- United States

- /

- Capital Markets

- /

- NYSE:FDS

Record Dividend and Earnings Could Be a Game Changer for FactSet Research Systems (FDS)

Reviewed by Sasha Jovanovic

- On November 6, 2025, FactSet Research Systems Inc. announced its Board of Directors approved a regular quarterly cash dividend of US$1.10 per share, payable on December 18, 2025, to shareholders of record as of November 28, 2025.

- The announcement comes as the company reported its best-ever fiscal fourth-quarter earnings and record new sales, emphasizing confidence in long-term opportunities despite industry concern around AI and ongoing CEO transition uncertainty.

- With record new sales underscoring FactSet’s earnings momentum, we’ll explore how this latest development could influence its investment narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

FactSet Research Systems Investment Narrative Recap

To own FactSet Research Systems, you need conviction in its durable position providing mission-critical data and analytics to financial clients, while accepting the risks of cost pressures and cyclical industry headwinds. The newly affirmed US$1.10 per share dividend aligns with the company’s messaging around confidence and long-term value, but it does not materially shift the biggest immediate catalyst, impactful adoption of GenAI tools in core workflows, or the primary risk from rising technology costs outpacing revenue benefits.

The most relevant recent announcement is FactSet’s record-setting fourth-quarter results, which paired with ongoing product innovation and partnerships, helped secure robust new client wins. This momentum supports optimism around near-term product-led growth, though it exists alongside persistent concerns about increased technology investments and evolving sector client budgets.

Yet, investors should be aware that in contrast to the strong dividend signals, FactSet’s rising technology expenses could...

Read the full narrative on FactSet Research Systems (it's free!)

FactSet Research Systems' narrative projects $2.7 billion revenue and $730.7 million earnings by 2028. This requires 5.7% yearly revenue growth and a $197.8 million earnings increase from $532.9 million today.

Uncover how FactSet Research Systems' forecasts yield a $337.81 fair value, a 29% upside to its current price.

Exploring Other Perspectives

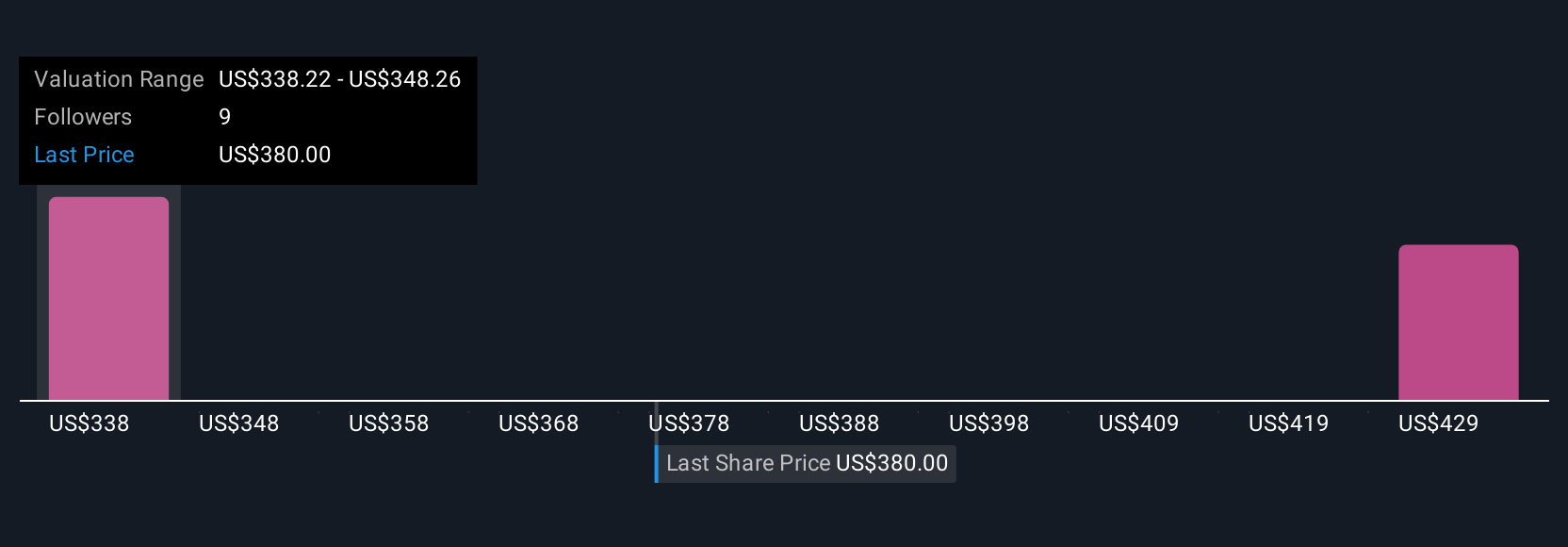

Three individual members of the Simply Wall St Community estimate FactSet shares are worth between US$276.99 and US$337.81. While product innovation could support long-term adoption, the wide valuation range reminds you that views on the company’s future can differ considerably, see what other investors project before deciding how to proceed.

Explore 3 other fair value estimates on FactSet Research Systems - why the stock might be worth as much as 29% more than the current price!

Build Your Own FactSet Research Systems Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your FactSet Research Systems research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

- Our free FactSet Research Systems research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate FactSet Research Systems' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 35 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FDS

FactSet Research Systems

Operates as a financial digital platform and enterprise solutions provider for the investment community.

Undervalued with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives