- United States

- /

- Diversified Financial

- /

- NYSE:GPN

The Bull Case For Global Payments (GPN) Could Change Following Uber Eats Integration With Genius POS System

Reviewed by Sasha Jovanovic

- Global Payments announced it has partnered with Uber Eats to make Uber Eats the preferred delivery partner integrated into its Genius POS system for restaurants in the U.S. and Canada, aiming to simplify onboarding and streamline delivery operations, while also unveiling new hardware and client wins such as 7 Brew Drive-Thru Coffee.

- This marks a shift toward more seamless restaurant technology, as Global Payments introduces the industry's first modular countertop POS device and deepens innovation within its Genius platform to support diverse merchant needs.

- We'll examine how the integration of Uber Eats with Genius POS may influence Global Payments' long-term competitive positioning and recurring revenue opportunities.

Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

Global Payments Investment Narrative Recap

To be a shareholder in Global Payments, one generally needs to believe that its investments in payment technology, like deepening POS platform integration, will allow it to capture a growing share of digital transaction volumes, offsetting risks from competitive pricing pressure and evolving merchant preferences. The latest Uber Eats integration streamlines delivery for restaurants, aligning with the critical catalyst of driving more recurring SaaS-like revenue, but does not materially address ongoing threats from new decentralized payment alternatives or profit margin compression.

Among the recent announcements, the launch of Genius POS’s modular countertop device stands out as directly relevant. This hardware rollout expands the value proposition of Genius POS, aiming to attract a broader merchant base and accelerate cross-selling, directly supporting Global Payments’ biggest near-term catalyst, integrated payment volumes and margin expansion through product bundling.

Yet, in contrast to these growth opportunities, investors should pay close attention to how increasing competition from fintechs and embedded payment solutions could...

Read the full narrative on Global Payments (it's free!)

Global Payments is projected to reach $12.3 billion in revenue and $1.7 billion in earnings by 2028. This outlook assumes a 7.0% annual revenue growth rate and a $0.2 billion increase in earnings from the current $1.5 billion.

Uncover how Global Payments' forecasts yield a $104.36 fair value, a 42% upside to its current price.

Exploring Other Perspectives

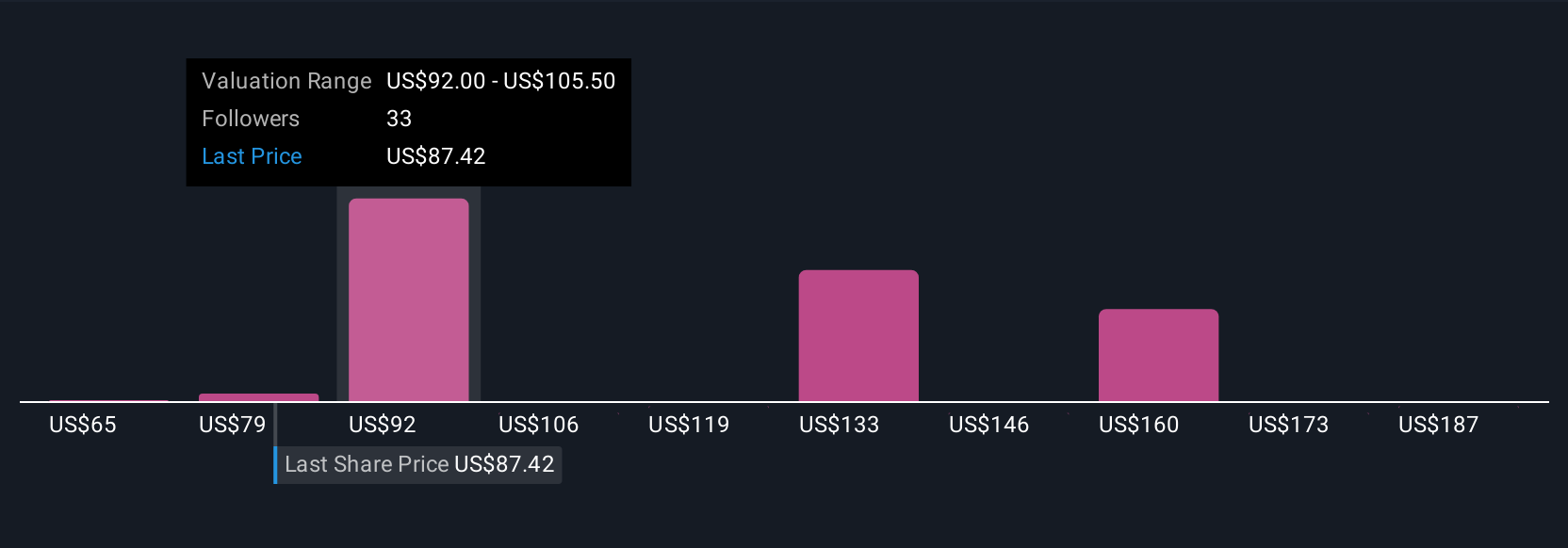

Private investors in the Simply Wall St Community have posted 11 fair value targets for Global Payments, ranging widely from US$65 to US$200 per share. While many see a sizable gap to current market value, keep in mind that compressing industry fees and shifting merchant behaviors could shape returns differently than some expect, so it pays to examine a mix of opinions.

Explore 11 other fair value estimates on Global Payments - why the stock might be worth over 2x more than the current price!

Build Your Own Global Payments Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Global Payments research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Global Payments research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Global Payments' overall financial health at a glance.

Searching For A Fresh Perspective?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 36 best rare earth metal stocks of the very few that mine this essential strategic resource.

- We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GPN

Global Payments

Provides payment technology and software solutions for card, check, and digital-based payments in the Americas, Europe, and the Asia-Pacific.

Undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives