

If ICE’s momentum and market depth have you reassessing your outlook, it could be the perfect time to discover fast growing stocks with high insider ownership.

With the stock still trading at a notable discount to its analyst price target, robust earnings growth, and new product launches, the question remains: is ICE now an undervalued play, or is the market already factoring in its future success?

Most Popular Narrative: 21.1% Undervalued

Despite a last close of $157.27, the most followed narrative pegs Intercontinental Exchange's fair value much higher. This sets the stage for a deeper dive into the forces driving analyst conviction.

The continued expansion and integration of ICE's global electronic trading platforms across asset classes, including record energy, interest rate, and equity contract volumes, suggests ongoing benefits from digitization and greater market electronification. These factors are likely to drive sustained double-digit growth in transaction revenues and operating leverage.

What’s behind the optimism? The narrative is built on bold growth expectations in earnings and profit margins, driven by ICE’s relentless digitization and ambitious product expansion. The real surprise lies in the aggressive multiple analysts assign to future profits. Want to uncover the punchy forecasts that justify this bullish fair value? The full narrative has all the revealing details.

Result: Fair Value of $199.25 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, risks remain. Prolonged weakness in key trading volumes or costly integration missteps could quickly reshape market expectations for ICE’s growth trajectory.

Find out about the key risks to this Intercontinental Exchange narrative.

Another View: What About Multiples?

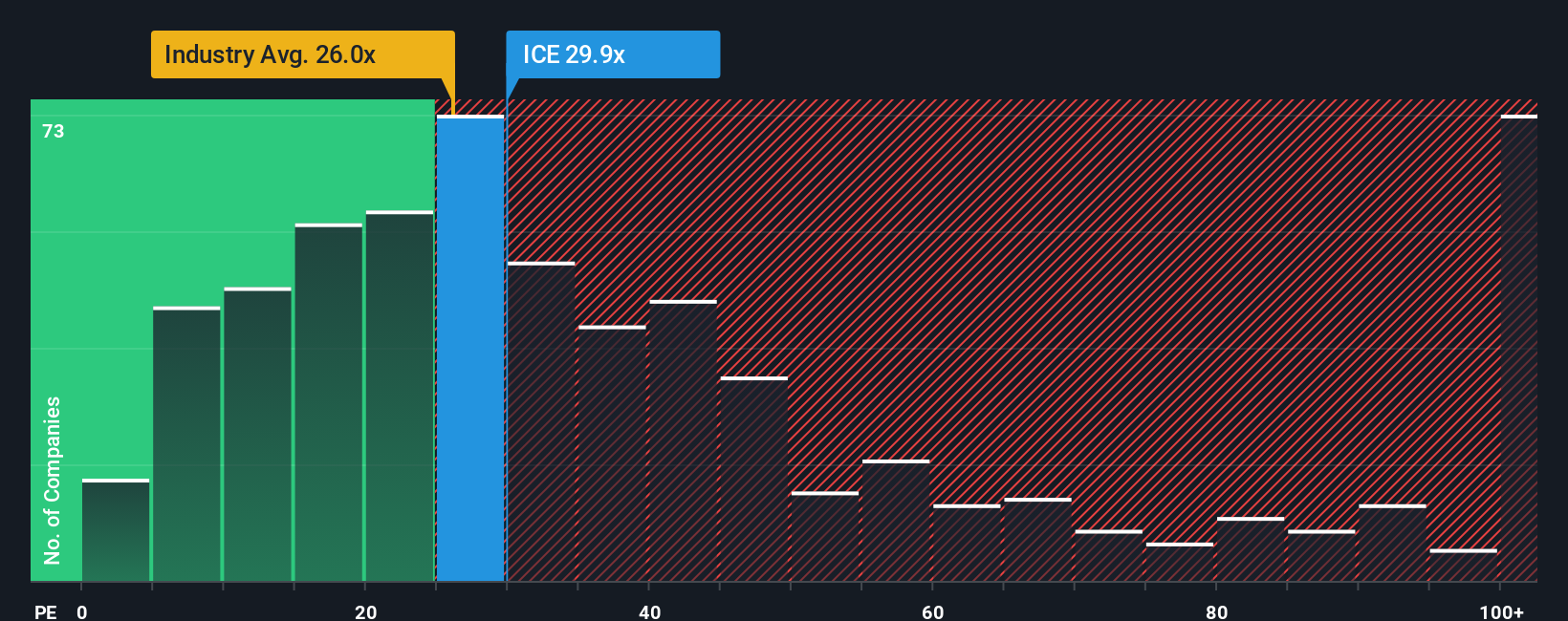

While the most popular narrative points to ICE being undervalued, looking at its current price-to-earnings ratio of 30 times earnings paints a more complicated picture. This is below the average for its peers (33.6x), but still significantly higher than the fair ratio of 18.8x our analysis suggests the market could shift toward. If peers rerate or the industry cools, does ICE have room to fall further, or will growth cushion the risk?

See what the numbers say about this price — find out in our valuation breakdown.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Intercontinental Exchange for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Intercontinental Exchange Narrative

If you think there’s more to ICE’s story or want to dive into the numbers yourself, you can shape your own perspective in just a few minutes. Do it your way.

A great starting point for your Intercontinental Exchange research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Don’t wait on the sidelines while others seize opportunities. Take charge of your investing journey and catch what’s next; these strategies could give your portfolio an edge.

- Hunt for strong yields and steady income by checking out these 21 dividend stocks with yields > 3% with payouts above market averages and solid fundamentals.

- Jump on exciting tech themes and find leaders shaping tomorrow’s world by browsing these 26 AI penny stocks thriving at the intersection of innovation and AI.

- Boost your returns by targeting quality businesses trading below their true worth, using these 871 undervalued stocks based on cash flows to spot hidden market gems.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ICE

Intercontinental Exchange

Provides technology and data to financial institutions, corporations, and government entities in the United States, the United Kingdom, the European Union, India, Israel, Canada, and Singapore.

Solid track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives