- United States

- /

- Diversified Financial

- /

- NYSE:HASI

Assessing HA Sustainable Infrastructure Capital After Recent Clean Energy Investment News and Price Drop

Reviewed by Bailey Pemberton

- If you have ever wondered whether HA Sustainable Infrastructure Capital could offer real value for your portfolio, you are in the right place.

- The stock has seen its share of ups and downs recently, dropping 4.2% over the last week and 12.1% for the past month. It is up 2.1% year-to-date, which points to both volatility and potential.

- Recent headlines have focused on the company's ongoing investments in clean energy projects and partnerships with municipal agencies, which adds important context to these price changes. News of expanded infrastructure funding and initiatives to accelerate renewable energy adoption may be driving renewed interest and debate among investors.

- With a valuation score of 3 out of 6, according to our checks, there is a lot to unpack when it comes to how this company is priced. We are about to break down a few different approaches to valuation. Stay tuned for a perspective you probably will not want to miss at the end.

Approach 1: HA Sustainable Infrastructure Capital Excess Returns Analysis

The Excess Returns model is designed to estimate a company's intrinsic value by measuring the profit generated above its cost of equity. In other words, it evaluates how efficiently HA Sustainable Infrastructure Capital uses shareholder funds to drive sustainable earnings growth.

According to this approach, HA Sustainable Infrastructure Capital has a Book Value of $20.39 per share, and analysts expect the company to earn a stable EPS of $3.05 per share, based on weighted future Return on Equity estimates from seven analysts. The calculated Cost of Equity is $2.33 per share, leading to an Excess Return of $0.72 per share. On average, the firm maintains a robust Return on Equity of 13.47%. Forward-looking estimates also project a Stable Book Value of $22.62 per share, based on blended estimates from five analysts.

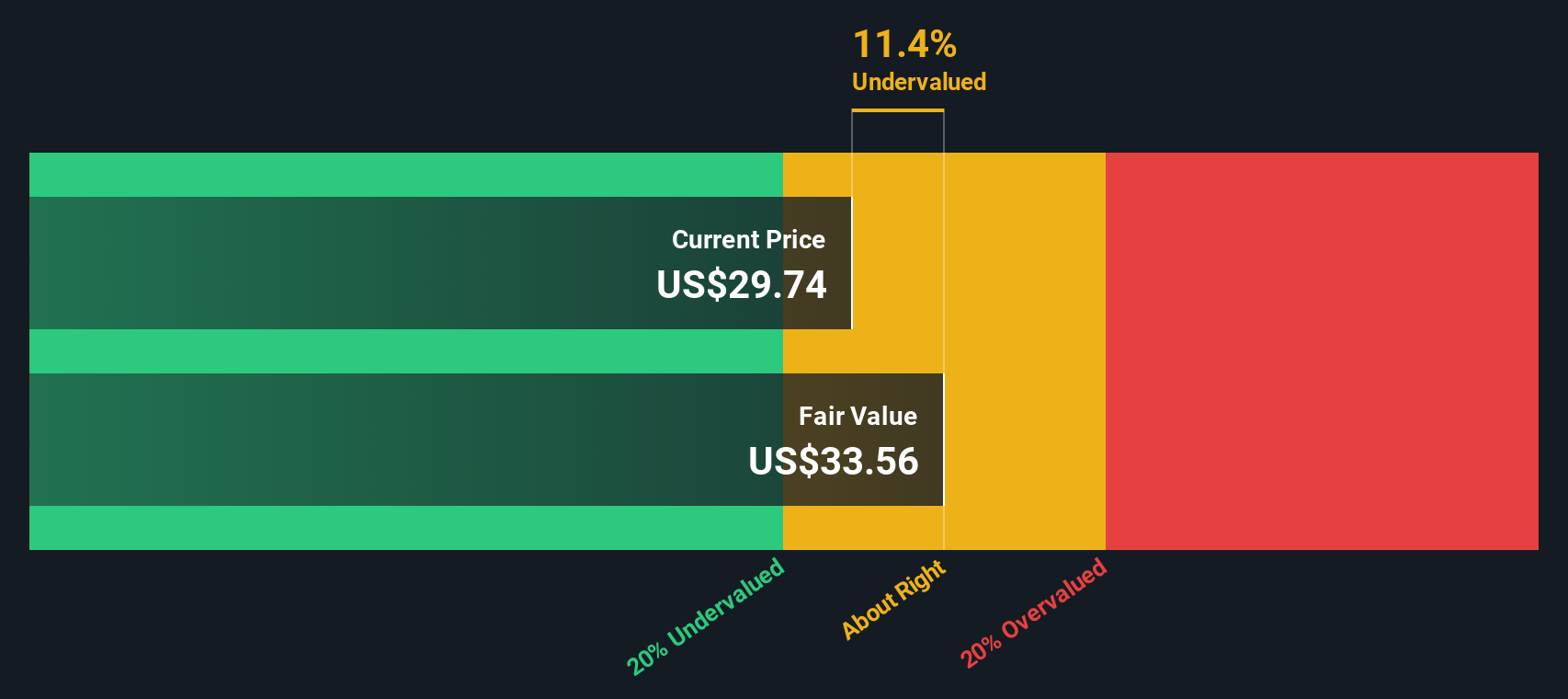

Using the Excess Returns framework, the model estimates an intrinsic value that is 14.9% above the current share price. This substantial discount suggests that the stock is undervalued at present and may offer attractive upside for investors who believe the company will sustain or improve its efficiency and growth trajectory.

Result: UNDERVALUED

Our Excess Returns analysis suggests HA Sustainable Infrastructure Capital is undervalued by 14.9%. Track this in your watchlist or portfolio, or discover 832 more undervalued stocks based on cash flows.

Approach 2: HA Sustainable Infrastructure Capital Price vs Earnings

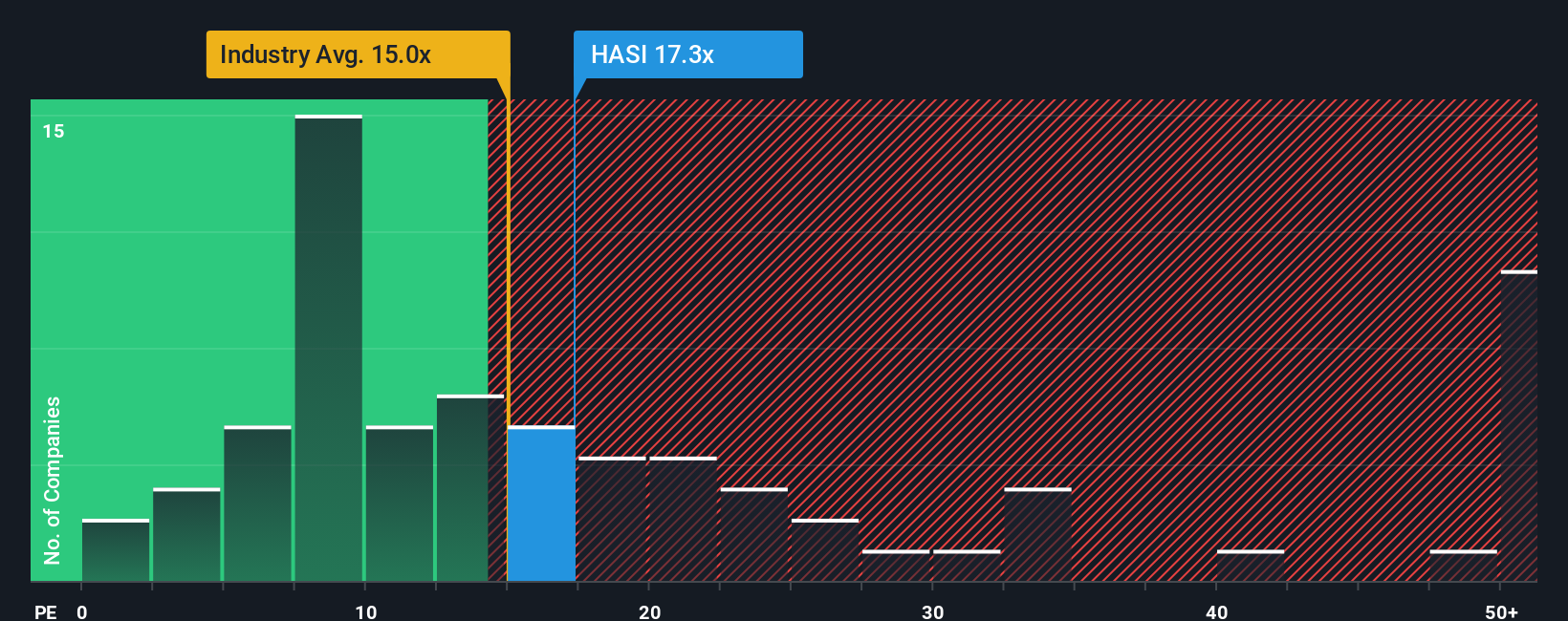

The Price-to-Earnings (PE) ratio is a go-to valuation metric for profitable companies because it directly ties the company’s market value to its earnings power. It answers a simple question: “How much are investors willing to pay for each dollar of earnings?” This makes it especially relevant for firms with consistent and predictable profits like HA Sustainable Infrastructure Capital.

In valuing companies through PE, it is important to remember that growth expectations and risk profiles have a big influence on what constitutes a “fair” PE ratio. Businesses with higher expected earnings growth or lower perceived risk typically command higher PE multiples, while riskier or slower-growing firms trade at lower valuations.

HA Sustainable Infrastructure Capital currently trades at a PE ratio of 16.85x. This sits slightly above the Diversified Financial industry average of 15.12x, but well below the peer average of 47.61x. To go a step further, Simply Wall St’s “Fair Ratio” metric, currently 14.91x, puts a fine point on this comparison. The Fair Ratio is designed as a proprietary measure that goes beyond simple peer or industry averages, factoring in earnings growth, risk, profit margins, company size, and more to produce a more nuanced target multiple for valuation.

With its PE ratio just 1.94x above the Fair Ratio, HA Sustainable Infrastructure Capital appears only modestly more expensive than what would be justified by its fundamentals and outlook. This difference is small enough to suggest the market is pricing the stock about right at these levels.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1410 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your HA Sustainable Infrastructure Capital Narrative

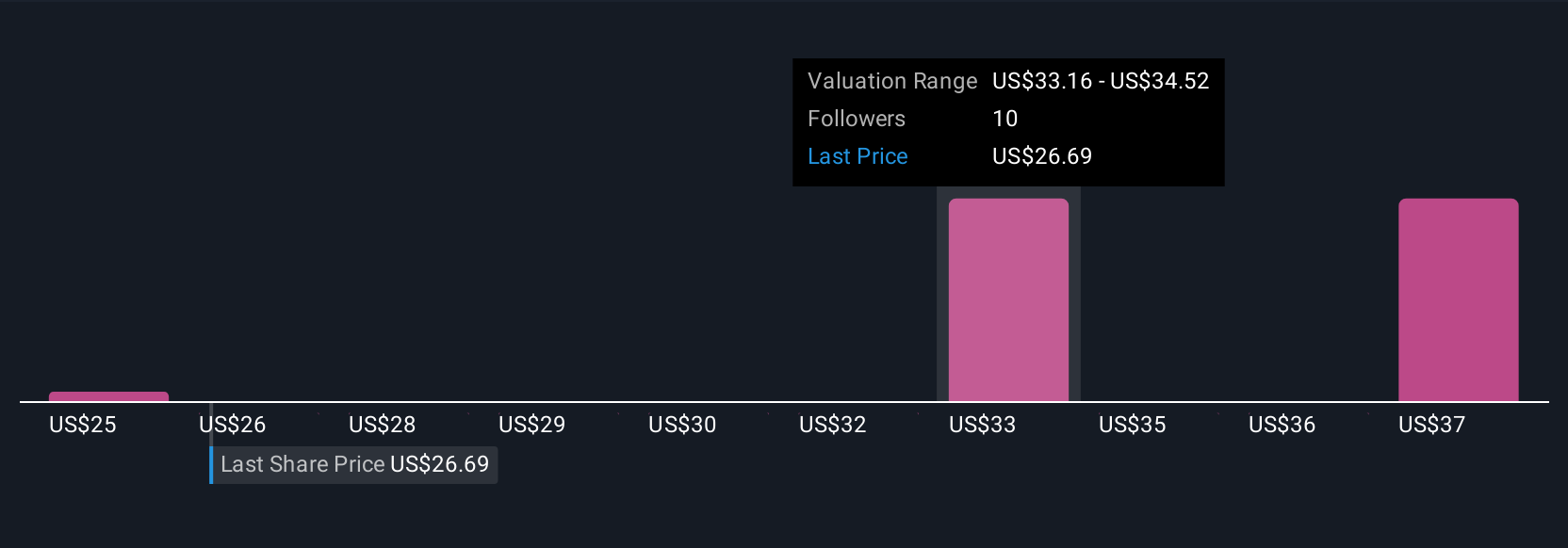

Earlier, we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. A Narrative is simply your take on a company’s story, your expectations for its future revenue, earnings, profit margins, and ultimately, its fair value. Instead of only focusing on numbers, Narratives help you connect the dots between your perspective on HA Sustainable Infrastructure Capital’s business, where it might be headed, and what you believe it is worth.

On Simply Wall St’s Community page, millions of investors use Narratives as an accessible, interactive tool. Narratives let you track your personal forecast, compare with other investors, and see how your fair value stacks up against the current price to help decide when to buy or sell. The best part is that Narratives update automatically when new events or earnings are reported, so your view stays relevant.

For example, some investors think HA Sustainable Infrastructure Capital is worth much more because of expected green energy growth, while others take a conservative view based on recent market volatility. However you see the company’s future, Narratives offer a flexible, smarter way to make confident investment decisions.

Do you think there's more to the story for HA Sustainable Infrastructure Capital? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if HA Sustainable Infrastructure Capital might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HASI

HA Sustainable Infrastructure Capital

Through its subsidiaries, engages in the investment in energy efficiency, renewable energy, and sustainable infrastructure markets in the United States.

Average dividend payer and fair value.

Similar Companies

Market Insights

Community Narratives