- United States

- /

- Diversified Financial

- /

- NYSE:FIS

How Investors May Respond To FIS (FIS) Q3 Earnings Beat and Launch of Asset Servicing Platform

Reviewed by Sasha Jovanovic

- Fidelity National Information Services recently announced third-quarter results exceeding expectations, driven by recurring revenue growth and margin expansion, alongside the launch of the FIS Asset Servicing Management Suite aimed at improving operational efficiency in asset servicing.

- This integrated platform seeks to address key industry pain points by automating critical asset servicing functions and minimizing data fragmentation, positioning FIS to support clients in streamlining operations.

- We'll explore how these strong earnings and the innovative asset servicing platform are shaping the company's current investment narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Fidelity National Information Services Investment Narrative Recap

To be a shareholder in Fidelity National Information Services, you need to believe in its ability to capitalize on growing demand for integrated, cloud-based fintech and asset servicing solutions, while maintaining competitive margins in the face of fintech disruptors and evolving client preferences. The recent launch of the FIS Asset Servicing Management Suite directly supports short-term growth catalysts by addressing operational complexity for clients, though it does not fully resolve integration risks associated with prior and pending acquisitions, which remains the primary business risk in the near term.

The company’s raised revenue growth guidance of 5.4% to 5.7% for 2025 is the most relevant recent announcement, as it reflects optimism following the successful rollout of new products and a strong third quarter. This guidance highlights management’s confidence in the underlying business momentum, especially as the company looks to reinforce its position with product innovation driven by new platform launches.

However, investors should be aware that even with this positive momentum, ongoing integration challenges from recent and legacy acquisitions, such as the pending credit Issuer Solutions acquisition, could...

Read the full narrative on Fidelity National Information Services (it's free!)

Fidelity National Information Services is projected to reach $11.7 billion in revenue and $2.4 billion in earnings by 2028. This outlook assumes annual revenue growth of 4.3% and a substantial earnings increase of $2.24 billion from the current $158.0 million.

Uncover how Fidelity National Information Services' forecasts yield a $83.25 fair value, a 29% upside to its current price.

Exploring Other Perspectives

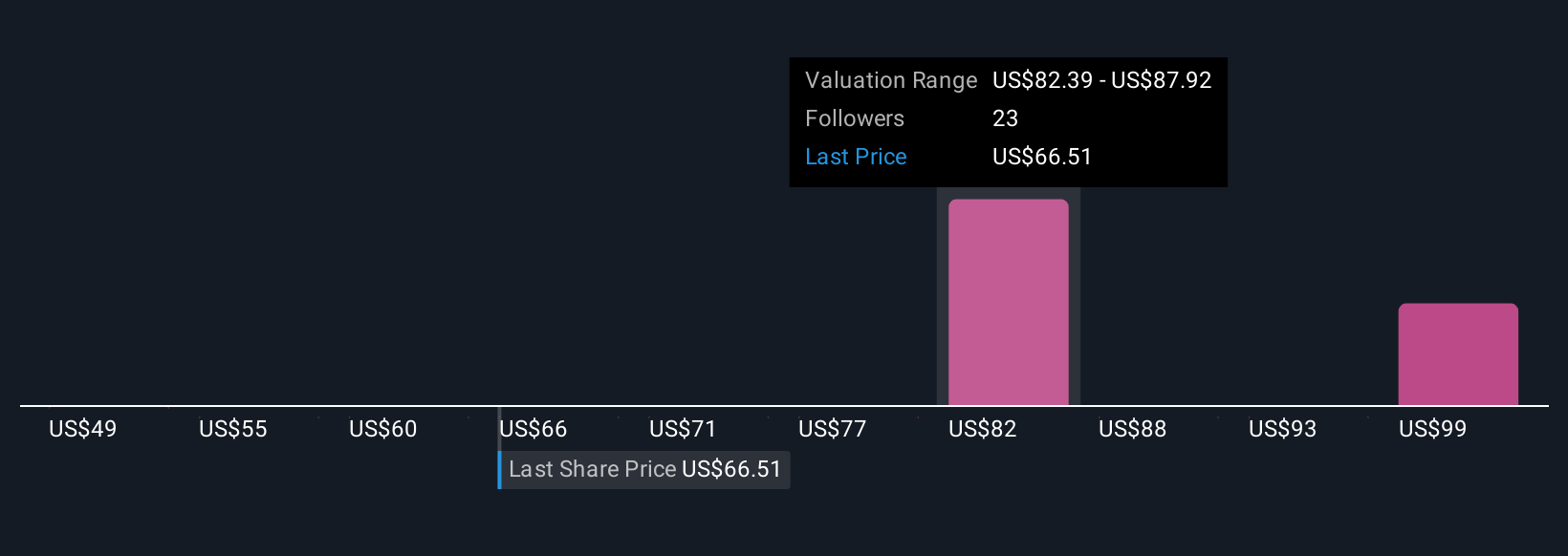

Fair value estimates from the Simply Wall St Community span from US$49.20 to US$117.13 across three perspectives, demonstrating wide variation on FIS’s future. Recurring revenue growth remains a crucial factor that can shape long-term performance, but your view may differ, explore other community viewpoints to see the range of potential outcomes.

Explore 3 other fair value estimates on Fidelity National Information Services - why the stock might be worth as much as 81% more than the current price!

Build Your Own Fidelity National Information Services Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Fidelity National Information Services research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

- Our free Fidelity National Information Services research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Fidelity National Information Services' overall financial health at a glance.

Ready For A Different Approach?

Our top stock finds are flying under the radar-for now. Get in early:

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 35 companies in the world exploring or producing it. Find the list for free.

- We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FIS

Fidelity National Information Services

Fidelity National Information Services, Inc.

Reasonable growth potential with slight risk.

Similar Companies

Market Insights

Community Narratives