- United States

- /

- Mortgage REITs

- /

- NYSE:BXMT

How Investors Are Reacting To Blackstone Mortgage Trust (BXMT) Major Turnaround and Share Buyback Completion

Reviewed by Sasha Jovanovic

- Blackstone Mortgage Trust recently reported a major turnaround in its third quarter and year-to-date 2025 results, with sales reaching US$33.73 million and net income at US$63.4 million, reversing last year's losses.

- The company also completed its announced share repurchase program, buying back 7,636,033 shares for US$138.21 million, which may reflect confidence in its future prospects and return of capital to shareholders.

- We’ll examine how Blackstone Mortgage Trust’s completion of its buyback program could influence its investment narrative going forward.

Rare earth metals are the new gold rush. Find out which 35 stocks are leading the charge.

Blackstone Mortgage Trust Investment Narrative Recap

To be a shareholder in Blackstone Mortgage Trust, an investor needs to believe in the company’s ability to restore and grow distributable earnings through asset resolution and capital redeployment. While the company’s return to profitability and the completion of its share buyback are encouraging, the most important short-term catalyst remains the ongoing resolution of impaired loans; the biggest risk continues to be timing mismatches between loan repayments and redeployment. These recent results do not materially alter that risk profile.

Of the company’s recent developments, the substantial share buyback stands out, as reducing the share count could benefit existing shareholders if earnings remain stable or improve. This move aligns with capital management efforts but does not directly address the outstanding $970 million of impaired loans, which remain a key factor in the company’s overall earnings stability and risk assessment.

However, investors should be especially aware that despite positive headline results, the risk related to unresolved impaired assets remains...

Read the full narrative on Blackstone Mortgage Trust (it's free!)

Blackstone Mortgage Trust's narrative projects $547.4 million in revenue and $513.3 million in earnings by 2028. This requires 32.2% yearly revenue growth and a $525.9 million increase in earnings from the current level of -$12.6 million.

Uncover how Blackstone Mortgage Trust's forecasts yield a $20.50 fair value, a 11% upside to its current price.

Exploring Other Perspectives

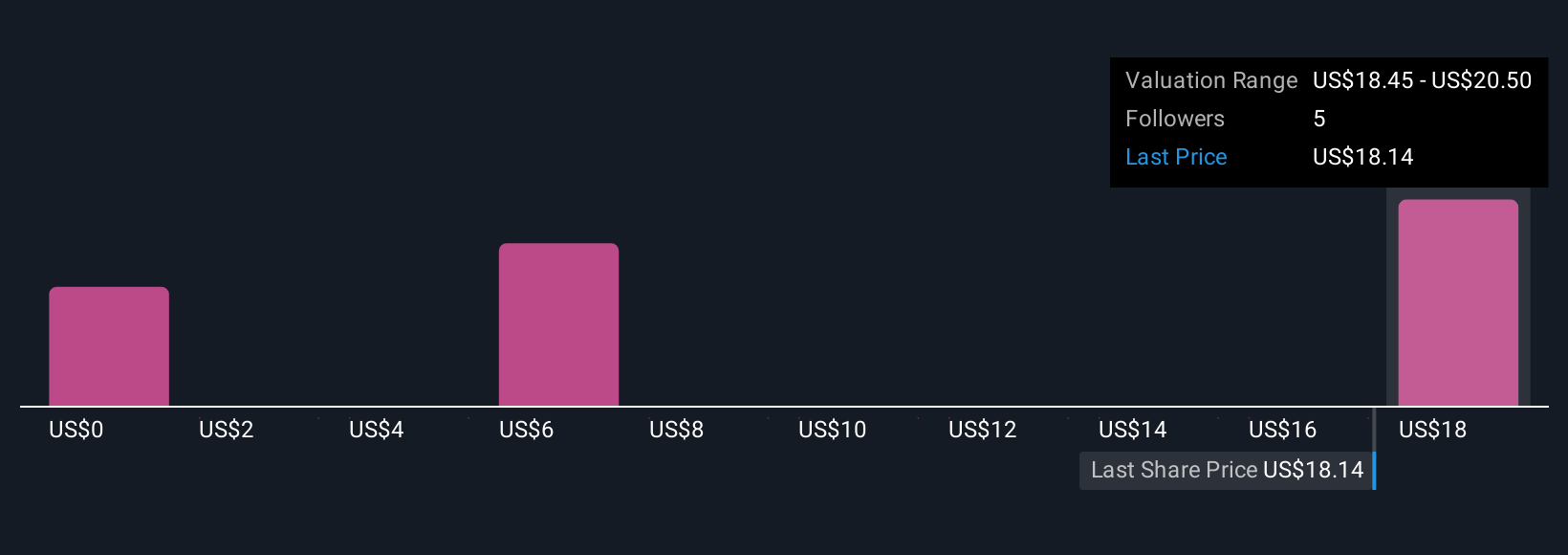

Five Simply Wall St Community fair value estimates for BXMT range from as low as US$2.05 to US$20.50. This diversity of opinion highlights how differing views on ongoing loan resolution and earnings stability could have broader impacts on long-term returns, explore several perspectives when considering your next step.

Explore 5 other fair value estimates on Blackstone Mortgage Trust - why the stock might be worth as much as 11% more than the current price!

Build Your Own Blackstone Mortgage Trust Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Blackstone Mortgage Trust research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Blackstone Mortgage Trust research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Blackstone Mortgage Trust's overall financial health at a glance.

Curious About Other Options?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Blackstone Mortgage Trust might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BXMT

Blackstone Mortgage Trust

A real estate finance company, originates senior loans collateralized by commercial properties in North America, Europe, and Australia.

Moderate growth potential second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives