- United States

- /

- Diversified Financial

- /

- NYSE:EQH

Equitable Holdings (EQH) Profit Margin Falls to 3.1%, Challenging Bullish Growth Narratives

Reviewed by Simply Wall St

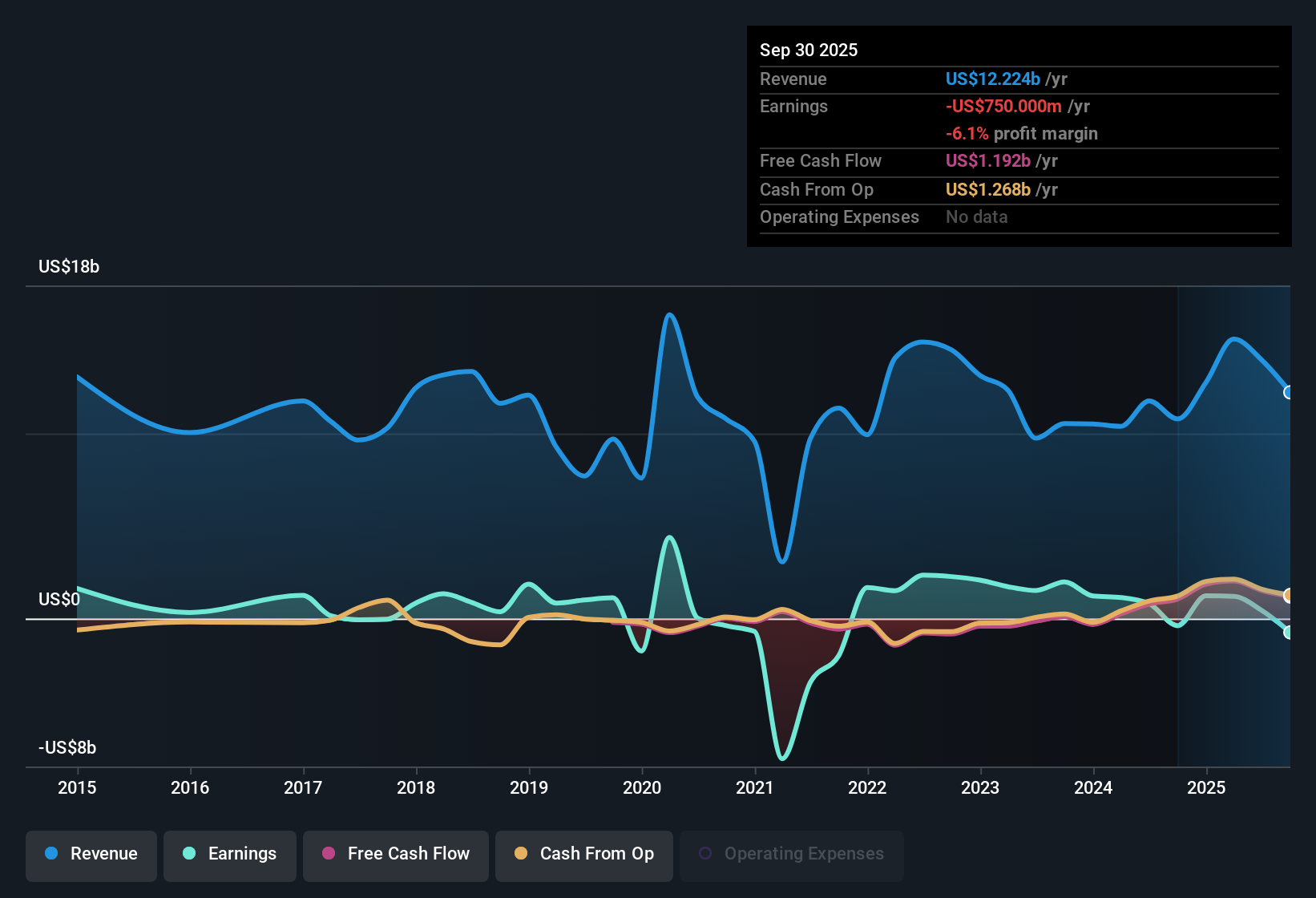

Equitable Holdings (EQH) reported a net profit margin of 3.1%, down from last year's 7%, as the company experienced a year-over-year decline in earnings. Over the past five years, however, earnings have averaged robust 40.4% annual growth. Analysts now forecast an even stronger 48.5% growth per year going forward, far outpacing the broader US market. With the current share price of $45.22, which is below both the estimated fair value of $108.21 and consensus price targets, investors are weighing the risks of margin pressure against the company's projected growth story.

See our full analysis for Equitable Holdings.The next section puts these headline figures in context, comparing them with the narratives that most investors are watching and debating right now.

See what the community is saying about Equitable Holdings

Margin Pressure Limits Upside Despite Return to Growth

- Analysts estimate that Equitable Holdings' profit margin, currently at 3.1%, will potentially rebound to 12.5% over the next three years.

- According to the analysts' consensus view, the margin recovery is expected to be driven by demographic shifts that keep organic demand high, with record $1.1 trillion assets under management and robust 12% growth in advisory services.

- Strategic partnerships with large asset managers and new product innovation are highlighted as ways Equitable can capture premium pricing and improve long-term profitability.

- However, competitive threats and a shift toward lower-return products may offset some of these gains and challenge the pace at which margins can expand.

- The gap between current and projected margins underlines the mixed outlook. While a climb above 12% would validate optimism, the path is not guaranteed according to the consensus narrative.

- Regulatory shifts and competition are expected to test whether operational efficiencies and digital expansion truly deliver improved margins at scale.

- Recent margin weakness sets a low base, but the growth trajectory relies on successfully navigating major changes to product mix and pricing power over the next few years.

- Investors following the consensus narrative will watch closely to see if Equitable’s expense control and capital redeployment can outpace sector-wide headwinds for margins.

Premium Valuation Despite Discount to Fair Value

- Equitable Holdings is trading at a Price-to-Earnings ratio of 30.5x, well above the industry (15x) and peer (15.1x) averages, while its $45.22 share price remains notably below both the DCF fair value of $108.21 and the consensus analyst target of $65.08.

- The analysts' consensus view acknowledges this apparent discount to fair value and targets even as EQH’s premium P/E signals strong embedded growth expectations.

- The valuation tension creates a test for the consensus: either significant earnings acceleration will need to materialize to justify the high multiple, or the market may be overly optimistic compared to historical performance and sector norms.

- Bulls cite the ongoing capital redeployment and share buybacks as levers for higher return on equity, but skeptics point out that unless analyst forecasted earnings of $2.3 billion are hit by 2028, the current multiple could be hard to sustain.

Asset Growth Fueled by Retirement Demand

- Assets under management reached a record $1.1 trillion, up 8% year over year, reflecting sustained organic demand for annuity and retirement solutions.

- As outlined in the analysts' consensus view, demographic trends, especially the aging US population and the ongoing shift from defined benefit to defined contribution plans, are expected to keep fueling net asset inflows and recurring fee-based revenue.

- Expansion of third-party and affiliated distribution channels, along with digitization, is expected to lower client acquisition costs and drive scalable asset and revenue growth.

- The consensus view acknowledges that although these trends support long-term growth, asset management outflows and market pressures could moderate the pace depending on industry competition.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Equitable Holdings on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Want to interpret these figures another way? Shape your perspective into a personal narrative in just a few minutes with Do it your way.

A great starting point for your Equitable Holdings research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

See What Else Is Out There

Despite Equitable Holdings’ growth prospects, margin pressures, a premium valuation, and uncertainty about future earnings raise concerns about whether profits can consistently catch up to expectations.

If you want stocks where the market price better matches financial realities, compare with these 836 undervalued stocks based on cash flows to find other companies trading at more attractive discounts right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Equitable Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:EQH

Equitable Holdings

Together with its consolidated subsidiaries, operates as a diversified financial services company worldwide.

Reasonable growth potential and fair value.

Similar Companies

Market Insights

Community Narratives