- United States

- /

- Diversified Financial

- /

- NYSE:FOUR

Is Shift4 Payments Still a Bargain After Expansion and Partnership News in 2025?

Reviewed by Bailey Pemberton

- Looking for clues on whether Shift4 Payments is a bargain or a bubble? You are not alone, and savvy investors know that value can hide in plain sight.

- The stock has seen a turbulent ride lately, with shares down 14.7% over the last month and dropping 39.4% year-to-date, despite an impressive 45.5% gain over three years.

- Recent headlines have focused on Shift4 Payments’ ambitious expansion plans and key partnership announcements, drawing renewed interest from investors and market-watchers. These updates have injected both excitement and fresh questions as to where the stock’s true value lies.

- On our valuation scorecard, Shift4 Payments clocks in at 3 out of 6. This means it is undervalued in half of our key checks, but the full story takes more than one metric. Let’s break down the methods and circle back at the end for an even deeper take on what drives its value.

Find out why Shift4 Payments's -40.0% return over the last year is lagging behind its peers.

Approach 1: Shift4 Payments Excess Returns Analysis

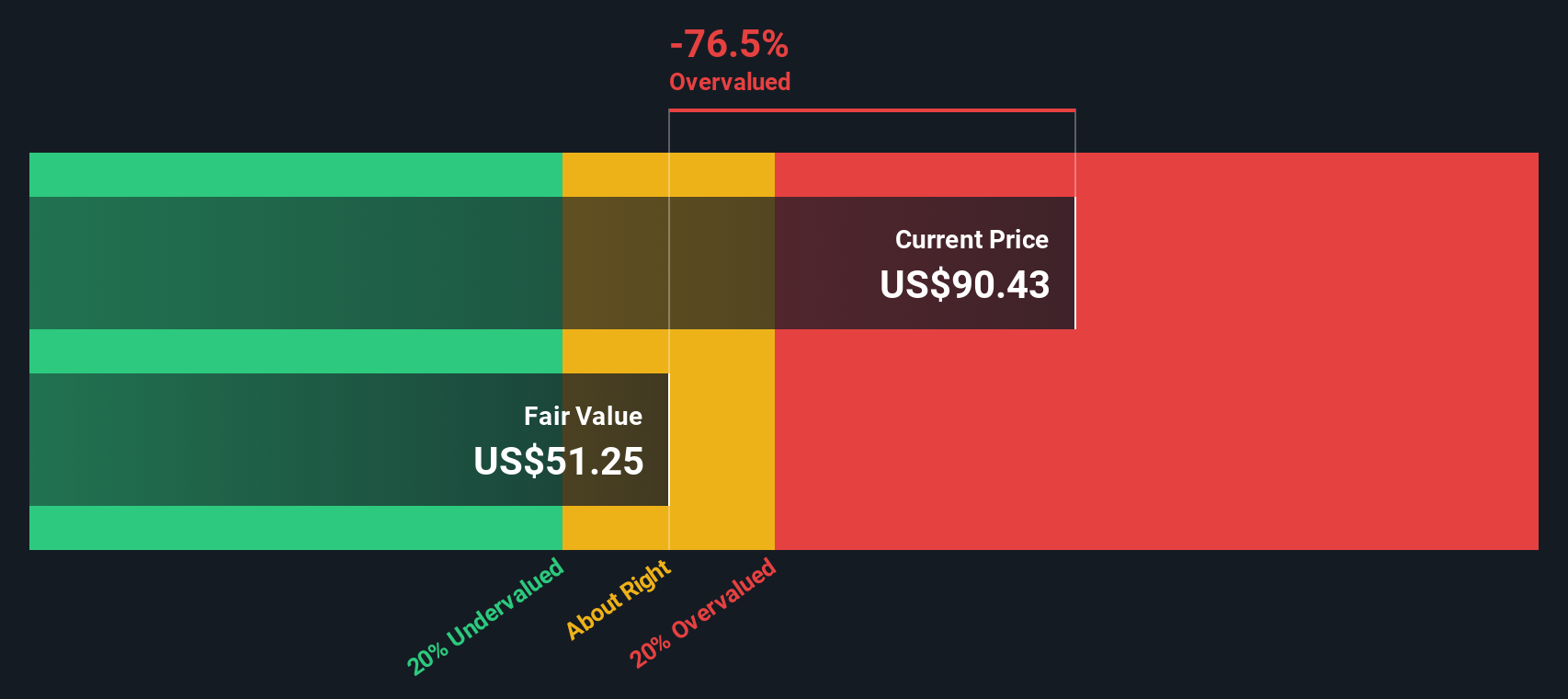

The Excess Returns valuation model looks at how much profit Shift4 Payments can generate above its cost of equity, focusing on the return on invested capital and the company’s growth in book value per share. This method takes into account not just earnings, but the efficiency with which the business reinvests capital for long-term value creation.

Shift4 Payments currently has a book value of $10.14 per share and a stable earnings per share estimate of $3.42, based on the median Return on Equity (ROE) from the past five years. The company’s cost of equity is calculated at $1.92 per share, resulting in an excess return of $1.49 per share. With an average ROE of 15.87%, Shift4 Payments is demonstrating the ability to earn substantially above its cost of capital. Future expectations are also positive, with analysts projecting a stable book value of $21.51 per share.

Despite these attractive efficiency metrics, the Excess Returns model estimates Shift4 Payments’ intrinsic value at $47.83 per share. Given the current market price, this suggests the stock is 37.1% overvalued.

Result: OVERVALUED

Our Excess Returns analysis suggests Shift4 Payments may be overvalued by 37.1%. Discover 919 undervalued stocks or create your own screener to find better value opportunities.

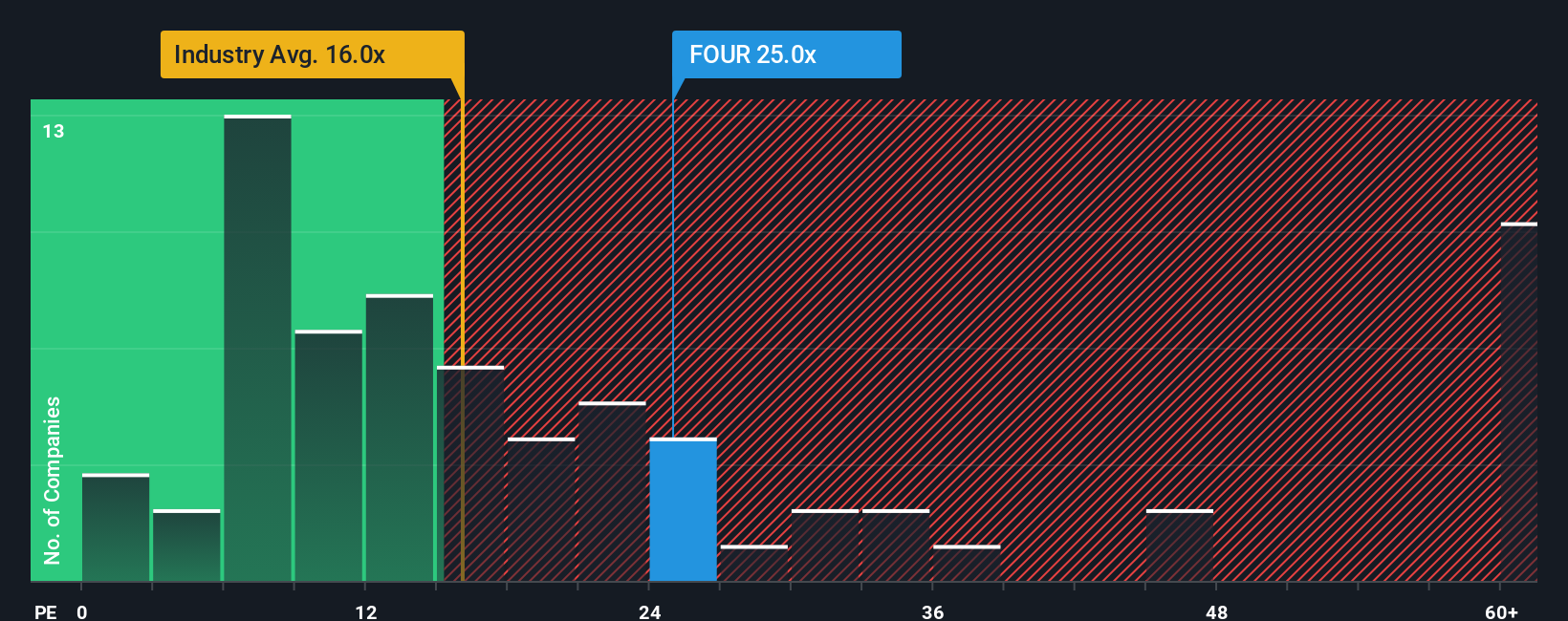

Approach 2: Shift4 Payments Price vs Earnings

The Price-to-Earnings (PE) ratio is one of the most widely used valuation tools for profitable companies like Shift4 Payments because it directly relates a company's share price to its earnings per share, providing a quick snapshot of investor expectations. This makes it especially suitable for businesses with positive, stable earnings streams.

Growth expectations and risk profiles both play significant roles in determining what constitutes a "normal" or "fair" PE ratio. Fast-growing companies often justify higher PE multiples, while those in more mature, low-growth sectors typically warrant lower ones. Company-specific risks or industry dynamics can also influence the appropriate level of the PE ratio.

Currently, Shift4 Payments trades at a PE ratio of 26.9x. This is about double the Diversified Financial industry average of 13.0x, but slightly below the average of close peers at 33.1x. Simply Wall St's proprietary Fair Ratio indicates Shift4's justified PE should be 27.4x, taking into account not just peer comparison, but also earnings growth, margins, specific market risks, and company size. This Fair Ratio offers a more comprehensive perspective than using only peer or industry averages, making it a particularly relevant benchmark for investors evaluating true value.

With Shift4’s current PE almost matching the Fair Ratio, the stock appears to be priced appropriately on this metric.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1422 companies where insiders are betting big on explosive growth.

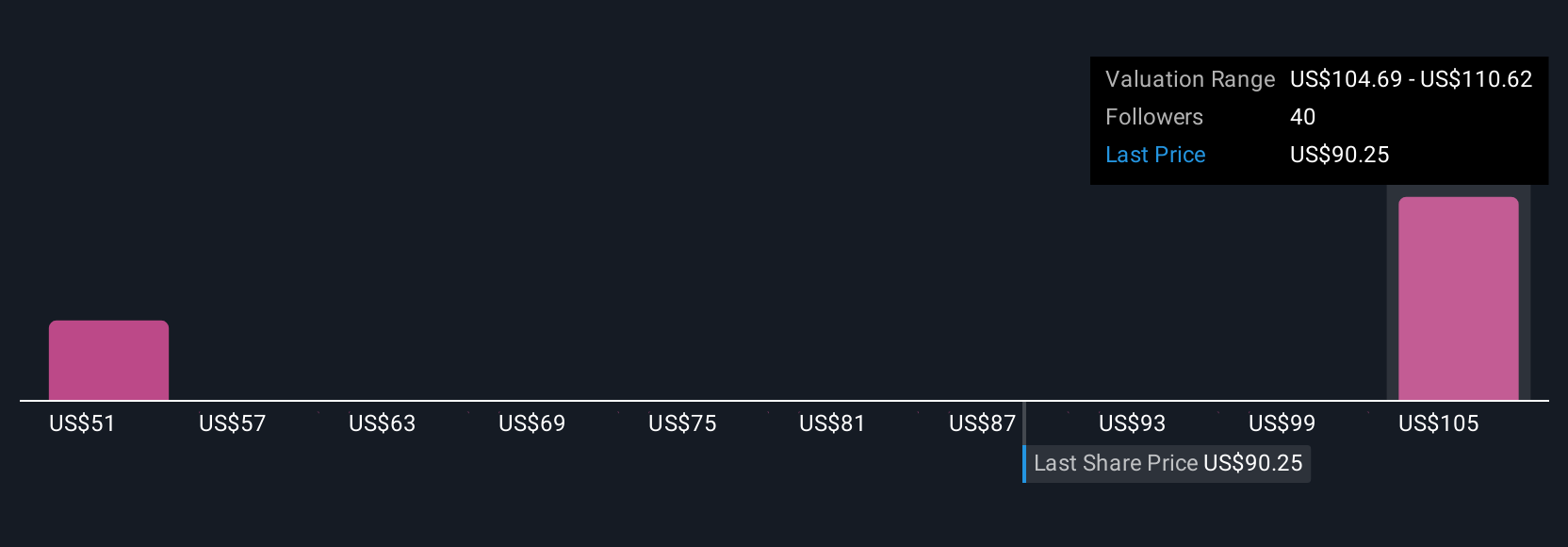

Upgrade Your Decision Making: Choose your Shift4 Payments Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is simply the story you believe about a company’s future, including your own expectations for its growth, earnings, and margins, all backed up by numbers. Narratives allow you to connect the company’s story to a personal financial forecast, and then to an estimated fair value, making sense of the big picture as well as the details.

On Simply Wall St, Narratives are a powerful yet approachable tool available within the Community page, trusted by millions of investors. They make it easy to decide whether to buy or sell by directly comparing your Fair Value to the current Price. Best of all, Narratives update dynamically as new news and earnings roll in, so your perspective always stays fresh.

For example, with Shift4 Payments, one investor might believe its international acquisitions and margin expansion will drive earnings up to $863 million, justifying a price target near $131, while another might focus on execution risks and see fair value closer to $88 based on lower earnings potential. Both perspectives are easily built and tracked right in your Narrative.

Do you think there's more to the story for Shift4 Payments? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FOUR

Shift4 Payments

Engages in the provision of software and payment processing solutions in the United States and internationally.

Exceptional growth potential with proven track record.

Similar Companies

Market Insights

Community Narratives