- United States

- /

- Capital Markets

- /

- NYSE:DFIN

The Market Doesn't Like What It Sees From Donnelley Financial Solutions, Inc.'s (NYSE:DFIN) Earnings Yet As Shares Tumble 28%

Donnelley Financial Solutions, Inc. (NYSE:DFIN) shareholders won't be pleased to see that the share price has had a very rough month, dropping 28% and undoing the prior period's positive performance. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 24% in that time.

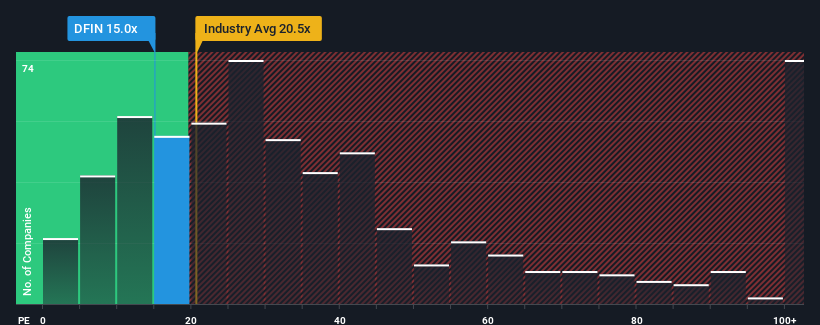

Since its price has dipped substantially, Donnelley Financial Solutions may be sending bullish signals at the moment with its price-to-earnings (or "P/E") ratio of 15x, since almost half of all companies in the United States have P/E ratios greater than 19x and even P/E's higher than 33x are not unusual. However, the P/E might be low for a reason and it requires further investigation to determine if it's justified.

Recent times have been advantageous for Donnelley Financial Solutions as its earnings have been rising faster than most other companies. It might be that many expect the strong earnings performance to degrade substantially, which has repressed the P/E. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Check out our latest analysis for Donnelley Financial Solutions

Does Growth Match The Low P/E?

There's an inherent assumption that a company should underperform the market for P/E ratios like Donnelley Financial Solutions' to be considered reasonable.

Retrospectively, the last year delivered a decent 13% gain to the company's bottom line. Still, lamentably EPS has fallen 26% in aggregate from three years ago, which is disappointing. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

Shifting to the future, estimates from the three analysts covering the company suggest earnings should grow by 1.9% over the next year. That's shaping up to be materially lower than the 14% growth forecast for the broader market.

With this information, we can see why Donnelley Financial Solutions is trading at a P/E lower than the market. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

The Final Word

Donnelley Financial Solutions' recently weak share price has pulled its P/E below most other companies. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As we suspected, our examination of Donnelley Financial Solutions' analyst forecasts revealed that its inferior earnings outlook is contributing to its low P/E. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. It's hard to see the share price rising strongly in the near future under these circumstances.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 1 warning sign with Donnelley Financial Solutions, and understanding should be part of your investment process.

If you're unsure about the strength of Donnelley Financial Solutions' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:DFIN

Donnelley Financial Solutions

Provides innovative software and technology-enabled financial regulatory and compliance solutions in the United States, Asia, Europe, Canada, and internationally.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives