- United States

- /

- Diversified Financial

- /

- NYSE:CPAY

Corpay (CPAY) Raises 2025 Outlook and Signs NHL Deal Is Its M&A Push Redefining Its Edge?

Reviewed by Sasha Jovanovic

- Corpay, Inc. recently reported third quarter results with revenue of US$1.17 billion and net income of US$277.94 million, announced a new multiyear partnership as the Official FX Provider of the NHL, and raised its 2025 earnings outlook following the Alpha acquisition and investment in AvidXchange.

- A unique aspect is Corpay’s continued focus on M&A and share buybacks while managing its leverage, alongside expanding cross-border payment partnerships that strengthen its presence in high-profile markets like professional sports.

- We will explore how Corpay's raised 2025 earnings guidance and ongoing acquisition strategy shape its long-term investment narrative.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

Corpay Investment Narrative Recap

Being a Corpay shareholder means believing in the company's ability to grow earnings through international expansion, ongoing acquisitions, and product innovation in business payments solutions. The recent earnings beat and raised 2025 outlook reinforce confidence in near-term profit growth, while ongoing M&A remains a key catalyst. However, the biggest immediate risk is effective integration of acquisitions without letting expenses or execution issues erode margins, recent news of the Alpha acquisition and new debt appears manageable and does not materially shift this risk.

The announcement of Corpay's expanded credit facility and closing of the Alpha acquisition is especially relevant, as it directly supports the company’s M&A-driven growth strategy. This move underpins management’s commitment to scaling global payments capabilities, but also amplifies the need to balance growth with disciplined leverage and cost control, key to supporting the improved earnings guidance.

By contrast, investors should remain aware of the heightened risk that heavy investment and ongoing M&A could outpace revenue gains and lead to...

Read the full narrative on Corpay (it's free!)

Corpay's narrative projects $5.7 billion revenue and $1.8 billion earnings by 2028. This requires 10.9% yearly revenue growth and an $0.8 billion earnings increase from $1.0 billion currently.

Uncover how Corpay's forecasts yield a $368.50 fair value, a 27% upside to its current price.

Exploring Other Perspectives

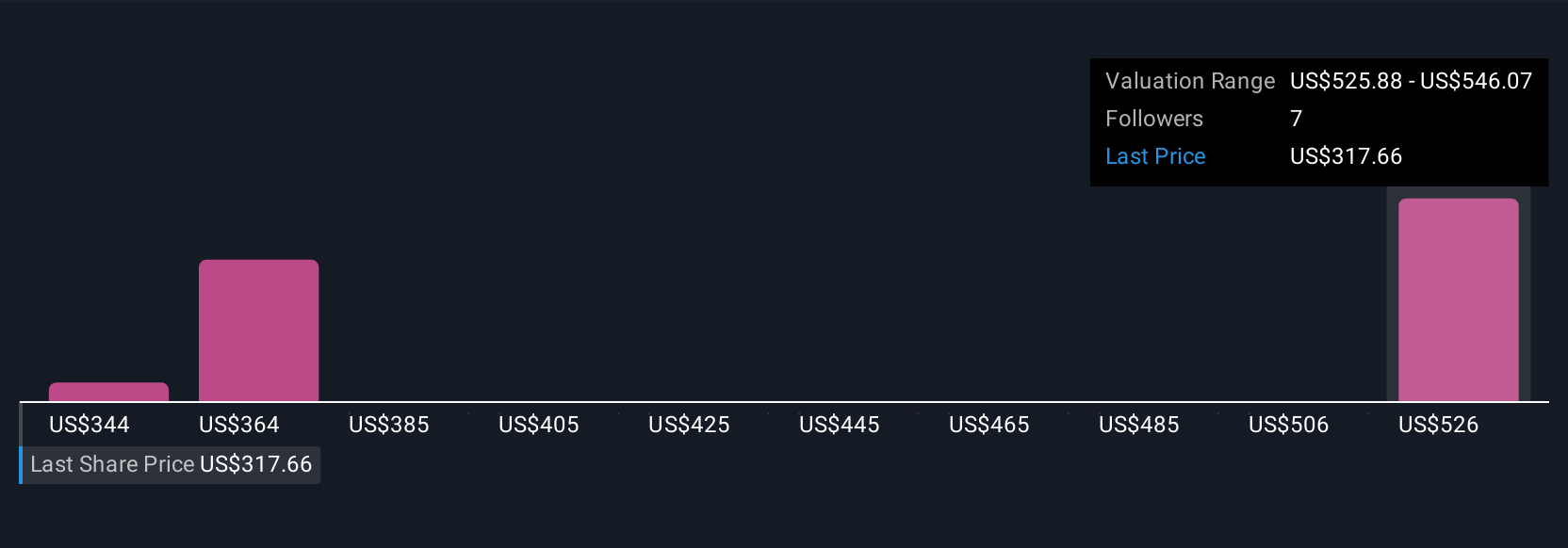

Four fair value estimates from the Simply Wall St Community for Corpay range from US$344.17 to US$511.72 per share. While opinions differ, the company's M&A activity and raised profit forecasts may shape how you weigh these varying outlooks and what comes next for Corpay’s earnings profile.

Explore 4 other fair value estimates on Corpay - why the stock might be worth as much as 76% more than the current price!

Build Your Own Corpay Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Corpay research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Corpay research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Corpay's overall financial health at a glance.

Curious About Other Options?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 37 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CPAY

Corpay

Operates as a payments company that helps businesses and consumers manage vehicle-related expenses, lodging expenses, and corporate payments in the United States, Brazil, the United Kingdom, and internationally.

High growth potential and good value.

Similar Companies

Market Insights

Community Narratives