- United States

- /

- Capital Markets

- /

- NYSE:DFIN

Some Confidence Is Lacking In Donnelley Financial Solutions, Inc.'s (NYSE:DFIN) P/E

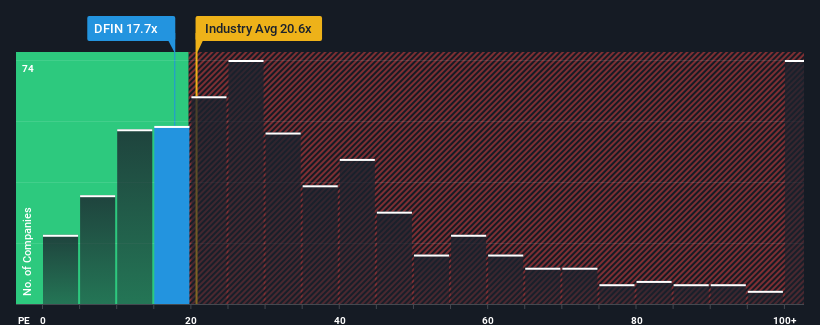

It's not a stretch to say that Donnelley Financial Solutions, Inc.'s (NYSE:DFIN) price-to-earnings (or "P/E") ratio of 17.7x right now seems quite "middle-of-the-road" compared to the market in the United States, where the median P/E ratio is around 17x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/E.

With its earnings growth in positive territory compared to the declining earnings of most other companies, Donnelley Financial Solutions has been doing quite well of late. One possibility is that the P/E is moderate because investors think the company's earnings will be less resilient moving forward. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

View our latest analysis for Donnelley Financial Solutions

How Is Donnelley Financial Solutions' Growth Trending?

In order to justify its P/E ratio, Donnelley Financial Solutions would need to produce growth that's similar to the market.

Retrospectively, the last year delivered an exceptional 27% gain to the company's bottom line. The latest three year period has also seen an excellent 149% overall rise in EPS, aided by its short-term performance. Accordingly, shareholders would have probably welcomed those medium-term rates of earnings growth.

Looking ahead now, EPS is anticipated to climb by 2.2% per year during the coming three years according to the four analysts following the company. With the market predicted to deliver 10% growth each year, the company is positioned for a weaker earnings result.

In light of this, it's curious that Donnelley Financial Solutions' P/E sits in line with the majority of other companies. Apparently many investors in the company are less bearish than analysts indicate and aren't willing to let go of their stock right now. Maintaining these prices will be difficult to achieve as this level of earnings growth is likely to weigh down the shares eventually.

The Bottom Line On Donnelley Financial Solutions' P/E

We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our examination of Donnelley Financial Solutions' analyst forecasts revealed that its inferior earnings outlook isn't impacting its P/E as much as we would have predicted. Right now we are uncomfortable with the P/E as the predicted future earnings aren't likely to support a more positive sentiment for long. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

Before you take the next step, you should know about the 1 warning sign for Donnelley Financial Solutions that we have uncovered.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:DFIN

Donnelley Financial Solutions

Provides innovative software and technology-enabled financial regulatory and compliance solutions in the United States, Asia, Europe, Canada, and internationally.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives