- United States

- /

- Capital Markets

- /

- NYSE:DFIN

Donnelley Financial Solutions (DFIN): Evaluating Valuation Following the Launch of Active Intelligence AI Suite

Reviewed by Simply Wall St

Donnelley Financial Solutions (DFIN) has just launched Active Intelligence, a suite of AI capabilities designed to make regulatory compliance more efficient for clients. This move signals a deeper focus on technological innovation and client collaboration.

See our latest analysis for Donnelley Financial Solutions.

DFIN’s reveal of its Active Intelligence platform comes as the company navigates a challenging stretch for its share price. The stock has retreated 13.9% over the past month and is now down 26.7% for the year to date. Despite recent headline innovation, overall market sentiment has cooled. However, long-term total shareholder returns remain strong, highlighted by a 181% gain over the past five years.

If DFIN’s momentum shift has you thinking more broadly about what’s possible, there’s no better time to broaden your search and discover fast growing stocks with high insider ownership

With the stock trading well below analysts’ price targets despite strong long-term returns, investors now face a key question: is this a timely entry point for DFIN, or has the market already accounted for its next leg of growth?

Most Popular Narrative: 30.8% Undervalued

The consensus narrative places Donnelley Financial Solutions’ fair value well above its recent close, setting up a compelling divide between share price and projected worth. This sharp disconnect invites a closer look at the core assumptions behind the bullish outlook.

The secular shift towards digitalization in capital markets and regulatory functions is accelerating migration from print to secure, cloud-based platforms, evidenced by notable growth in DFIN's software mix and sustained growth in recurring software products. This supports higher long-term net margins and more resilient cash flow.

What is the hidden catalyst making this valuation so compelling? At its heart, the narrative is powered by a future profit profile and margin leap typically reserved for software disruptors. Which key financial variables are driving the consensus to this premium fair value? Click through and uncover the next layer of this ambitious forecast.

Result: Fair Value of $64.33 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent declines in print revenue or prolonged weakness in capital markets activity could undercut these bullish assumptions going forward.

Find out about the key risks to this Donnelley Financial Solutions narrative.

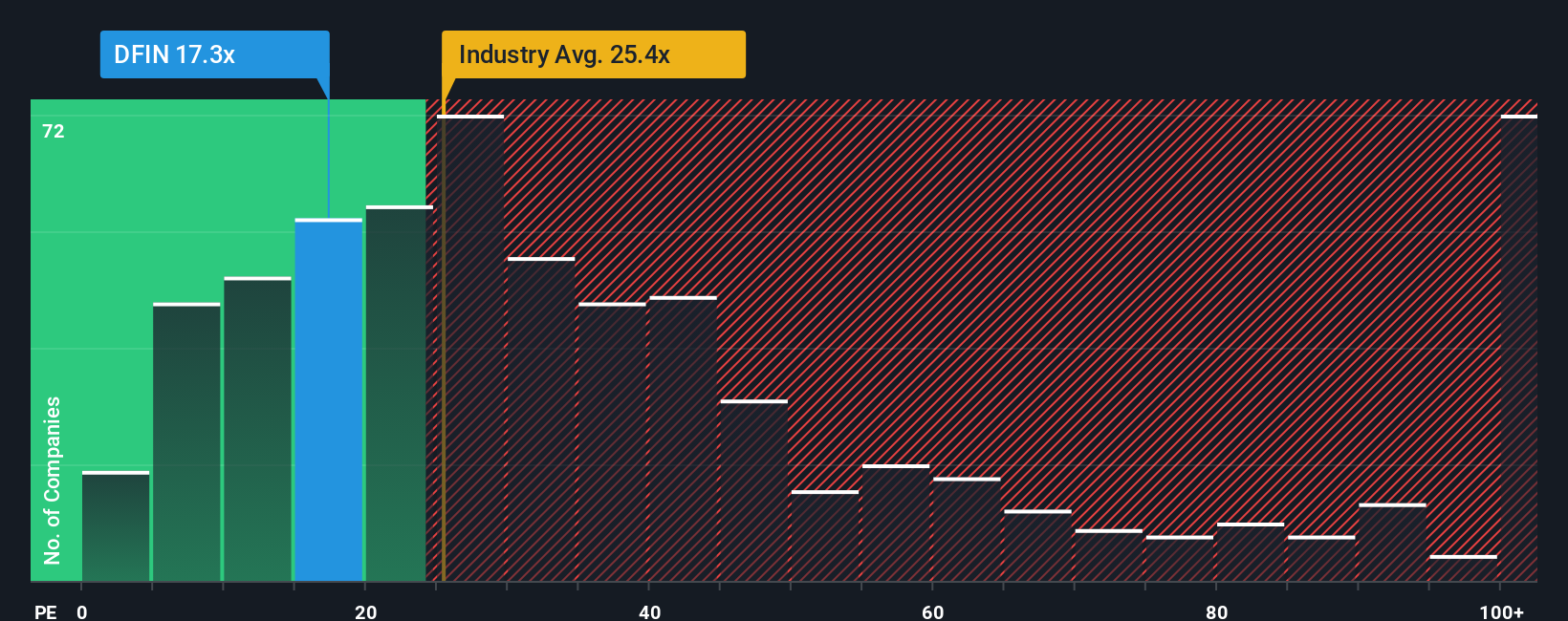

Another View: Earnings Multiple Tells a Different Story

Taking a look at Donnelley Financial Solutions through the lens of earnings multiples, things appear less compelling. The current price-to-earnings ratio is 36.3 times, which is higher than the industry average of 23.7 times and also exceeds the peer average of 18.5 times. The fair ratio sits at 27 times, suggesting the stock is priced on the higher side, which could elevate valuation risk if the company does not deliver improving results. Is this gap a warning sign or simply the cost of buying into transformation?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Donnelley Financial Solutions Narrative

If you see things differently or want to dive deeper into the numbers yourself, you can craft your own perspective in just a few minutes with Do it your way.

A great starting point for your Donnelley Financial Solutions research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Your next winning stock opportunity might be just around the corner, but you’ll only uncover it by searching smarter with the Simply Wall Street Screener today.

- Jump on companies at the forefront of medical tech innovation by checking out these 31 healthcare AI stocks. These companies are making patients' lives better and creating new investment opportunities.

- Tap into emerging market breakouts by reviewing these 3579 penny stocks with strong financials to spot high-upside shares that are trading below the radar.

- Capture growth before the crowd by investigating these 901 undervalued stocks based on cash flows. These options may show strong cash flows and real potential for long-term gains.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DFIN

Donnelley Financial Solutions

Provides innovative software and technology-enabled financial regulatory and compliance solutions in the United States, Asia, Europe, Canada, and internationally.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives