- United States

- /

- Capital Markets

- /

- NYSE:DBRG

DigitalBridge Group (DBRG): Exploring Valuation After Recent Share Price Decline

Reviewed by Simply Wall St

DigitalBridge Group (DBRG) shares were active in the market today, catching the eye of investors who have been following its recent performance. With shares trading at $9.26, the company has seen some clear moves over the past month and over the past 3 months.

See our latest analysis for DigitalBridge Group.

Momentum has cooled for DigitalBridge Group, as its 1-month share price return stands at -26.51%, and the stock has now posted a -20.82% total shareholder return over the past year. Recent declines suggest investors are taking a cautious approach, possibly reassessing growth potential as the market digests prior gains.

If you're rethinking your next move, this could be an ideal time to broaden your search and discover fast growing stocks with high insider ownership

With the stock trading well below analyst targets but posting sharp recent declines, investors have to ask: is DigitalBridge Group undervalued after its pullback, or has the market already accounted for all future growth?

Most Popular Narrative: 44% Undervalued

DigitalBridge Group’s most widely followed narrative suggests its shares trade well below a consensus fair value of $16.50, anchored in ambitious growth projections and profitability improvements over time. Today’s closing price reflects a sharp disconnect, setting up a striking contrast for investors weighing future potential versus current expectations.

Institutional investor appetite for real assets and digital infrastructure remains robust, reflected in strong fundraising momentum, an expanding private wealth platform, and higher-fee co-investment activity. This accelerates growth in recurring management fee revenue, margin expansion (FRE margin), and overall earnings predictability.

Want to know what’s supercharging this bullish outlook? The secret is hidden in off-the-charts revenue and margin forecasts. Which controversial profit assumptions really drive that $16.50 fair value? Dig into the full narrative for the bold growth math behind this valuation.

Result: Fair Value of $16.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, fierce competition and unpredictable funding environments could quickly dampen expected gains in revenue and margins for DigitalBridge Group in coming years.

Find out about the key risks to this DigitalBridge Group narrative.

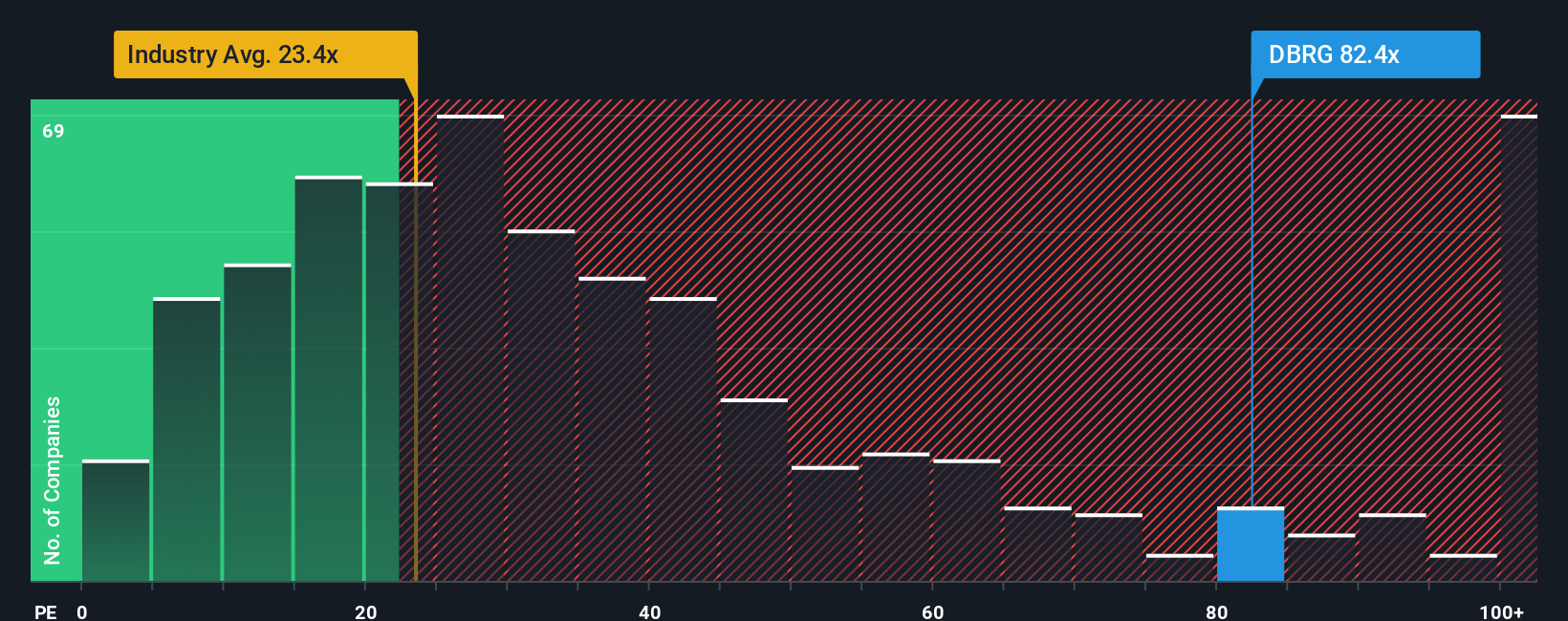

Another View: Multiples Tell a Different Story

Looking at earnings multiples, DigitalBridge Group appears expensive compared to both industry peers and what the market deems a fair ratio. The current price-to-earnings ratio stands at 82.9x, which is much higher than the industry average of 23.7x and the fair ratio of 26.4x. This premium signals extra risk if the market’s growth outlook changes suddenly. Could investors be banking on bold growth, or is the stock simply overvalued?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own DigitalBridge Group Narrative

If you have a different take or want to examine the numbers for yourself, it’s easy to dive in and assemble your own narrative in just a few minutes. Do it your way

A great starting point for your DigitalBridge Group research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Smart investors always scan the horizon for standout opportunities. Simply Wall Street’s screeners can help you seize market movers before they hit the headlines. If you’re ready to take the next step and outpace the crowd, start here:

- Pounce on new growth trends by zeroing in on these 27 AI penny stocks that are transforming entire industries with artificial intelligence.

- Build a portfolio packed with steady payouts when you tap into these 15 dividend stocks with yields > 3% offering yields higher than 3%.

- Capitalize on innovation’s next frontier by checking out these 26 quantum computing stocks for exposure to quantum breakthroughs reshaping tomorrow’s tech landscape.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DBRG

DigitalBridge Group

DigitalBridge (NYSE: DBRG) is a leading global alternative asset manager dedicated to investing in digital infrastructure.

High growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives