- United States

- /

- Diversified Financial

- /

- NYSE:FOUR

Shift4 Payments (FOUR): Evaluating Valuation After Securing Major Sports and Entertainment Partnership Wins

Reviewed by Simply Wall St

Shift4 Payments (NYSE:FOUR) has landed multi-year deals to serve as the exclusive payment technology partner for Liberty Sports Group and Front Row Hospitality. The company will also power payment operations for the Ottawa Senators’ arena. These partnerships are boosting the company’s presence in major sports and entertainment venues, drawing strong investor interest.

See our latest analysis for Shift4 Payments.

Shares of Shift4 Payments have shown signs of renewed optimism, climbing 5.6% in the past month as new stadium and arena partnerships grab attention. Even though the stock has faced a tough year with a -32.7% year-to-date share price return and a -36.1% total shareholder return over twelve months, its three-year total shareholder return of over 63% reminds investors that momentum can shift quickly in this sector.

If recent sports industry wins have you looking for what else might be gathering steam, this is the perfect time to explore fast growing stocks with high insider ownership

With analyst price targets well above current levels and new partnerships signaling momentum, the question for investors is whether Shift4 remains undervalued after its recent pop, or if the market has already priced in the growth ahead.

Most Popular Narrative: 23.9% Undervalued

Compared to its last close of $72.95, Shift4 Payments is seen as having significant upside by the most popular narrative, which estimates fair value well above the current stock price. The foundation of this view is rooted in the company’s expansion momentum and recurring revenue growth, setting the tone for further debate.

The cross-sell opportunity across the combined customer bases of newly acquired companies (for example, bringing Shift4's payment products into Global Blue's luxury retail clients, or introducing Global Blue's DCC product to Shift4 hotels and restaurants) creates a substantial embedded pipeline for incremental revenue and sustained organic growth over multiple years.

Want to dig into the growth engine driving this big value gap? The narrative is betting on integration synergies and cross-selling innovation. There is a bold financial story behind the scenes. Which future assumptions help justify a price far above today’s market? Read on to see how the most widely followed analysis connects Shift4’s expansion strategy to a striking valuation call.

Result: Fair Value of $95.90 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, there are real risks, including integration challenges from recent acquisitions and increasing competition in international markets, that could disrupt this growth story.

Find out about the key risks to this Shift4 Payments narrative.

Another View: High Price Tag by Traditional Metrics

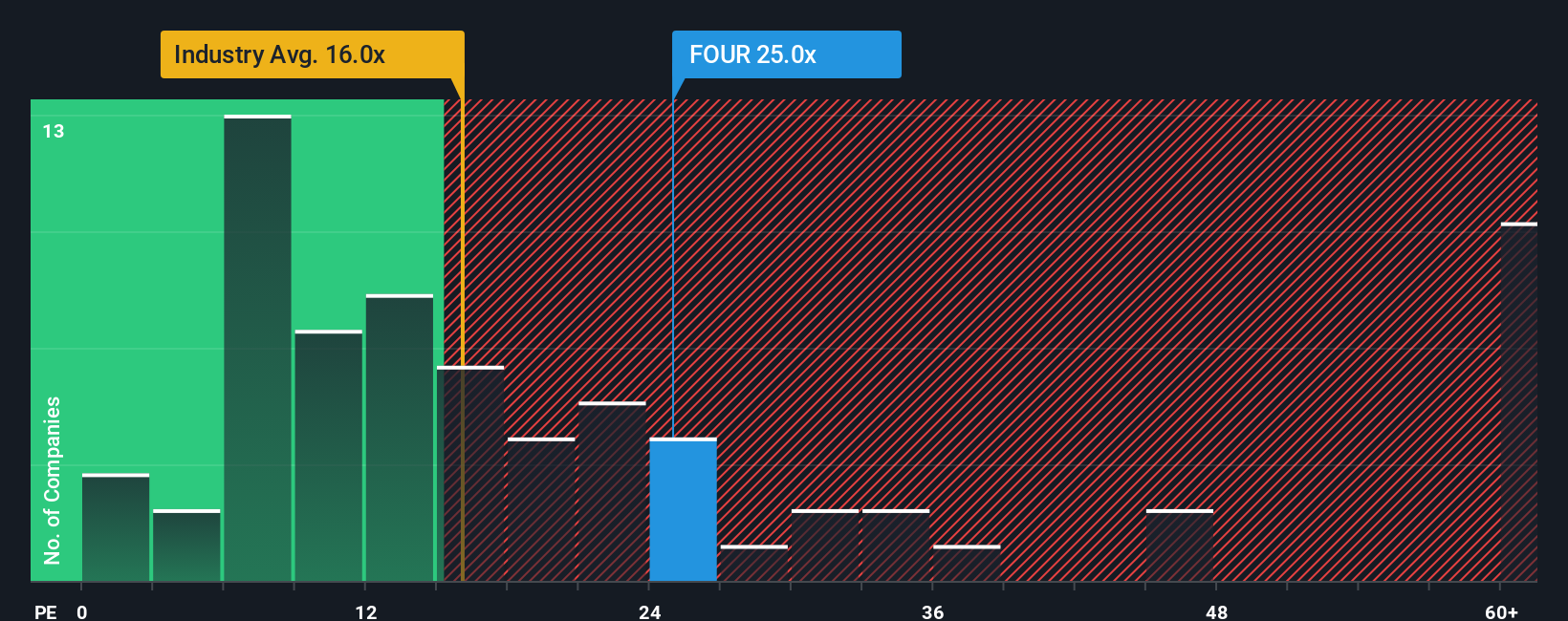

Looking from another angle, Shift4 Payments trades at a price-to-earnings ratio of 29.9x, which is more than double the US Diversified Financial industry average of 14x and above its fair ratio of 26.1x. This suggests the market is pricing in rapid growth, adding risk if expectations slip. Does this premium signal real potential or too much hype?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Shift4 Payments Narrative

If your perspective differs or you want to dive deeper into the numbers, crafting your own narrative is quick and easy. Do it your way

A great starting point for your Shift4 Payments research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Ready for Your Next Investment Breakthrough?

Take charge of your portfolio’s future by uncovering standout stocks you might have missed. Don’t let these fresh investment ideas pass you by.

- Boost your search for promising hidden gems by checking out these 928 undervalued stocks based on cash flows, which shows strong value based on cash flows.

- Lock in opportunities for steady income with these 14 dividend stocks with yields > 3%, featuring companies offering yields over 3%.

- Get ahead of digital trends by evaluating these 81 cryptocurrency and blockchain stocks, which is packed with trailblazers in cryptocurrency innovation and blockchain advancements.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FOUR

Shift4 Payments

Engages in the provision of software and payment processing solutions in the United States and internationally.

Exceptional growth potential with proven track record.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Not a Bubble, But the "Industrial Revolution 4.0" Engine

The "David vs. Goliath" AI Trade – Why Second Place is Worth Billions

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026