- United States

- /

- Capital Markets

- /

- NYSE:DFIN

Donnelley Financial Solutions (DFIN): Margin Drops to 4.3% on $80.7M One-Off Loss, Pressures Bull Case

Reviewed by Simply Wall St

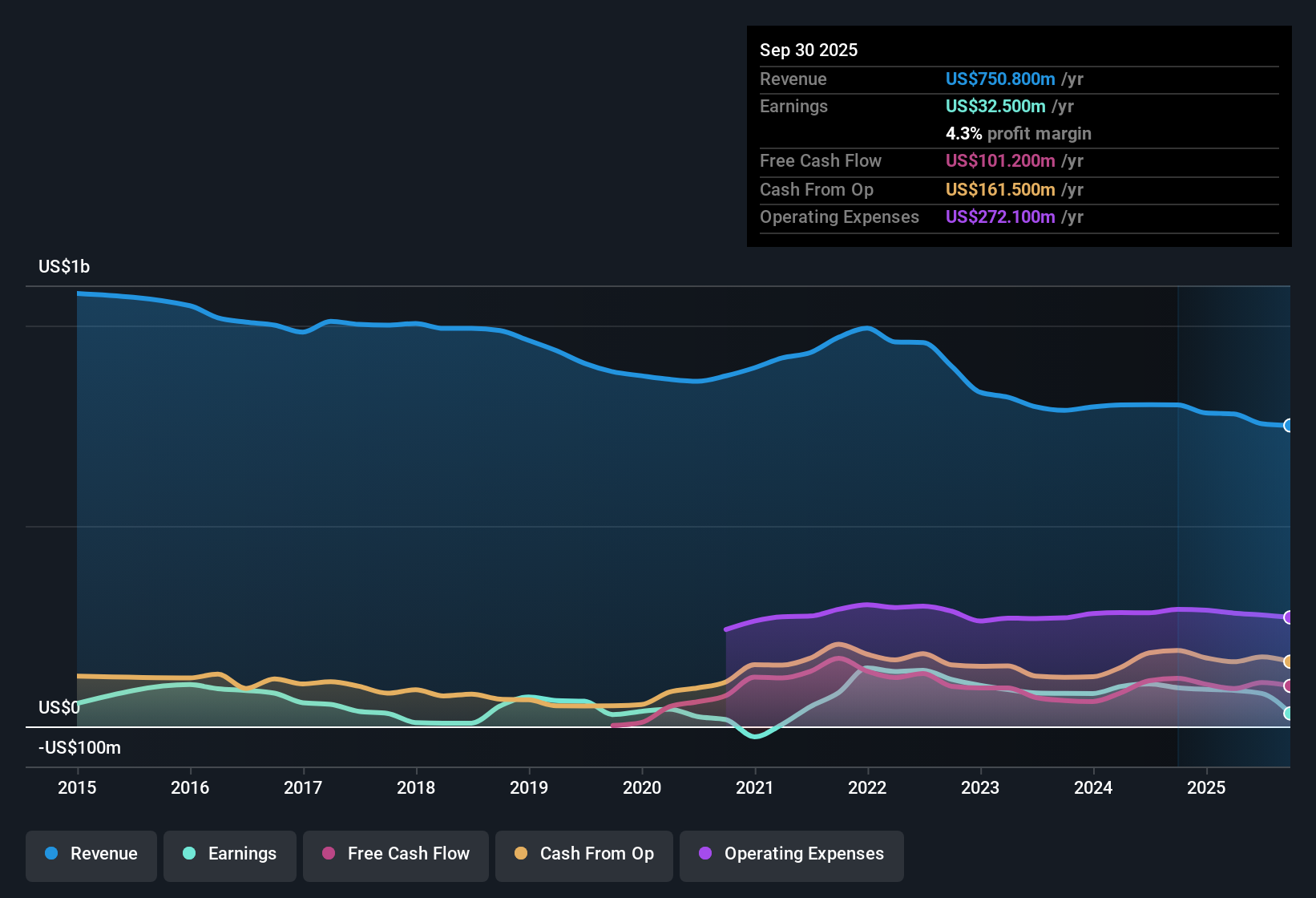

Donnelley Financial Solutions (DFIN) reported a net profit margin of 4.3%, significantly lower than last year's 12.1%. Recent results were affected by an $80.7 million one-off loss through September 2025. Despite near-term margin pressure, earnings have grown at a 9.7% annual rate over the past five years and are projected to accelerate sharply, with analyst forecasts calling for 62.2% yearly growth going forward, well ahead of the broader US market. Investors are keeping a close eye on the balance between strong long-term growth prospects and the impact of recent profitability headwinds.

See our full analysis for Donnelley Financial Solutions.Next, we will see how these headline numbers compare with the most common narratives about Donnelley Financial Solutions, highlighting both points of agreement and areas where they may challenge popular opinion.

See what the community is saying about Donnelley Financial Solutions

Recurring Software Revenue Powers Profitability Shift

- Recurring software solutions revenue, supported by digitalization and regulatory drivers, is expected to grow and lift net margins from 10.9% now to 15.4% within 3 years.

- Analysts' consensus view points to operational gains as digital products steadily replace legacy print. This is fueling more stable cash flows and greater earnings resilience.

- The drive toward higher-margin software, backed by new compliance rules like TSR, supports both margin expansion and an improved cash flow outlook. This contrasts with the historical erosion tied to print.

- Strategic automation initiatives should further boost operating leverage, helping Donnelley Financial Solutions withstand softness in lower-margin segments.

- What’s surprising is analysts expect outstanding shares to shrink by 4.72% per year, adding a tailwind to future EPS even if revenue growth remains muted.

Large Non-Recurring Loss Clouds Margin Story

- An $80.7 million one-off expense, set to impact results through September 2025, has driven the latest net margin down to 4.3% from 12.1% last year.

- Consensus narrative cautions that DFIN’s profit quality depends on whether margin hits are truly one-off or if persistent print decline and slower software growth erode future profitability.

- If secular print declines accelerate or lagging transactional revenues do not recover, structural margin pressures could outweigh benefits from automation and software migration.

- Progress toward margin rebound hinges not just on shedding legacy costs but also on sustained software sales momentum in a competitive SaaS market.

Premium Valuation Despite Recent Headwinds

- With a share price of $45.66, Donnelley Financial Solutions trades above its DCF fair value of $50.69 and at a price-to-earnings ratio of 18.7x, which is higher than both its peer set and the US capital markets industry average of 26.7x.

- According to the consensus narrative, the current share price and a price target of $64.33 create a valuation gap that relies on confidence that profit margins will rebound and automation will generate outsized gains.

- The forward PE ratio implied by 2028 estimates is 16.2x, which is lower than today’s and below the industry average. If margin expansion falls short of expectations, the upside case weakens.

- Market optimism about upside may be sensitive to slow revenue growth of 3.3% per year and ongoing competitive SaaS threats.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Donnelley Financial Solutions on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a unique take on these figures? Share your viewpoint and craft your personal narrative in under three minutes with Do it your way.

A great starting point for your Donnelley Financial Solutions research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

See What Else Is Out There

Donnelley Financial Solutions faces questions about sustaining margin rebound and steady earnings in light of one-off losses, slow revenue growth, and competitive pressures.

If reliable growth and earnings resilience matter most to you, use our stable growth stocks screener (2113 results) to compare companies delivering consistent performance even when volatility strikes.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DFIN

Donnelley Financial Solutions

Provides innovative software and technology-enabled financial regulatory and compliance solutions in the United States, Asia, Europe, Canada, and internationally.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives